Investing in Amazon used to be easy. You bought it, you waited, and you woke up richer. But lately, things have felt... different. Honestly, if you’ve been watching the ticker, it’s been a bit of a slog. While the rest of the market was doing victory laps in 2025, Amazon was just kinda sitting there, moving sideways like it forgot how to climb.

By late 2025, the stock was hovering around $227, while the S&P 500 was busy hitting all-time highs. It felt like a "gift" to some and a headache to others. But as we head into the thick of 2026, the conversation around the amazon stock forecast 2025 is shifting from "why is it stuck?" to "when does the rocket ship actually take off?"

The AWS Reacceleration: The Engine is Warming Up

Let's talk about the elephant in the room: cloud computing. For a minute there, people thought Amazon Web Services (AWS) was losing its mojo. Microsoft Azure and Google Cloud were nipping at its heels, and AWS’s market share dipped slightly to around 29% in Q3 2025.

But here's the kicker. AWS still accounts for a massive 60% of Amazon’s operating profit. It’s the bank that funds everything else. In late 2025, we started seeing the "AI fingerprints" everyone was waiting for. Enterprises aren't just flirting with AI anymore; they’re moving their core workloads to the cloud to handle the massive compute power required.

Analysts like John Dinsdale from Synergy Research Group have pointed out that the cloud market is actually reaccelerating. We’re talking about a market that cleared $107 billion in just one quarter. Amazon is pouring money—we’re talking a staggering $125 billion in capital expenditure—into data centers and AI infrastructure. They’re building the "railroad tracks" for the next decade of tech.

Why the "Boring" Retail Business Actually Matters

You probably think of Amazon as the place where you buy toothpaste at 11 PM. To Wall Street, it’s a logistics puzzle.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

Amazon has been quietly re-architecting its entire U.S. delivery network into regional clusters. This isn't just nerdy supply chain talk. It’s about money. By moving items closer to you before you even click "buy," they’re cutting shipping distances and air freight costs.

- Robotics at Scale: They now have over a million robots in their warehouses.

- The Sequoia System: This tech cuts order processing time by 25%.

- Projected Savings: These automation moves are expected to save the company roughly $4 billion in fulfillment costs annually.

When you save $4 billion on the "boring" stuff, that money drops straight to the bottom line. It makes the retail side—which used to be a low-margin drag—suddenly look a lot more attractive.

The Advertising Gold Mine Nobody Noticed

If you want to understand the amazon stock forecast 2025, you have to look at the ads. No, not the annoying ones on TV—the ones on the search results page.

Amazon’s advertising revenue is growing at a clip of about 22% to 24% year-over-year. It surpassed $60 billion in 2025. Think about that for a second. That is "found money" for Amazon because they already have the traffic. They don't have to go out and find users like Meta or Google; we're already there with our credit cards out.

Prime Video is also getting in on the action. Since they introduced ads in early 2024, that segment has been a sleeper hit. S&P Global Market Intelligence estimates that Prime Video ad revenue could hit $806 million soon. It’s a high-margin business stacked on top of a high-margin business.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

What the Analysts are Actually Saying

Wall Street isn't exactly quiet about this stock. The consensus is overwhelmingly bullish, even if the price action has been sluggish.

| Institution | Price Target (12-Month) | Rating |

|---|---|---|

| Goldman Sachs | $275 | Buy |

| BMO Capital | $304 | Outperform |

| CIBC | $315 | Buy |

| Rosenblatt | $305 | Buy |

Most analysts see a median target somewhere around $288 to $295. Some of the more aggressive bulls think we could see $340 if the AI integration in AWS really catches fire.

But it’s not all sunshine. The "bears" (the skeptics) worry about margins. They see that $125 billion in spending and wonder if Amazon is overextending itself. There's also the "Trump tariff" factor. With shifts in trade policy, the cost of goods for third-party sellers could spike, which might dampen the holiday shopping frenzy.

The Reality Check: Valuation and Risks

Is the stock "cheap"? Well, sort of.

