You’ve probably seen the headlines. The phrases "divorce terrorism," "third Google founder," and "billion-dollar estate" get thrown around a lot whenever Allison Huynh net worth comes up in conversation. Honestly, it’s a bit of a mess. Trying to pin down a single number for her bank account is like trying to catch a Bay Area fog bank with a butterfly net.

But if you’re looking for the short answer: we’re talking hundreds of millions, likely north of half a billion, depending on how the dust finally settled on one of Silicon Valley’s most exhausting legal marathons.

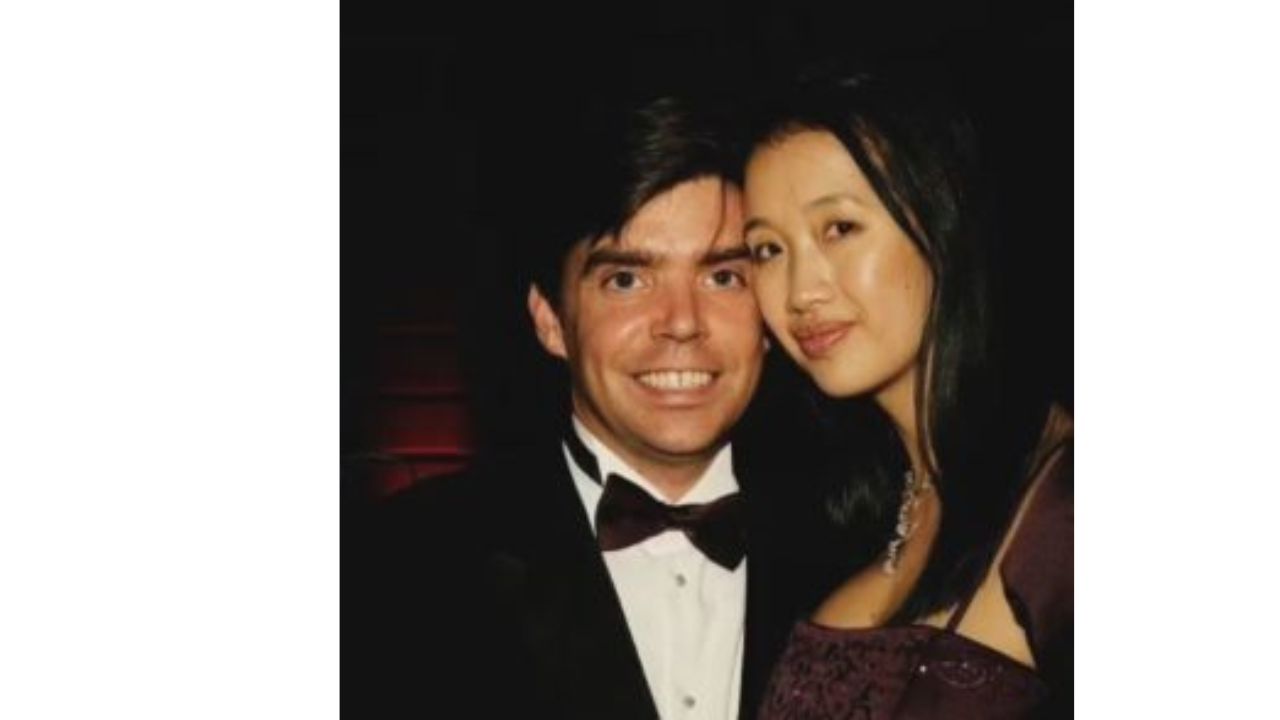

Huynh isn't just a "plus-one" to a tech titan. She’s a Stanford-educated researcher, a robotics pioneer, and a woman who was in the room—and the code—when the modern internet was being built. To understand her wealth, you have to look past the tabloid drama and into the actual assets, the Google stock, and the robotics labs that started it all.

The Google Shadow and the $1.8 Billion Question

Most people link Huynh’s wealth directly to her ex-husband, Scott Hassan. For those who don't know the deep lore of Mountain View, Hassan is often called the "third founder" of Google. He’s the guy who wrote a massive chunk of the original search engine code before Larry Page and Sergey Brin even incorporated.

When Google went public, that early involvement turned into a mountain of Alphabet stock. By the time Huynh and Hassan hit the rocks in 2014, their joint estate was valued at roughly $1.8 billion.

👉 See also: PepsiCo Earnings Date October 2025: Why Most People Missed the Real Story

Here’s where it gets kinda wild. They didn’t have a prenup.

