You’ve got a car sitting in the driveway. It’s older. Maybe the transmission is starting to slip, or perhaps it’s just taking up space while the registration fees keep piling up. You want it gone, but the thought of dealing with Facebook Marketplace "is this still available" messages makes you want to scream. So, you think about the American Cancer Society vehicle donation program. It sounds like a win-win, right? You get a tax break, and they get money for cancer research.

But honestly, most people have no idea how the gears actually turn behind the scenes. They think a volunteer from the ACS shows up at their house, hops in the driver's seat, and drives it to a laboratory. That's not how it works. Not even close.

The gritty reality of the "Cars for Kars" style donation

When you choose an American cancer society vehicle donation, you are essentially entering a partnership with a middleman. The ACS, like almost every major non-profit, doesn't have a fleet of tow trucks or a used car lot. They partner with professional auction firms and processing centers—specifically, a company called Insurance Auto Auctions (IAA).

IAA handles the heavy lifting. They pick up the car. They sell it. They take a cut for their services, and then the remaining proceeds—usually the lion's share—go to the American Cancer Society.

It's a streamlined system, but it means the "value" of your donation isn't necessarily what the Kelley Blue Book says. It’s whatever a buyer at a wholesale auction is willing to pay on a Tuesday morning. This matters because your tax deduction is directly tied to that final sale price. If the car sells for $450, that’s your deduction, even if you thought it was worth a grand.

Why American cancer society vehicle donation actually makes an impact

Cancer is expensive. Beyond the obvious medical bills, there’s the "hidden" cost of just surviving. The ACS uses the money from these junkers—and some high-end gems—to fund things like the Hope Lodge program.

If you haven't heard of Hope Lodge, it’s basically a free place for patients and their caregivers to stay when treatment is far from home. Think about that for a second. Imagine having to travel 300 miles for chemo and not knowing how you’re going to pay for a hotel for two weeks. Your beat-up 2008 Honda Civic might literally pay for a dozen nights of lodging for a family in crisis.

👉 See also: Why Your Best Kefir Fruit Smoothie Recipe Probably Needs More Fat

Then there is the research. Since 1946, the ACS has invested over $5 billion in research. They were early funders for people like Dr. James Allison, who later won a Nobel Prize for his work on immunotherapy. When you donate a vehicle, you aren't just getting rid of a hunk of metal; you’re fueling a machine that funds the next breakthrough in CAR-T cell therapy or early detection screenings.

The logistics: How it actually happens

The process is surprisingly fast. You call them or fill out an online form. You’ll need the title. If you don't have the title, things get hairy. In most states, you cannot donate a vehicle without a clear title in your name.

- Information gathering: You provide the VIN, mileage, and condition. Be honest. If the engine is seized, tell them. It won't necessarily disqualify the car—they take "clunkers"—but it helps the tow driver prepare.

- The Pickup: A local towing company (contracted by IAA) calls you to schedule a time. Usually, this happens within 48 to 72 hours.

- The Paperwork: You hand over the keys and the signed title. Pro tip: Always take your license plates off. In many states, you are liable for what happens with those plates until they are returned to the DMV or transferred.

- The Sale: The car goes to auction.

