Timing a stock like AMD isn't just about staring at a ticker. Honestly, it’s about understanding the rhythm of their fiscal year, especially when they’re locked in a high-stakes AI arms race with Nvidia. If you're hunting for the amd earnings date 2025 schedule, you’ve likely noticed that the company follows a pretty predictable Tuesday-night pattern.

They usually drop the news after the closing bell at 4:15 PM ET. Then, Lisa Su and her team hop on a call at 5:00 PM ET to tell everyone how the quarter actually went.

The Official AMD Earnings Date 2025 Calendar

For 2025, AMD has already moved through most of its reporting cycle. Because the company’s fiscal year aligns with the calendar year, their "2025" reports cover the performance within those specific months.

Here is how the year actually played out for their financial disclosures:

- Q4 2024 Results (Reported in 2025): February 4, 2025. This was the big "kickoff" that set the tone for their AI GPU expectations.

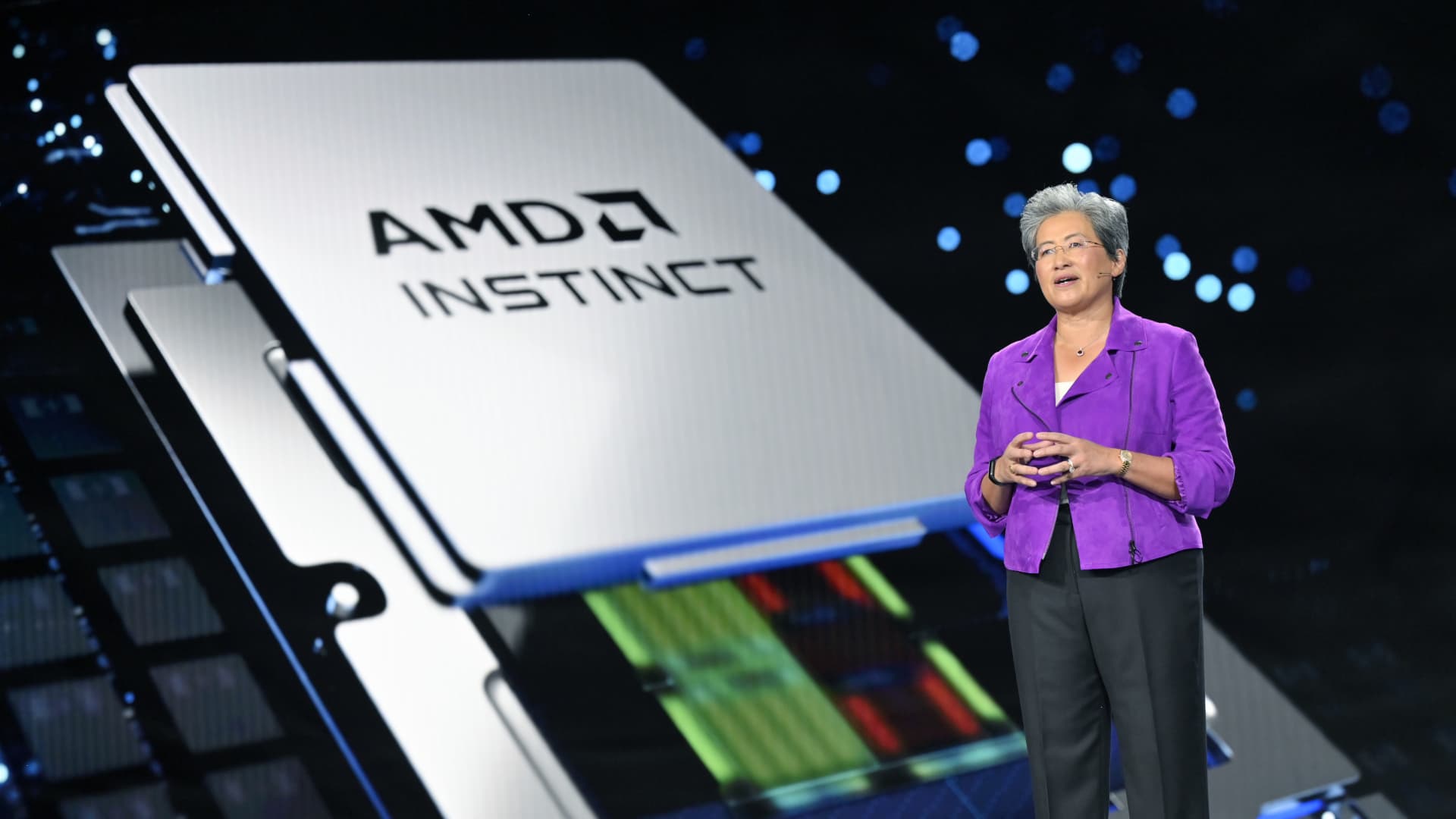

- Q1 2025 Results: May 6, 2025. This quarter highlighted the initial ramp-up of the Instinct MI300 series.

- Q2 2025 Results: August 5, 2025. A critical mid-year check-in where the market looked at data center growth vs. traditional PC chips.

- Q3 2025 Results: November 4, 2025. This was a massive one. AMD reported a record $9.2 billion in revenue, driven by a 36% year-over-year jump.

If you are looking for the next big update—the one that wraps up the entire 2025 fiscal year—mark your calendar for February 3, 2026. That is when they will officially release the Q4 2025 and full-year results.

👉 See also: Why the Department of Energy Nuclear Energy Strategy Is Finally Moving the Needle

Why Investors Obsess Over These Dates

It’s not just about the numbers. It’s about the "guide." AMD’s stock often moves more on what they say will happen in the next three months than what actually happened in the last three. For instance, back in the August 2025 call, everyone was hyper-focused on whether the AI revenue forecast would be raised again.

The market has a weird habit of "buying the rumor and selling the news." You've probably seen it: AMD beats every estimate, but the stock still dips 3%. Why? Usually, it's because the "whisper numbers" among institutional traders were even higher than the analysts' official guesses.

Key Factors That Influenced the 2025 Reports

Throughout the 2025 earnings cycle, a few specific themes kept popping up. If you missed the calls, here is the shorthand version of what was actually happening behind the scenes.