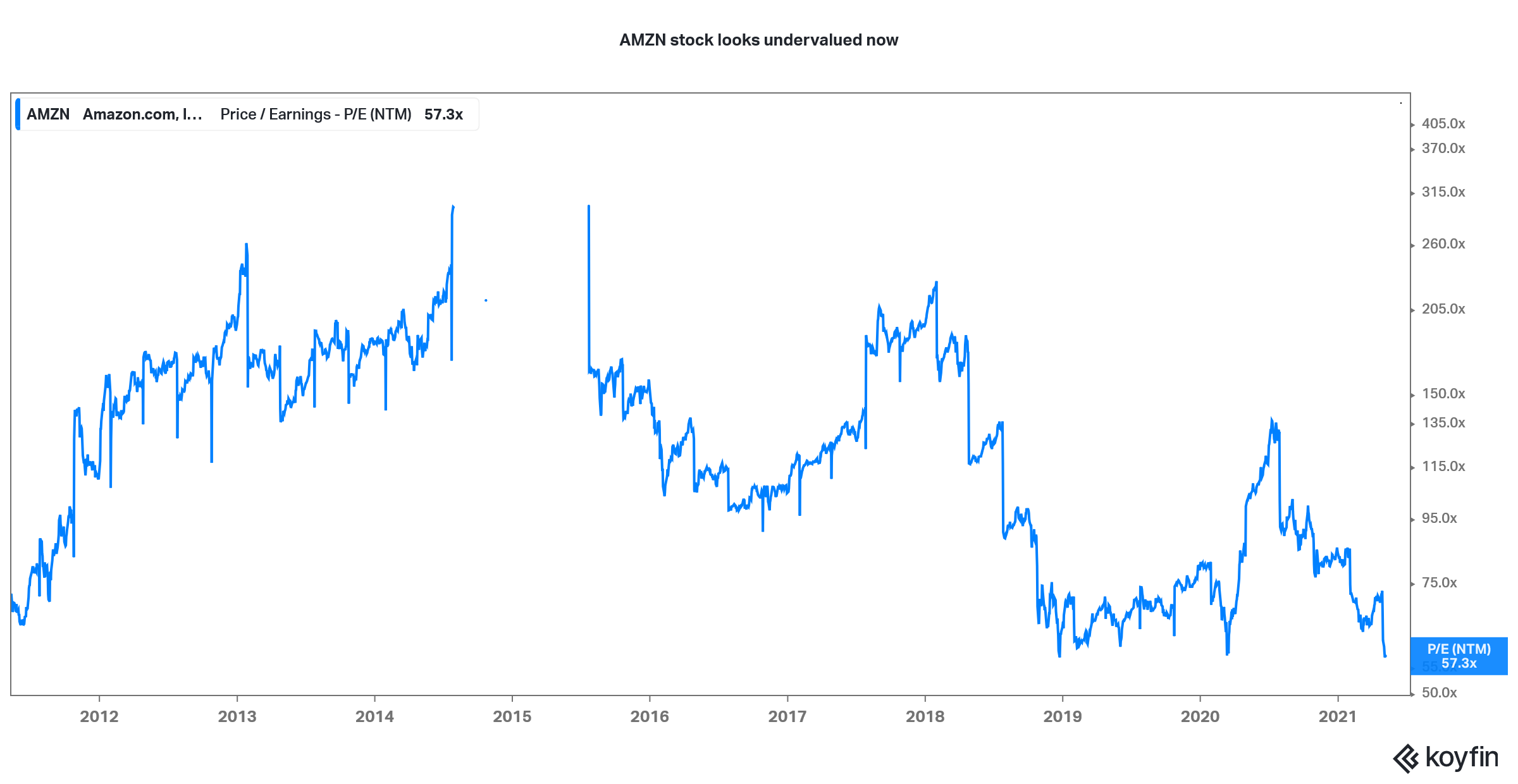

In early 2026, Amazon’s price-to-earnings (P/E) ratio was sitting around 34 or 35. Now, compared to the S&P 500 average of 25, that looks expensive. But compared to Amazon’s own history? It’s actually on the lower end. For years, this stock traded at P/E multiples that would make your eyes water.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The real risk isn't that Amazon fails; it’s that the competition is just really good. Microsoft has a head start with OpenAI. Google’s Gemini 3 is making serious waves in the enterprise space. Amazon is playing catch-up with its own chips like Trainium and Inferentia. If those chips don't perform as well as Nvidia’s or Google’s TPUs, AWS could lose its "preferred" status among developers.

Moving Forward: How to Play This

If you’re looking at the amazon stock forecast 2025 and wondering what to do, it basically comes down to your time horizon.

Honestly, if you're trying to make a quick buck in three weeks, this might not be your play. Amazon is in a "heavy investment" cycle. They are building for 2030, not just next month. However, for those with a bit of patience, the combination of a high-margin ad business, a reaccelerating cloud segment, and massive logistics savings is a powerful cocktail.

Actionable Insights for Your Portfolio:

- Watch the Capex: Keep a close eye on the quarterly earnings reports. If capital expenditure starts to level off while revenue keeps climbing, that’s when the "margin explosion" happens.

- Monitor AWS Growth: If AWS stays above 20% growth, the bull case remains intact. If it dips into the low teens, it's time to worry.

- Look at the Ad Revenue: This is the secret sauce. As long as this keeps growing at 20%+, it provides a massive safety net for the stock's valuation.

- Consider the Entry Point: Many traders see the $215–$225 range as a strong support level. Buying on those "boring" sideways dips has historically been a winning strategy for long-term holders.

Amazon is no longer just an e-commerce company. It’s a global infrastructure and data behemoth. The stock might have been "stuck" in 2025, but the underlying business is arguably stronger than it's ever been. Over the next year, we'll see if the market finally decides to reward that strength.