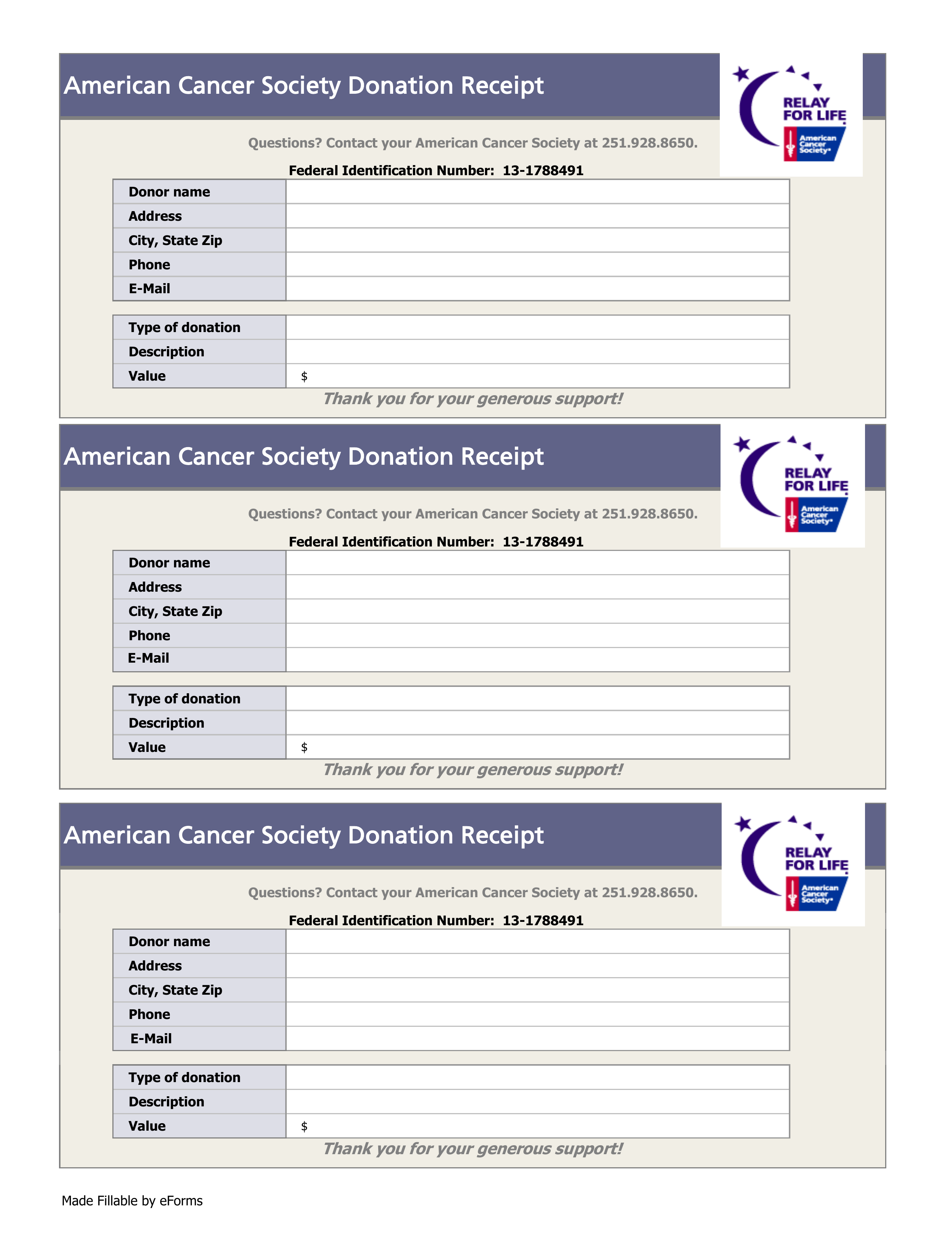

- The Receipt: This is the most important part for your taxes. Within 30 days of the sale, you’ll get a 1098-C form in the mail.

What most people mess up

The IRS is surprisingly picky about car donations. You can't just guess the value. If the car sells for more than $500, you can only deduct the exact amount it sold for at auction. If it sells for less than $500, you can generally claim the "fair market value" up to that $500 limit.

There's a weird exception, though. If the charity decides to keep the car to use in their fleet—say, to drive patients to appointments—you can often deduct the full fair market value. But let's be real: the American Cancer Society rarely keeps the cars. They want the cash. Cash pays for scientists. Cash pays for the 24/7 helpline (1-800-227-2345).

Is it better to sell it yourself and donate the cash?

Honestly? Sometimes.

If you have a car worth $10,000 and you have the patience to sell it privately, you will almost certainly get more money than an auction house would. If you then write a check for $10,000 to the ACS, the charity gets more money, and you get a bigger tax deduction.

✨ Don't miss: Exercises to Get Big Boobs: What Actually Works and the Anatomy Most People Ignore

But most people don't do that. Why? Because selling a car is a nightmare. It takes weeks. You have to deal with lowballers and people who don't show up. The vehicle donation program is built for convenience. You sacrifice a bit of the total value in exchange for a tow truck showing up and making your problem disappear.

The "Hidden" benefits: Environmental impact

We don't talk about this enough. Older cars are often environmental disasters. They leak oil. They have inefficient catalytic converters. When you donate a car that’s headed for the end of its life, the processing centers ensure that fluids are drained properly and heavy metals are recycled. It’s a way of cleaning up the driveway and the planet at the same time.

Critical things to check before you sign the title

Don't just sign and hope for the best. You need to be smart.

- Check the charity status: Ensure you are actually dealing with the American Cancer Society (a 501(c)(3) organization). There are plenty of "charity" sounding organizations that spend 90% of their revenue on marketing and only 10% on the actual cause. The ACS is a heavy hitter with high transparency ratings on Charity Navigator.

- Empty the glove box: You would be shocked at how many people leave their registration, insurance cards, or even spare house keys in the car. Check the "secret" compartments.

- Take photos: Before the tow truck hauls it away, snap a few photos of the exterior and the odometer. It’s your insurance policy in case something goes wrong during transit.

Common myths about car donations

Some people think the car has to be running. It doesn't. As long as it has an engine and is towable, most programs will take it. Others think they can donate a car they "found" on a property they bought. Nope. No title, no donation. The legal headache for the charity isn't worth the $300 in scrap metal.

Then there’s the myth that this is a "tax loophole." It’s not a loophole; it’s a standard deduction. You aren't "making money" by donating a car. You are reducing your taxable income. If you’re in the 24% tax bracket and you donate a car that sells for $1,000, you're essentially saving $240 on your tax bill. You’d still be "richer" if you sold the car for $1,000 cash, but you’d have the headache of the sale.

How the money is spent (The Breakdown)

When that car sells, the money doesn't just vanish into a black hole. The ACS is pretty clear about their spending. Roughly 75% to 80% of their total income goes directly toward program services. This includes:

🔗 Read more: Products With Red 40: What Most People Get Wrong

- Patient Support: Navigating the healthcare system is a nightmare. ACS provides coordinators to help people understand their diagnosis.

- Discovery: Funding labs that look for the "Achilles heel" of different cancer types.

- Advocacy: Working with the American Cancer Society Cancer Action Network (ACS CAN) to push for laws that limit tobacco use or increase access to screenings.

Actionable steps to finalize your donation

If you're ready to pull the trigger, here is exactly what you need to do right now. Don't let that car sit for another winter.

First, find your title. If you can't find it, go to your local DMV website and order a duplicate. You cannot move forward without it.

Second, visit the official ACS vehicle donation page or call 1-877-957-2277. This ensures you are going through the legitimate portal and not a third-party aggregator that takes a bigger cut.

Third, call your insurance agent. Once the car is picked up and you have the towing receipt, cancel the insurance. Don't pay for another day of coverage on a car you no longer own.

Finally, keep that 1098-C receipt. Put it in your "Taxes" folder immediately. If you're using software like TurboTax or H&R Block, it will ask for the specific details from this form, including the date of the contribution and the VIN.

Donating a car isn't going to make you rich, and it won't solve the world's problems overnight. But it takes a piece of clutter in your life and turns it into a night of sleep for a patient in a Hope Lodge or an hour of time for a researcher looking for a cure. That's a pretty good trade for an old car that won't start anyway.