Money is weird. One day you're looking at your bank account thinking everything is stable, and the next, a global shift in copper prices or a central bank meeting in Lusaka changes the value of every cent you own. If you’ve been watching the american dollar to zambian kwacha exchange rate lately, you know exactly what I’m talking about. It’s been a wild ride. Honestly, most people just check a converter app and assume that's the whole story. It isn't.

The Kwacha is currently doing something pretty remarkable. In early 2026, it’s emerged as one of the strongest performing currencies globally, catching a lot of seasoned traders off guard. But why? Is it just luck, or is there something deeper happening in the Zambian economy that the rest of the world is finally starting to notice?

The Copper Connection: It's Not Just a Metal

Zambia and copper are basically inseparable. When you talk about the american dollar to zambian kwacha rate, you're essentially talking about the price of red metal. Right now, copper is ripping. Prices have recently surged past $13,000 a ton. That’s a massive deal for a country where copper makes up the lion's share of export earnings.

When the world wants more copper for electric vehicles and renewable energy, they need Kwacha to pay for it. Or, more accurately, the mining companies like First Quantum and Mopani Copper Mines convert their massive US dollar earnings back into Kwacha to pay taxes, salaries, and local suppliers.

This creates a huge "buy" signal for the local currency.

- Supply and Demand: More dollars flowing in means the Kwacha gets stronger.

- Tax Season: We often see a "spike" in Kwacha value when large mining firms settle their quarterly bills with the Zambia Revenue Authority (ZRA).

- Sentiment: Investors see record copper prices and bet that Zambia's economy is headed for a surplus.

But wait, there's a twist. While copper is the "anchor," the government has been getting way more aggressive about how money moves inside the country.

