It was supposed to be the jewel in the crown of Siberia. A massive, world-defying project that would make Russia an unstoppable force in the global energy market. But honestly, if you look at the docks of the Gydan Peninsula right now, the vibe is more "ghost town" than "global hub."

The Arctic LNG 2 project is basically a giant, expensive lesson in what happens when geopolitical ambition hits a brick wall made of Western sanctions and frozen sea ice.

For months now, we’ve seen headlines about Arctic LNG 2's Russian shipment fails to find buyer, and honestly, the situation is getting kinda desperate for Novatek, the company running the show. Imagine spending billions to freeze gas into a liquid, loading it onto a ship, and then... nobody wants to touch it. It’s like throwing a massive party where the neighbors have blocked the driveway and told all the guests they’ll be arrested if they show up.

The Ghost Fleet and the "Buyer" Problem

Let's talk about the tankers. Russia has been trying to use what people call a "shadow fleet." These are often older vessels with murky ownership, designed to bypass the heavy-duty sanctions placed by the U.S. and its allies.

One vessel, the Pioneer, spent something like four months just wandering around at sea. It’s a 138,000-cubic-meter lonely heart. It picked up a load of gas in August, sailed around the world, and eventually just had to slink back to a storage unit in Kamchatka because no one would take the risk of buying the cargo.

Why the hesitation? Because the U.S. State Department isn't playing around. They’ve been slapping sanctions on specific ships, their managers, and even the companies that provide the insurance. If a port allows a sanctioned ship to dock, that port risks being cut off from the global financial system. For most countries, a few thousand tons of Russian gas just isn't worth losing access to the U.S. dollar.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

China is Buying, But There's a Catch

Now, it’s not entirely a failure. China has started to step in, but even that is complicated. In late 2025 and early 2026, we’ve seen a handful of shipments finally reach Chinese terminals like Beihai.

But here is the thing: China is basically the only game in town, and they know it.

- Deep Discounts: Reports suggest Novatek is having to sell this gas for way below market value.

- Quarantined Terminals: Beijing has "quarantined" certain docks so they only handle Russian gas. This keeps the "tainted" fuel away from their other international business.

- Infrastructure Gaps: China can’t take it all, and they definitely can't take it fast enough to keep the project's production lines running at full speed.

The result? Arctic LNG 2 has had to actually cut its production. You can’t keep making the stuff if you have nowhere to put it. Storage tanks at the plant are topping out, and without a steady stream of buyers, the whole multi-billion dollar operation starts to grind to a halt.

