You've got an Amex Platinum or Hilton Aspire sitting in your wallet, and that $200 or $250 airline fee credit is staring you in the face. It's frustrating. Amex officially says these credits are for "incidental fees" like checked bags or overweight luggage, not for the actual plane tickets. But let’s be real. Nobody wants to spend $200 on overpriced snack boxes or WiFi. You want flights.

That is where the Amex airline credit United Travel Bank strategy comes in. It is, quite honestly, the most popular "open secret" in the award travel world. It basically turns a restrictive credit into a digital piggy bank you can use to book flights whenever you want.

Does it work every time? Usually. Is it official policy? Absolutely not.

If you call American Express and ask if buying TravelBank cash will trigger your credit, they will tell you no. If you ask United, they’ll probably be confused. Yet, thousands of data points on forums like FlyerTalk and Reddit’s r/amex confirm that this specific transaction usually triggers the automated reimbursement system. It’s a loophole that has survived for years, even while other favorites—like the Southwest gift card trick—have been patched and killed off by the Amex algorithms.

Why the United TravelBank is Different

Most airlines sell gift cards through a third-party processor. When you buy a Delta gift card, the charge often shows up as "CashStar" or something similar on your statement. Amex sees that and knows it wasn't an airline fee.

United does it differently.

When you fund your United TravelBank, the transaction is processed directly by United Airlines. It usually codes as a "Special Service Ticket" or "Document Type: Passenger Ticket." For some reason, the Amex automated system sees these small denominations—typically $50 or $100—and assumes they are baggage fees or seat upgrades.

📖 Related: TSA PreCheck Look Up Number: What Most People Get Wrong

It’s a bit of a gamble, but a calculated one.

The Step-by-Step Reality of Using the Amex Airline Credit United Travel Bank

First things first: you have to select United Airlines as your designated airline for the year. You can't just go buy TravelBank cash and expect a credit if your card is still set to Delta or American. You do this in your Amex Benefits dashboard. Do it before you spend a single dime.

Once that is locked in, head over to the United website. Look for the TravelBank section. You’ll need to be logged into your MileagePlus account.

