If you’ve been watching the tickers lately, you know the vibe around AMG Critical Materials N.V. has shifted. Hard. For a long time, this was the "wait and see" company. People liked the idea of a circular economy and lithium independence in Europe, but the execution? That's always the scary part.

Honestly, the start of 2026 feels like the payoff for a very long game. We aren't just talking about speculative spreadsheets anymore. We’re talking about actual lithium hydroxide coming out of a refinery in Germany. Specifically, the Bitterfeld plant—the one everyone was whispering about for years—is now in that high-stakes "qualification phase."

The Bitterfeld Breakthrough: Europe’s First Real Lithium Win

The biggest chunk of AMG Critical Materials news right now is centered squarely on Saxony-Anhalt. In late December 2025, the company secured a cool €36 million from the German Federal Ministry for Economic Affairs. That’s not just "extra" money. It’s a massive signal from the German government that they are betting the farm on AMG to secure the local supply chain.

The plant in Bitterfeld-Wolfen isn't just a pilot project. It's the first industrial-scale battery-grade lithium hydroxide facility on the continent. As of mid-January 2026, they are busy shipping out commercial qualification batches to customers. The goal? Hit full design capacity of 20,000 tons per year by mid-2026.

💡 You might also like: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

Think about why this matters. Most lithium currently takes a world tour—mined in Australia or Chile, shipped to China for refining, then finally sent back to Europe for a Volkswagen or a BMW. AMG is basically cutting out the middleman by taking tech-grade salts and turning them into battery-ready fuel right in the heart of Germany.

Why the Stock Is Suddenly On a Tear

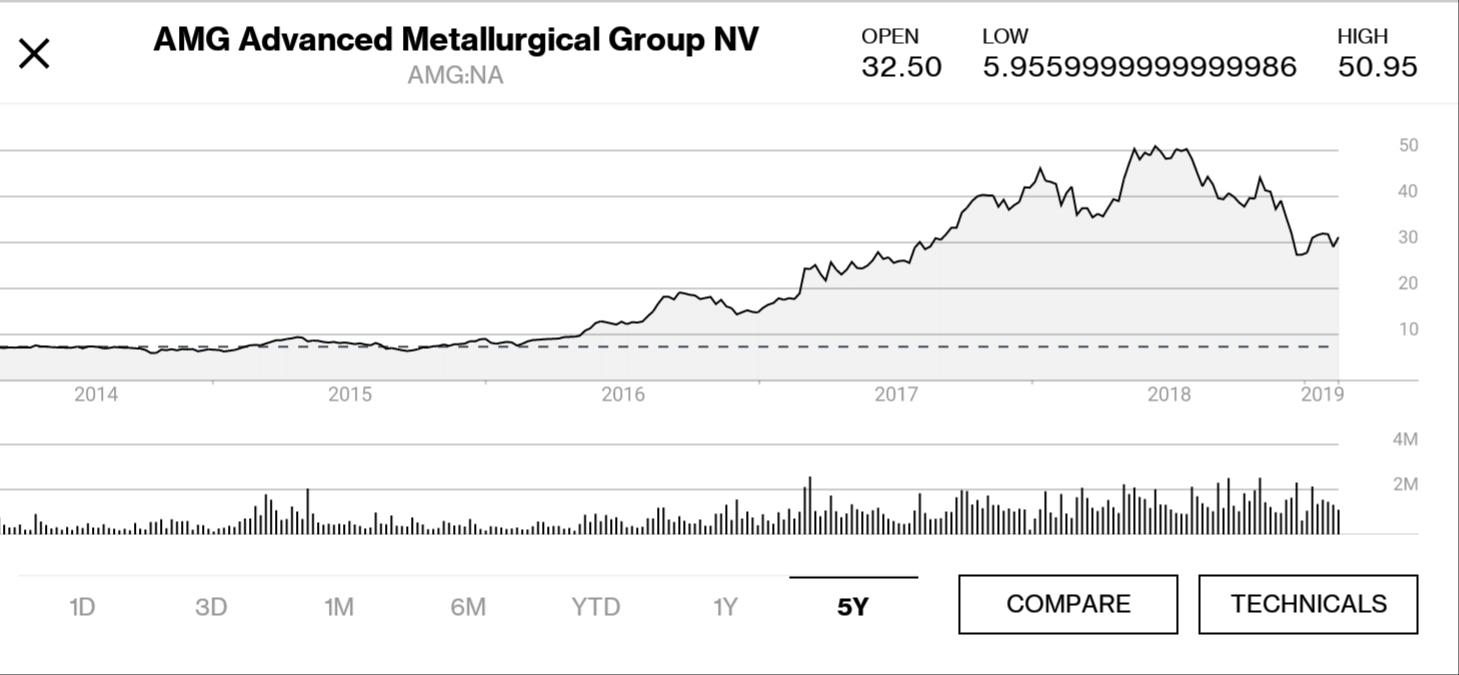

If you look at the 52-week range, it’s wild. We’re seeing AMG shares (AMVMF) trading around $43, a massive jump from the $14 levels we saw roughly a year ago. What changed?