The Ice is a Literal Wall

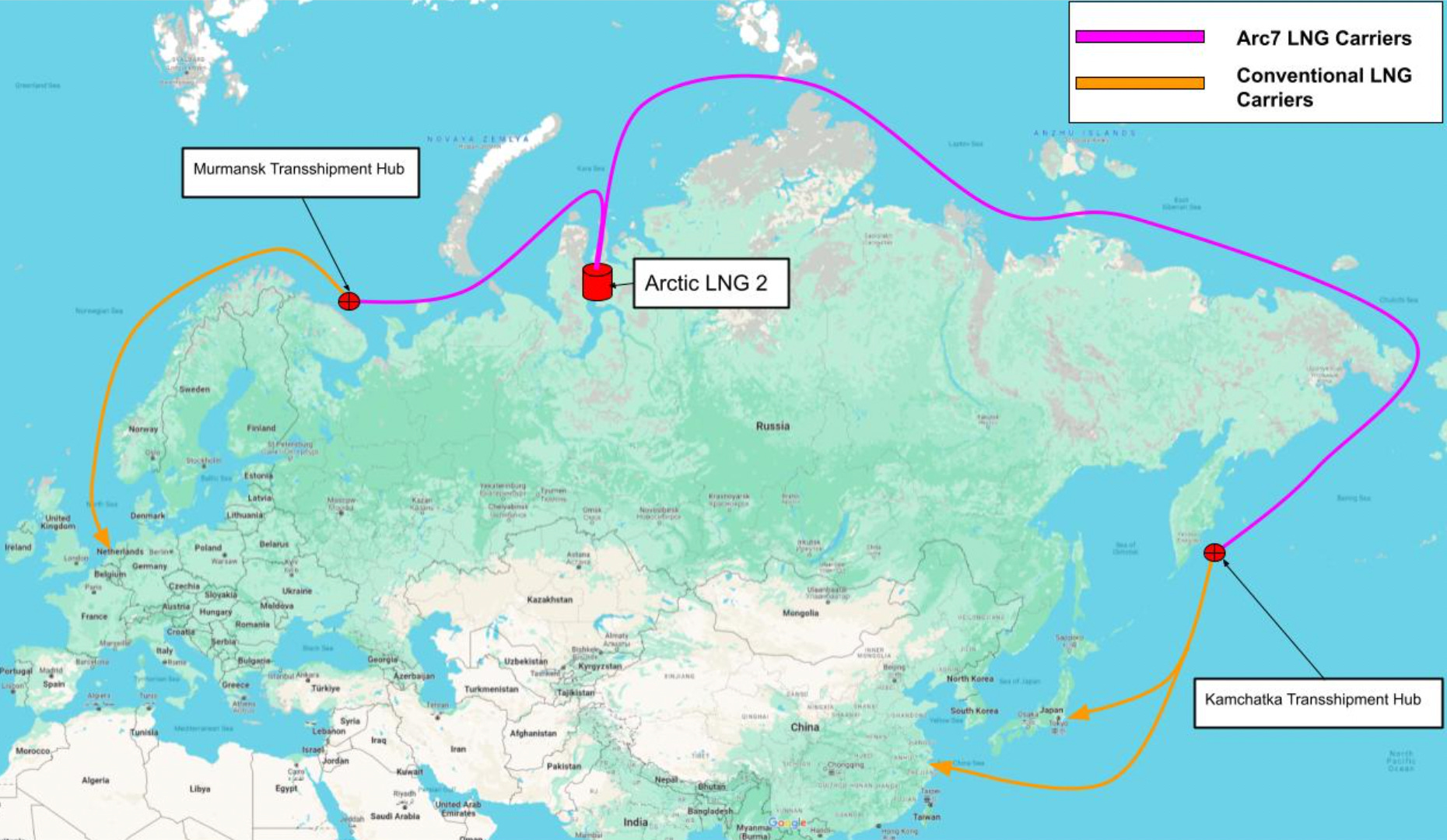

Even if Russia finds a buyer who doesn't care about sanctions, they have to deal with the Arctic itself. This isn't the Caribbean. To move gas year-round, you need specialized Arc7 ice-class tankers.

Russia was supposed to get a whole fleet of these from South Korea, but—you guessed it—sanctions killed those deals. Now, they are trying to build their own at the Zvezda shipyard. They just launched the Alexey Kosygin recently, which is a big deal for them, but one or two ships can't replace the 15-20 they actually need.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

Without those ice-breaking ships, the project is basically trapped for half the year. During the winter of 2025, they were relying on a single icebreaker, the Christophe de Margerie, to shuttle gas to floating storage units near Murmansk. It's a logistical nightmare. It’s slow, it’s expensive, and it makes the gas even less competitive on the global stage.

What Most People Get Wrong About the Sanctions

Some analysts thought Russia would just find a "dark" market for LNG like they did for oil. But LNG is way harder to hide. You can’t just transfer gas between ships in the middle of the ocean as easily as you can with crude oil. You need specialized equipment, super-chilled tanks, and very specific terminals.

The "ghost fleet" strategy that worked for Russian Urals oil is failing for Arctic LNG 2.

Essentially, the U.S. has successfully "killed" the commercial viability of the project for now. Even if the gas moves, the profit margins are getting eaten up by the insane shipping costs and the massive discounts demanded by the few brave buyers left.

Current Reality Check:

- Production: Dropped significantly because storage is full.

- Buyers: Mostly limited to a few specific Chinese ports and potentially some "test" shipments to India that haven't quite scaled up yet.

- Shipping: Reliant on a tiny handful of ice-class ships and a "shadow fleet" that is being hunted by Western regulators.

The Outlook for 2026

So, where does this leave us? Honestly, Arctic LNG 2 is currently a "zombie" project. It’s technically alive, it’s producing some gas, but it’s not the world-altering energy powerhouse Putin promised.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

The project was designed to produce nearly 20 million metric tons a year. Right now, it's lucky if it hits a fraction of that.

For the global market, this means the "supply wave" people expected from Russia isn't coming. Instead, the world is looking toward new projects in Qatar and the U.S. Gulf Coast to fill the gap. Russia's dream of tripling its LNG exports by 2030 is looking more like a fantasy every day.

Actionable Insights for Energy Observers

If you’re tracking this for business or just curious about how the energy war is playing out, here is what to watch for in the coming months:

- Monitor the Zvezda Shipyard: The speed at which Russia can churn out domestic Arc7 tankers is the only thing that can save this project from being a seasonal-only operation.

- Watch India's Move: There’s a lot of talk about Novatek lobbying New Delhi. If India starts accepting sanctioned Arctic LNG 2 cargoes, it would be a massive win for Moscow and a major blow to U.S. sanction efforts.

- Suez Canal Transits: Keep an eye on whether these "shadow" tankers start using the Suez Canal more frequently to reach Asia. It’s a sign they are trying to avoid the treacherous (and expensive) Northern Sea Route.

The "failure to find a buyer" isn't just a temporary glitch; it's a structural failure caused by a world that has largely decided the risk of doing business with this specific project is too high. Unless there’s a massive shift in the geopolitical landscape, those lonely tankers in the Arctic are going to keep wandering for a long time.

Track the movements of the Alexey Kosygin over the next few weeks to see if it successfully completes its first commercial run, as this will be the primary indicator of whether Russia can maintain any winter export capacity at all. Check satellite imagery or maritime tracking services for the Saam FSU near Murmansk to see if ship-to-ship transfers are increasing, which would signal a shift in their "shadow" logistics strategy.