Choosing Your Amounts

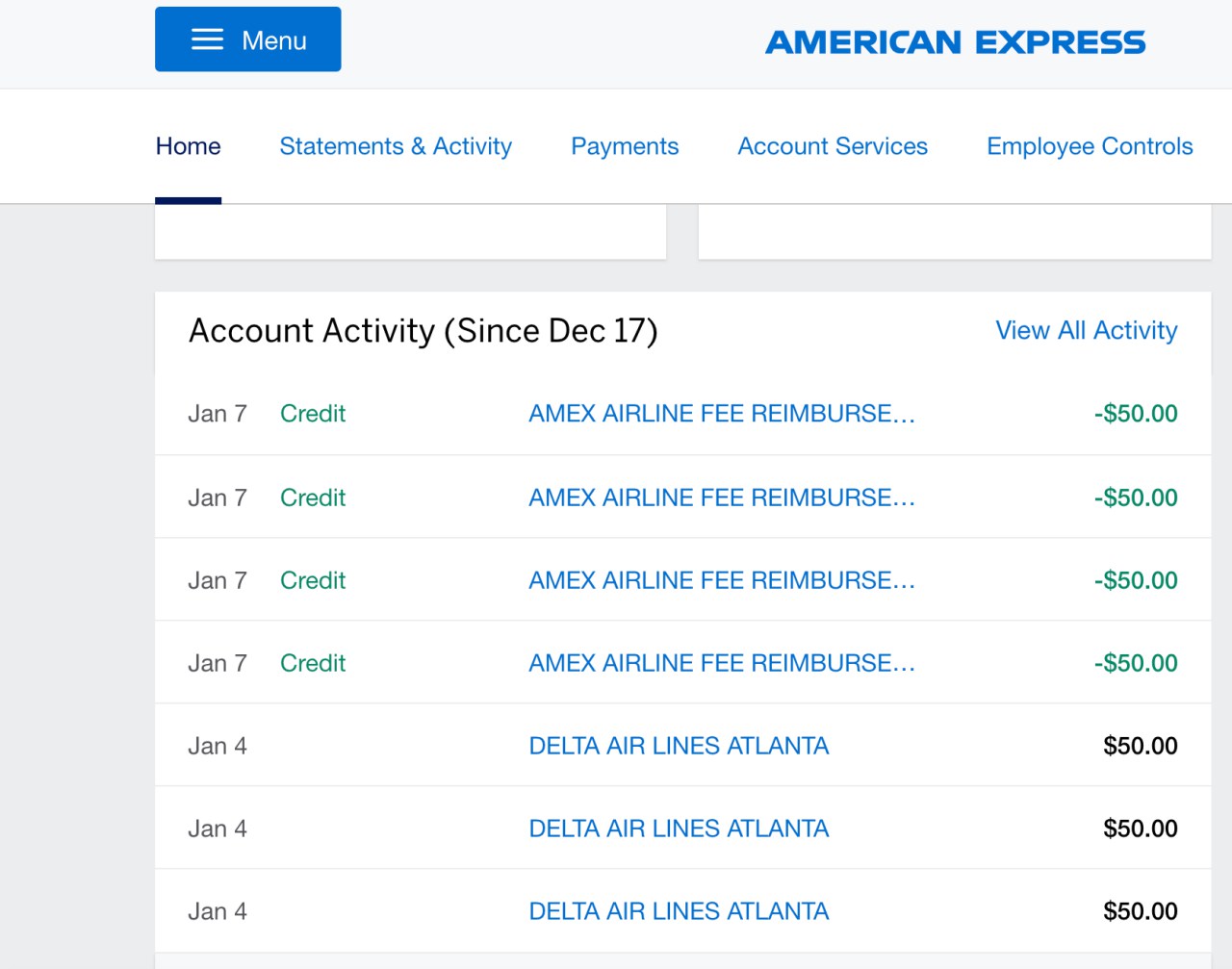

Don’t get greedy. While some people report success with $250 chunks, the safest play has always been smaller increments. Think $50 or $100. If you have a $200 credit, buy two $100 increments.

Wait.

Don't buy them back-to-back within seconds. Some users suggest waiting a day or at least a few hours between transactions to ensure they don't get flagged as a duplicate charge or a single large purchase that might look more like a base fare ticket.

👉 See also: Historic Sears Building LA: What Really Happened to This Boyle Heights Icon

The Waiting Game

After the charge hits your statement, it’ll initially look like a regular purchase. You’ll see "United Airlines" and the amount. Then, the silence.

It usually takes between 3 to 7 days for the "Airline Fee Reimbursement" to appear on your Amex activity. Sometimes it’s faster; sometimes, during high-volume periods like December, it can take two weeks. If it hasn't posted after 14 days, that is usually a sign that something went wrong or the "pipes" are temporarily clogged.

What You Can Actually Buy With TravelBank Funds

Once the money is in your United account, it’s basically United-only currency. You can use it to book any flight operated by United or United Express.

- Can you use it for codeshare? Generally, no. If you’re trying to book a Lufthansa flight through United's site, the TravelBank option often disappears at checkout.

- Does it expire? Yes. Usually, TravelBank funds expire after 5 years, but you should always check the specific terms on your United profile because they occasionally tweak these rules.

- Can you combine it? You can usually combine TravelBank funds with a credit card to cover the remaining balance of a flight. This is huge. It means your $200 credit acts as a genuine $200 discount on your next vacation.

Risks and Common Failures

Nothing is guaranteed. Amex is well aware that people do this. They have "clawed back" credits in the past for other loopholes, though they haven't targeted TravelBank users en masse yet.

A big mistake people make is buying the funds through the United app. For whatever reason, mobile app transactions sometimes code differently than desktop ones. Stick to a standard web browser on a computer.

Another issue? Using a new Amex card and trying to use the credit within minutes of selecting United as your airline. The system needs time to update. Wait 24 hours after selecting United before you make the purchase.

✨ Don't miss: Why the Nutty Putty Cave Seal is Permanent: What Most People Get Wrong About the John Jones Site

Also, keep an eye on the "meter" in your Amex app. If the meter doesn't move after a week, it might be time to accept that the specific transaction didn't trigger the credit. Whatever you do, do not chat with an Amex representative and say, "Hey, why didn't my TravelBank purchase count as a fee?" That is the fastest way to get the loophole closed for everyone. You are technically violating the terms of service; if it doesn't work, you just have to take the "L."

The Ethics of the Loophole

Some people feel weird about this. They think it's "cheating." But look at it from a different perspective: Amex advertises a $200 benefit that is notoriously difficult to use. If you don't check bags and you don't buy lounge passes, that $200 is effectively dead weight. By using the Amex airline credit United Travel Bank method, you're simply extracting the value you're already paying for via that hefty annual fee.

The Points Guy and various other travel experts have tracked this for years. It remains one of the few reliable ways to make the Platinum card's high fee actually worth it for the average traveler who isn't flying every single week.

Actionable Strategy for Your Credits

If you are ready to try this, here is the most logical path forward to maximize your chances of success:

- Verify your airline selection. Go to the "Benefits" section of your Amex account. Ensure United Airlines is the selected airline. If it's already set to something else and you haven't used any of the credit yet, you can usually change it once per year (typically in January), though reps can sometimes change it for you via chat if you haven't touched the credit yet.

- Log into United TravelBank. Don't checkout as a guest. Make sure the money is going into your actual MileagePlus account.

- Test the waters. Buy one $50 or $100 increment.

- Monitor the statement. Wait for the charge to move from "Pending" to "Posted."

- Check the reimbursement. Once you see the credit hit, go back and spend the remainder of your annual allowance.

- Book your travel. Remember that TravelBank cash can't be used for everything (like some International partner flights), so plan your United-specific trips accordingly.

- Check expiration dates. Periodically log into your United account to make sure your funds aren't nearing their end-of-life date.

This isn't a permanent fix, and one day, Amex might change how United transactions are coded. But for now, it is the most effective way to turn a "fee credit" into a "flight credit." Just remember to keep it low-profile and don't expect a refund if the "glitch" doesn't work in your favor. It’s a game of patience and small numbers.