In California, that usually means a 50/50 split of everything acquired during the marriage. But because Hassan’s Google shares were technically "pre-marital" (he bought 160,000 shares for a measly $800 before they wed), the legal battle turned into a decade-long siege. Huynh argued that her support and her own work in their joint ventures entitled her to a massive slice of the pie.

Why the Settlement Was So Messy

- The "Revenge" Site: At one point, Hassan actually admitted to launching a website specifically to host embarrassing public records about Huynh.

- The Trust Fund Takedown: Huynh alleged that a $20 million trust for their three children was slashed to just $500,000 during the heat of the battle.

- The "Fire Sale": She even sued to stop him from selling a robotics company, Suitable Technologies, for a "paltry" $400,000, claiming it was a tax move designed to keep her from her share.

She’s a Founder in Her Own Right

It’s easy to get distracted by the divorce drama, but Huynh’s personal portfolio is legit. She didn't just sit around waiting for a settlement check. She’s been a senior research fellow at Stanford’s Robotics Laboratory and was a key player at Willow Garage, the legendary robotics incubator.

If you’ve ever heard of the Robot Operating System (ROS), you’ve seen the legacy of where she worked. She also founded MyDream Interactive, a software studio that jumped into VR and "non-violent" gaming long before it was trendy.

Basically, she’s an engineer at heart. She’s spent years investing in:

- AI and Robotics: Early-stage stuff that most people didn't understand in 2010.

- Blue-Chip Art: A classic billionaire move, but one she’s done with a sharp eye for value.

- Real Estate: We're talking prime Palo Alto and San Francisco properties.

The "Divorce" from the Democratic Party

Lately, Huynh has been making waves for a different kind of "divorce." A former high-level fundraiser for Obama and Biden, she’s been very vocal about her shift toward the Republican party.

✨ Don't miss: Tennant Company Stock Price: Why Most Investors Are Missing the Real Story

She’s gone on record (notably on Fox News) criticizing California’s "wealth tax" proposals. She’s basically warned that the state is becoming a "shadow of itself" and that the "Billionaire Tax Act" will cause a mass exodus of the very people who fund the next wave of AI and healthcare.

Whether you agree with her politics or not, this shift is a huge indicator of her current mindset. She’s protecting the "American Frontier"—which, not coincidentally, is the name of her foundation. She’s heavily focused on U.S.-Vietnam business relations, claiming to have facilitated billions in investment. That kind of influence isn't just "divorce money." That's power.

So, What is Allison Huynh Net Worth in 2026?

If we look at the $1.8 billion estate from 2018 and account for the legal fees (which her lawyer Pierce O’Donnell once hinted were record-breaking), Huynh likely walked away with a settlement in the **$400 million to $600 million range**.

Add to that her own successful exits, her investments in companies like Magic Leap (where she and Hassan were original seed investors), and her current venture capital work through Alo Ventures, and the number stays high.

She’s currently investing in:

- Plaid and Discord: High-growth tech.

- Reddit: Another smart pre-IPO play.

- Luxury Real Estate: Specifically outside of California now, following the "billionaire exodus" she’s been preaching about.

The Reality Check

Is she a billionaire? Probably not on her own. But she’s one of the wealthiest women in tech who isn't a household name.

The most important takeaway isn't the number of zeros, though. It’s the fact that she’s transitioned from being a "Silicon Valley wife" to a political influencer and venture capitalist who is actively moving money out of California to protect it.

If you’re watching her next moves, keep an eye on the American Frontier Foundation. That’s where she’s putting her "soul's work" now, focusing on AI, fintech, and renewable energy between the U.S. and Vietnam. She’s playing a long game that goes way beyond a courtroom in San Jose.

How to Track Her Moves

If you want to understand where she's heading next, look at the portfolio of Alo Ventures. While most VCs are chasing the same three AI trends, Huynh tends to look for "cultural pride" and "innovation gaps." She’s also become a bellwether for tech-money flight; where she invests her personal real estate capital is usually a good indicator of where the next tech hub is actually growing.

Stick to the SEC filings and real estate records. The gossip columns will give you the drama, but the property deeds in Florida and Texas tell the real story of where her net worth is landing.

Stop looking at the 2014 headlines. They’re old news. Huynh has pivoted, and her current wealth is being used as a political and economic tool in a way that few saw coming ten years ago.