- Antimony Prices went through the roof: While everyone was obsessing over lithium, AMG’s Technologies segment was quietly printing money. Antimony prices spiked in late 2025, and because AMG is a major player there, it padded their EBITDA significantly.

- The Engineering Backlog: AMG Engineering hit an all-time high order backlog of over $416 million. They aren't just mining; they're the guys selling the vacuum furnaces and turbine blade coating tech that the aerospace industry desperately needs.

- The "LIVA" Strategy: Their hybrid energy storage systems (HESS) are actually being deployed. They’ve got a system in Hauzenberg using a mix of Lithium-Ion and Vanadium Redox Flow batteries. It’s "peak shaving" for industrial plants—basically saving them millions in electricity spikes.

The Brazil Expansion and the Low-Cost Crown

Dr. Heinz Schimmelbusch, who was reappointed as CEO in 2025 for another two-year stint, has been beating the drum on "cost leadership" for decades. He’s not wrong to brag. The Mibra mine in Brazil is one of the lowest-cost producers of lithium concentrate globally.

📖 Related: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Recent reports from the tail end of 2025 show they’ve managed to get their production costs down to around $420 per dry metric ton. When you compare that to the spot prices, the margins are getting very healthy again. They’ve dealt with some equipment hiccups in the Brazil expansion—one specific piece of machinery slowed things down in mid-2025—but they’re back up to 110,000 tons per year and heading for 130,000.

What Most People Get Wrong About the "Vanadium" Piece

Most people think of AMG as just a lithium play. That’s a mistake. The Vanadium segment is actually their secret weapon for 2026. They have this massive recycling facility in Ohio that takes spent catalysts from oil refineries—basically trash—and extracts vanadium.

By the second quarter of 2026, they’re set to become the only chrome metal producer in the United States. In a world where trade barriers and tariffs are the new normal, being the only domestic producer of a critical aerospace metal is a massive moat.

👉 See also: Are There Tariffs on China: What Most People Get Wrong Right Now

The Reality Check: It’s Not All Sunshine

We have to be real here. The lithium market is still a rollercoaster. While prices have recovered from the 2024-2025 slump, analysts like those at Morgan Stanley are still debating whether we'll see a massive 80,000-ton deficit or a more balanced market by the end of 2026.

AMG is also navigating a world of "intrusive" questions from trade authorities. With China tightening export controls on rare earths and other metals, AMG has to be incredibly agile. They've streamlined the portfolio—selling off their graphite business for $55 million in late 2025—to keep the balance sheet lean.

Actionable Insights for 2026

If you're following this company or the sector, keep these three milestones on your radar:

- Mid-2026 Production Targets: This is the big one. If Bitterfeld hits its 20,000-ton design capacity on schedule, the "execution risk" premium on the stock will likely vanish.

- US Chrome Integration: Watch for the Q2 2026 startup of the New Castle, PA expansion. If they successfully become the sole US source, look for long-term aerospace contracts to follow.

- Saudi "Supercenter" Progress: The joint venture in Saudi Arabia is moving through detailed engineering. This is their bridge to the Middle Eastern market and a massive source of spent catalysts for their recycling business.

The bottom line? AMG stopped being a "story stock" and started being an infrastructure reality. They’ve successfully moved from "we might do this" to "we are shipping this." In the world of critical minerals, that transition is everything.

Next Steps for Tracking Progress

To stay ahead of the curve on AMG's developments, you should monitor the quarterly earnings calls specifically for "realized sales price vs. cost per ton" metrics in the Brazil lithium operations. This delta is the clearest indicator of their cash flow health regardless of global price volatility. Additionally, watch the European Chemicals Agency (ECHA) updates regarding lithium's classification, as this remains the primary regulatory hurdle for the Bitterfeld refinery's long-term expansion phases.