📖 Related: Why the Surprise Spinner Google Birthday Doodle Still Matters Years Later

The Data Center Explosion

By the time the Q3 report hit in November, the Data Center segment was the star of the show. Revenue there hit $4.3 billion. That’s up 22% compared to the previous year. The MI350 Series GPUs are basically the company’s golden ticket right now.

The China Problem

It wasn't all sunshine. In the Q2 and Q3 reports, AMD had to deal with significant "inventory charges"—we’re talking roughly $800 million—specifically because of U.S. government export controls on high-end AI chips like the MI308. They basically couldn't ship certain tech to China, and that left a mark on the GAAP margins.

The "Zen 5" PC Recovery

While everyone talks about AI, the "Client" segment (laptops and desktops) actually had a massive 2025. In the November report, Client revenue was up a staggering 46%. People are finally upgrading those old COVID-era PCs, and the Ryzen 9000 series (Zen 5) launched right into that demand.

How to Prepare for the Next Earnings Call

If you're planning to trade or hold through an amd earnings date 2025 event, or the upcoming 2026 wrap-up, you need a plan. Don't just look at the EPS (Earnings Per Share).

🔗 Read more: Square Root of 8: Why This Irrational Number Is More Than Just 2.82

- Check the Gross Margin: AMD has been fighting to keep this above 50%. In Q3 2025, they hit 54% on a non-GAAP basis. If that number slips, big investors get twitchy.

- Listen for "MI350" and "MI400": These are the code names for their next-gen AI chips. Any delay in these timelines usually causes a sell-off.

- Watch the Cash Flow: One of the most underrated parts of the 2025 reports was the record free cash flow. A company with cash can buy back shares or acquire smaller AI startups.

Actionable Steps for Investors

Don't wait until the day of the announcement to do your homework. Start by visiting the AMD Investor Relations page about two weeks before the scheduled date. That’s usually when they put out the "save the date" press release.

Next, look at the "implied move" in the options market. You can use tools like MarketChameleon to see how much the stock typically swings after an earnings report. Historically, AMD can jump or dive anywhere from 5% to 10% in the 24 hours following a release.

Finally, read the transcript, don't just look at the headlines. Headlines often miss the nuance of the Q&A session where analysts grill Lisa Su about supply chain constraints or competition with Intel's latest Xeon chips. Understanding that nuance is the difference between guessing and actually knowing why the stock is moving.