Wall Street has a funny way of looking at a company like Alphabet. When the tech giant released its earnings report for the first quarter of 2023, the headlines were a bit of a mess. People saw a beat on the top line but were squinting at the bottom line. Honestly, if you want to understand the health of the "House of Google," you have to look past the surface-level revenue and get into the weeds of the Alphabet Q1 2023 diluted EPS.

It was $1.17.

That was the number. Compared to $1.23 in the same quarter the previous year, it looked like a dip. But a single number never tells the whole story, does it? You have to account for the massive $2.6 billion in charges related to workforce reductions and office space exits. Without those one-time hits, that EPS would have looked a whole lot different.

The Reality of the $1.17 Alphabet Q1 2023 Diluted EPS

Let's be real: 2023 was the "year of efficiency" before that phrase became a tired corporate cliché. Alphabet was coming off a massive hiring spree during the pandemic, and the bill finally came due. The Alphabet Q1 2023 diluted EPS reflected a company trying to steer a massive ship in a very choppy macroeconomic ocean.

Inflation was biting. Advertisers were pulling back.

Search remained the bedrock, though. Google Search and other related revenues hit $40.36 billion. It’s still the most profitable real estate on the internet. However, the net income for the quarter landed at $15.05 billion. When you divide that by the diluted share count, you get that $1.17 figure. It’s a GAAP (Generally Accepted Accounting Principles) number, meaning it includes all the "ugly" stuff like severance pay for the 12,000 employees laid off in January.

If you’re wondering why the market didn't freak out, it’s because investors were already looking at the $70 billion share buyback program Alphabet announced at the same time. Buybacks are a way for a company to say, "We think our stock is cheap, and we’re going to prove it." By reducing the number of shares outstanding, they effectively juice the EPS in future quarters. It’s a classic move.

🔗 Read more: Price of Tesla Stock Today: Why Everyone is Watching January 28

What the Analysts Got Wrong (And Right)

Most analysts at firms like Morgan Stanley and Goldman Sachs were bracing for a disaster. They worried that TikTok was eating YouTube’s lunch and that ChatGPT was going to make Search obsolete overnight. Neither happened in Q1. YouTube ads actually brought in $6.69 billion. While that was down slightly year-over-year, it showed a lot more resilience than the "experts" predicted.

The "Other Bets" category—which includes things like Waymo and Verily—lost $1.2 billion. That’s just standard operating procedure for Alphabet. They throw money at the wall to see what sticks. But in the context of the Alphabet Q1 2023 diluted EPS, these losses are the "tax" investors pay for the hope of hitting a future goldmine.

Breaking Down the Segments

Google Cloud was the secret star of the show. For the first time ever, the Cloud division actually turned an operating profit. We’re talking $191 million in profit compared to a loss of $706 million a year earlier. That is a massive swing. It signals that Google is finally catching up to AWS and Azure in terms of operational maturity.

Cloud's success is vital because it diversifies the income stream away from just selling ads. When you look at the Alphabet Q1 2023 diluted EPS, you’re seeing the transition of Cloud from a cash-burning liability to a contributor.

Then there’s the AI piece.

Sundar Pichai was under immense pressure during the Q1 earnings call to prove Google wasn’t falling behind. This was the quarter where "Bard" (now Gemini) was the main topic of conversation. The costs associated with training these Large Language Models (LLMs) are astronomical. They require specialized chips (TPUs) and an insane amount of electricity. This "AI tax" is now a permanent fixture in Alphabet's capital expenditures.

💡 You might also like: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

The Impact of the Buyback

You can't talk about EPS without talking about share counts. Alphabet’s board authorized $70 billion to repurchase both Class A and Class C shares. This is significant. Why? Because EPS is a fraction.

$$Earnings\ Per\ Share = \frac{Net\ Income}{Shares\ Outstanding}$$

If you shrink the denominator (shares outstanding), the EPS goes up even if the profit stays the same. Alphabet has been using this lever aggressively. In Q1 2023, they were essentially signaling to the market that even if ad growth slowed down, they could keep the EPS attractive by retiring shares. It’s a financial engineering strategy that works—until it doesn’t.

Why This Specific Quarter Matters Now

Looking back, Q1 2023 was the inflection point. It was when the company moved from "growth at all costs" to "disciplined innovation." The Alphabet Q1 2023 diluted EPS of $1.17 was the floor.

Since then, we've seen how the integration of AI into Search—SGE or Search Generative Experience—has changed the cost structure. The margins on a traditional search are much higher than an AI-generated search. In Q1 2023, Google was just starting to figure out how to bridge that gap without killing their golden goose.

