When you think of the person running Amazon, you probably picture someone with a bank account that looks like a phone number. Jeff Bezos set that bar. He’s a guy whose wealth fluctuates by billions of dollars while he’s eating breakfast. But Andy Jassy net worth is a different story. It’s a massive amount of money, sure, but it’s not "owning a super-yacht that needs its own support yacht" money.

Honestly, the numbers might surprise you. As of early 2026, Andy Jassy's net worth is estimated to be around $550 million to $600 million.

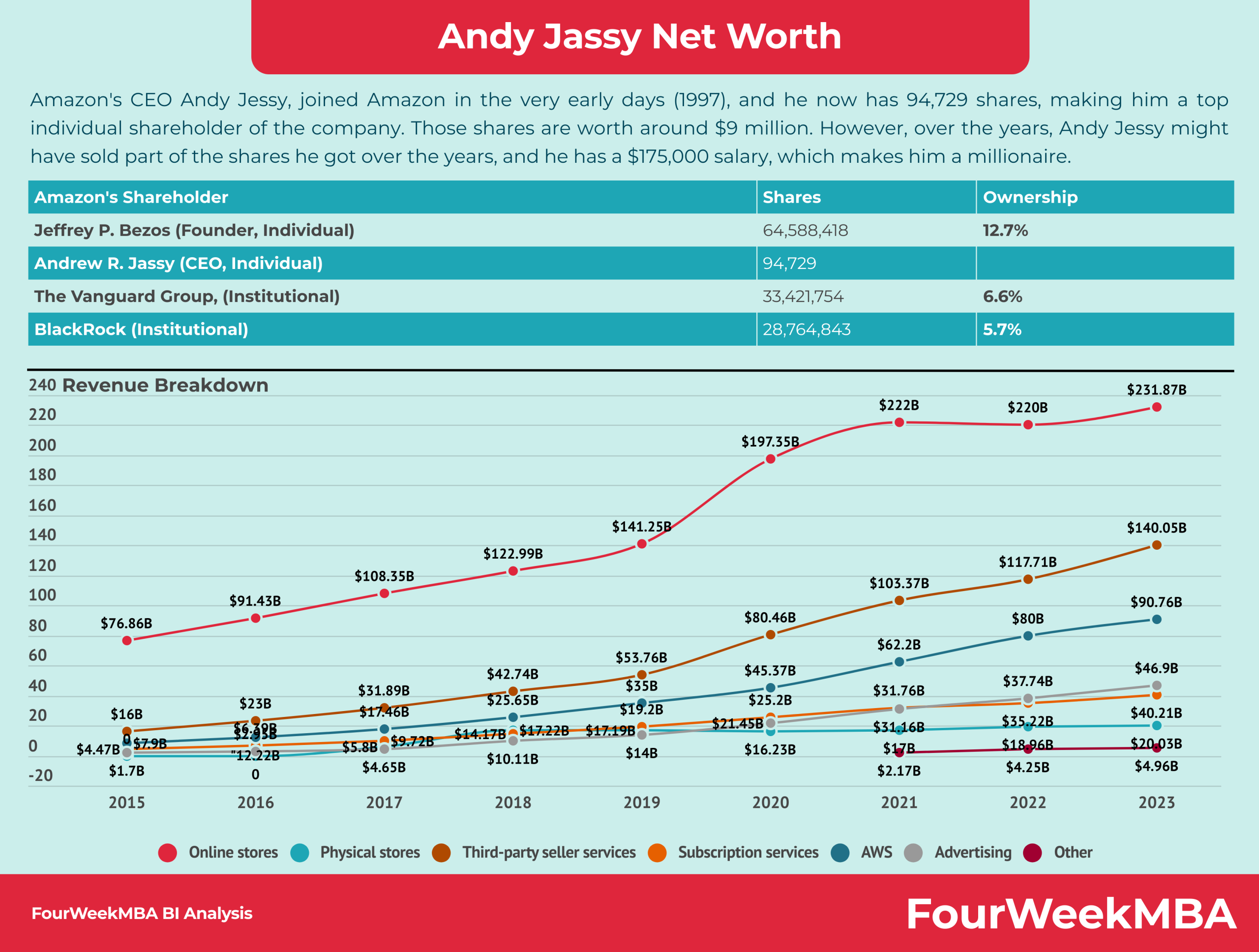

Why isn't he a billionaire? He’s the CEO of a company worth over $2.5 trillion. He built AWS (Amazon Web Services), the division that basically prints money for the entire corporation. You’d think he’d be further up the Forbes list. But Jassy is a prime example of the "professional CEO" rather than the "founder billionaire." Most of his wealth is tied up in Amazon stock, and while he’s been there since 1997, he hasn't just sat on every share he’s ever received.