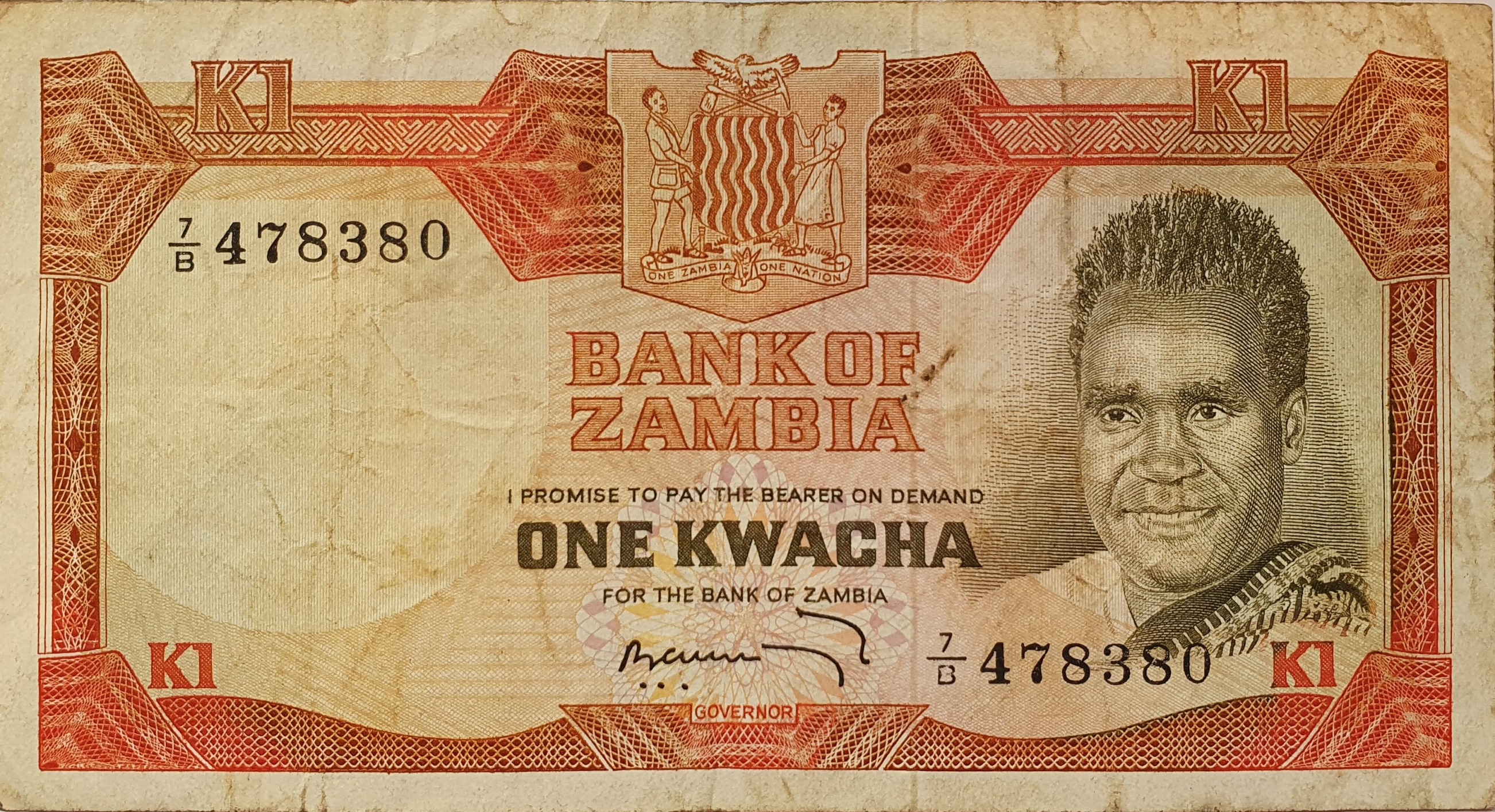

The Bank of Zambia's Bold Move

You might have missed it, but the Bank of Zambia (BoZ) recently threw a wrench in the gears of the "dollarized" economy. They basically told everyone: "Stop using dollars for local stuff." It’s a mandate that requires all domestic transactions to be settled in Kwacha.

Before this, it was common to see everything from high-end real estate to consulting fees quoted and paid in US dollars. By forcing the use of the Kwacha, the central bank created "artificial" demand. Suddenly, if you wanted to buy a house or pay for a large contract in Lusaka, you had to sell your dollars and buy Kwacha.

Governor Dr. Denny Kalyalya hasn't been shy about this. The goal is to stabilize the currency and reclaim control over monetary policy. And so far, it’s working. The american dollar to zambian kwacha rate responded by strengthening significantly, dipping from the high 20s down toward the 20.07 range in mid-January 2026.

Debt Restructuring: The Long Shadow

You can't talk about the Kwacha without mentioning the "D" word. Debt.

For years, Zambia was locked in a grueling process of restructuring its external debt after becoming the first African nation to default during the pandemic era. Fast forward to 2026, and the picture looks totally different. Finance Minister Situmbeko Musokotwane recently highlighted that the country has hit a 94% milestone in its debt restructuring exercise.

This isn't just boring accounting. It's a massive relief valve. When a country isn't constantly worried about a default, international investors feel safe bringing their money back. S&P Global recently upgraded Zambia’s credit rating to "CCC+," which might sound low, but it's a huge step up from the "Selective Default" status of previous years.

Why the Rate Still Fluctuates Every Day

Even with all this good news, the american dollar to zambian kwacha rate isn't a straight line. It's more like a jagged mountain range.

Inflation is the main culprit here. While the Bank of Zambia is aiming for a target band of 6-8% by the first quarter of 2026, we’ve been coming down from much higher levels. In late 2025, inflation was still hovering around 11.9%. When prices for bread and fuel go up, the "real" value of the Kwacha takes a hit, even if the exchange rate looks okay on paper.

Then there's the IMF. Zambia recently decided not to pursue a 12-month extension of its IMF lending program, which was set to expire at the end of January 2026. Some folks got nervous. They wondered if the government was losing its appetite for fiscal discipline ahead of the August elections. Usually, an IMF "stamp of approval" keeps the currency steady. Without it, the market gets a bit jumpy.

The "Real World" Impact: Traveling or Sending Money?

If you're an expat sending money home or a business owner importing spare parts, these numbers aren't just digits on a screen. They're your profit margins.

👉 See also: How Much Does a Euro Cost: What Most People Get Wrong

When the Kwacha strengthens—meaning you get fewer Kwacha for your American dollar—imports become cheaper. This is great for the guy running a hardware store in Kitwe who needs to buy tools from abroad. But it’s tough for the local farmer trying to export honey or soybeans, because their goods suddenly look more expensive to foreign buyers.

Honestly, the "best" rate is usually a stable one. Extreme volatility is the enemy of business. No one wants to sign a contract today only to find out the money is worth 10% less tomorrow.

Practical Steps for Managing Your Money

If you need to deal with the american dollar to zambian kwacha exchange, don't just wing it.

First off, watch the copper markets. If copper is tanking in London, expect the Kwacha to feel the pressure in Lusaka about 48 hours later. It’s like a delayed echo. Second, keep an eye on the Bank of Zambia’s Monetary Policy Committee (MPC) statements. They meet quarterly, and even a 25-basis-point change in the interest rate (like the cut to 14.25% in late 2025) can shift the currency’s direction.

Also, shop around. Commercial banks in Zambia often have wider spreads (the difference between the buy and sell price) than specialized fintech apps. If you're moving a large amount, those few "ngwee" per dollar add up to thousands of Kwacha quickly.

The era of the "unstable Kwacha" might not be totally over—there are still election risks and climate concerns like the 2024 drought that crippled power generation—but the fundamentals have shifted. Zambia is no longer just a "distressed" market. It's a copper-powered comeback story.

Monitor the weekly treasury bill auctions every Thursday. This is where you see how much local appetite there is for the Kwacha. If the auctions are oversubscribed, it usually means big players are bullish on the currency, signaling a potential gain against the dollar in the coming days.