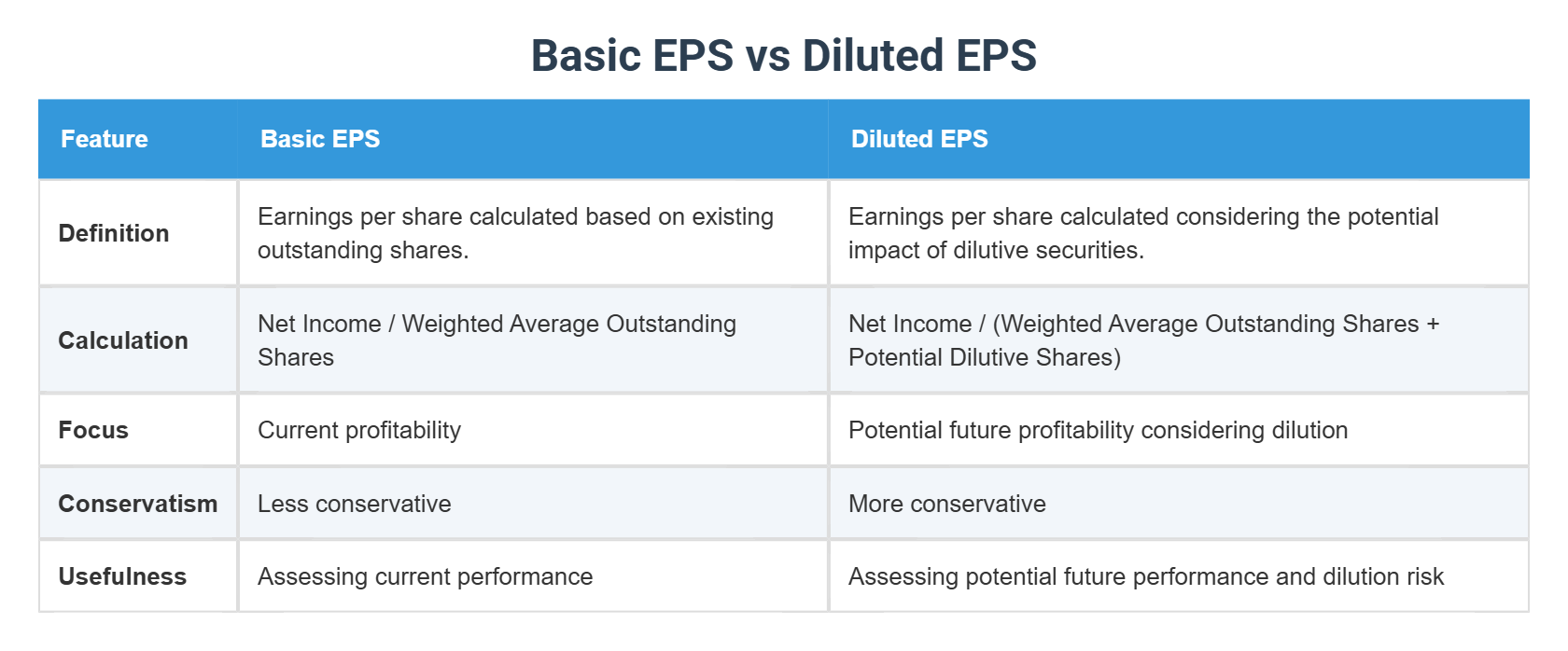

Investors often overlook the "Diluted" part of EPS. Dilution happens when a company issues stock options to employees. Alphabet gives out a lot of stock-based compensation (SBC). In a down market, SBC is a double-edged sword. It keeps talent without spending cash, but it dilutes the existing shareholders. The Q1 report showed Alphabet was starting to get a grip on this, though SBC remains a huge line item that eats into the bottom line.

📖 Related: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

Real-World Takeaways for Investors

If you were holding Google stock back then, you probably remember the volatility. The stock jumped after the report because the $1.17 EPS was better than the $1.07 or $1.08 some bears were whispering about. It proved that the core search business is an absolute tank. It can take hits from privacy changes on iOS, competition from Amazon in product search, and the rise of AI, and still print billions.

Ruth Porat, the CFO at the time, was very clear: the company was re-engineering its cost base. That's CFO-speak for "we are going to be a lot stingier with our money."

- The Severance Factor: The $2.6 billion charge was a one-time event, but it masked the true earning power of the company in that quarter.

- The Cloud Milestone: Turning a profit in Cloud changed the narrative from "Google is an ad company" to "Google is a diversified infrastructure play."

- The Search Moat: Despite the AI hype, people still "Google" things. The volume didn't drop.

Moving Forward: What to Watch

When analyzing the Alphabet Q1 2023 diluted EPS, it’s a lesson in looking beyond the primary headline. A "miss" or a "beat" is often just a matter of how analysts set their expectations, not how the business is actually performing. Alphabet's ability to maintain a dollar-plus EPS while laying off thousands and pivoting its entire technical architecture to AI is, frankly, impressive.

If you're tracking Alphabet's performance today, use Q1 2023 as your baseline for "the new normal." It was the moment the company grew up and started acting like a mature value stock rather than a wild-eyed startup.

To get a true sense of where the company is headed, don't just look at the net income. Watch the free cash flow. In Q1 2023, free cash flow was $17.2 billion. That’s the real money they have to play with. It's the money that funds the AI labs, pays for the satellite offices, and buys back those billions in shares.

The next time you see an earnings report, do yourself a favor: ignore the first tweet you see. Go to the investor relations page. Open the PDF. Look at the "Operating Income" by segment. That's where the truth is hidden. The Alphabet Q1 2023 diluted EPS was just the tip of the iceberg in a quarter that redefined what Google would become in the AI era.

Actionable Insights for Your Portfolio:

- Check the SBC: Always look at how much stock-based compensation is diluting your shares. If SBC is growing faster than revenue, that's a red flag.

- Monitor Cloud Margins: Now that Google Cloud is profitable, watch if those margins expand to 20-30% like AWS. That's where the next leg of growth comes from.

- Ignore the AI Hype, Watch the CapEx: AI is expensive. Watch the Capital Expenditures (CapEx) in the earnings reports. If Google is spending $10 billion a quarter on servers, they need to show a return on that investment in the Search revenue line eventually.

- The Buyback Yield: Calculate the "buyback yield" by comparing the $70 billion authorization to the total market cap. It gives you a sense of how much downside protection the company is providing to its own stock price.

Alphabet remains a powerhouse, but it's a powerhouse in transition. Q1 2023 was the first real evidence that they could handle the shift without losing their footing.