Breaking Down the Andy Jassy Net Worth

To understand where the money is, you have to look at the SEC filings. That’s where the real data lives.

As of January 2026, Jassy owns roughly 2.2 million shares of Amazon (AMZN). With the stock trading around $240 per share, his direct holdings are worth approximately $528 million.

But that’s just the liquid part. Or, well, "liquid-ish."

He also has a massive mountain of unvested Restricted Stock Units (RSUs). When Jassy took the top job in 2021, he was granted a ten-year pay package worth about $212 million. The catch? He doesn't get it all at once. It vests over a decade. This means a huge chunk of his "wealth" is actually potential wealth that depends on him staying at the company and the stock price not cratering.

💡 You might also like: Current stock price for coca cola: Why the Market Is Missing the Real Story

Where the Rest of the Cash Is

It’s not all just digital numbers in a brokerage account. Jassy has some serious real estate and other ventures:

- Seattle Estate: He lives in a 10,000-square-foot house in the Capitol Hill neighborhood. He bought it way back in 2009 for about $3.1 million, but in today's market, it’s worth significantly more.

- Santa Monica Pad: In 2020, he dropped $6.7 million on a 5,500-square-foot home in California. It’s a modest move for a guy in his position, but still a clear sign of his "half-billionaire" status.

- Sports Investments: Jassy is a big hockey fan. He’s a minority owner of the Seattle Kraken NHL team. Sports franchises are basically gold mines lately, so this stake is likely a growing part of his portfolio.

The "What If" Factor: Shares Left on the Table

There is a fascinating bit of math that analysts love to do regarding Jassy’s career. He was employee number 247. If he had never sold a single share of Amazon since he started in the late 90s, he would be a multi-billionaire today.

Back in the early 2000s, Amazon wasn't the "Everything Store" yet. It was a risky bet. Jassy sold shares over the years—around 460,000 of them—to diversify his life or pay for those houses. If he’d held those, they’d be worth over $1.5 billion now.

It’s easy to play Monday morning quarterback with someone’s portfolio. But Jassy’s strategy has always been about steady growth. He’s not a founder-owner like Bezos, who started with a massive percentage of the company. He’s a high-level executive who climbed the ladder.

How His 2025 Performance Impacted His Wealth

2025 was a weird year for Amazon. The company pivoted hard into Generative AI, spending over $75 billion on capital expenditures. Jassy is betting the farm on AWS remaining the backbone of the AI revolution.

Because his compensation is so heavily weighted toward stock (over 77% of his package is usually bonuses and stock), his personal net worth is essentially a leveraged bet on Amazon's AI success. When the stock hits a new all-time high—like the $258 mark we saw recently—Jassy’s net worth jumps by $20 million in a single afternoon. When the market dips, he "loses" more money in a day than most people see in a lifetime.

His base salary is actually quite small by CEO standards—just $365,000 a year. You read that right. He makes less in cash salary than many specialized surgeons or high-end lawyers. The real money is in the equity.

The Path to a Billion

Will he ever hit the ten-figure mark? Probably.

If Amazon stock hits $450 or $500 in the next few years, and his 2021 RSU grant continues to vest, Jassy will likely join the billionaire club. He’s 58 years old, so he has plenty of runway left.

But Jassy doesn't seem to have the "wealth accumulation at all costs" vibe that some of his peers do. He’s known for being a "builder." He spent 20 years building AWS into an $80 billion-a-year business. For him, the net worth seems to be a byproduct of the work rather than the goal itself.

✨ Don't miss: Charles Schwab Index 500: What Most People Get Wrong

Actionable Insights for Investors

Watching Andy Jassy's net worth tells you a lot about where Amazon is going. Here is what you should take away from his financial structure:

- Skin in the Game: Jassy hasn't been dumping shares. While he does sell occasionally (around 20,000 shares in late 2025), he still holds the vast majority of his equity. That’s a vote of confidence.

- The AI Pivot is Real: Jassy’s personal fortune depends on AWS dominating the AI space. If you're looking at AMZN stock, watch the "Bedrock" and "Trainium" updates—those are the engines that will drive Jassy’s wealth (and yours) higher.

- Long-Term Vesting: Most of his pay is locked up until 2031. This suggests the board wants him there for the long haul to see the AI transition through.

Don't expect Jassy to start buying social media platforms or building rockets anytime soon. He’s a different kind of leader—quiet, operational, and focused on the cloud. His net worth reflects that. It's built on 25 years of showing up to "Day 1" every single morning.

To track his future moves, keep an eye on SEC Form 4 filings. Any time he sells more than a fraction of a percent of his holdings, it's a signal. But for now, he’s sitting tight on a half-billion-dollar empire that he helped build from the ground up.