You’re standing in the aisle of a grocery store in Seattle, staring at a bottle of bourbon. It's priced at $35. You get to the register, and suddenly you’re staring at a receipt for nearly $50. No, the cashier didn't make a mistake. You just ran headfirst into the highest spirits tax in the country.

Most people think a beer is just a beer, but the government sees it as a "gallon of taxable units." Depending on which side of a state line you’re on, that "unit" might cost you two cents or two dollars. It’s a messy, inconsistent, and often frustrating system that affects everything from your Friday night plans to the local economy.

The Massive Gap in Alcohol Tax Per State

If you want the cheapest booze in America, pack your bags for Wyoming. Seriously. In Wyoming, the excise tax on beer is about $0.02 per gallon. It’s basically a rounding error. On the flip side, if you’re buying beer in Tennessee, you’re paying over $1.28 per gallon. That’s a 6,400% difference.

💡 You might also like: Finding an Example of IRS Tax Transcript and Making Sense of the Chaos

Why the gap? It’s rarely about the alcohol itself. It’s about history, state budgets, and how much a local government relies on "sin taxes" to keep the lights on. States like Tennessee or Alaska (which sits at $1.07 per gallon for beer) use these high rates to fund public services without necessarily hiking income tax.

Spirits: The Heavy Hitters

When we talk about the alcohol tax per state, distilled spirits take the biggest beating. In 2026, Washington remains the king of the mountain, charging a staggering $36.98 per gallon. Virginia and Alabama aren't far behind, both hovering in the $20-plus range.

Compare that to Missouri. In the "Show Me State," they only show you a tax of $2.00 per gallon.

- Washington: $36.98/gal

- Virginia: $23.47/gal

- Alabama: $22.87/gal

- Missouri: $2.00/gal

- New Hampshire: $0.00 (Effective rate)

Wait, New Hampshire is $0? Sorta. New Hampshire and Wyoming are "control states" for spirits. This means the state government actually runs the liquor stores. Instead of charging a traditional excise tax, they just bake their profit margin into the price of the bottle. It’s a different way of reaching the same goal: getting a piece of the pie.

Understanding the "Three-Tier" Headache

You can't talk about alcohol taxes without mentioning the three-tier system. It’s a leftover relic from the post-Prohibition era. Basically, a producer (the brewery) sells to a wholesaler, who then sells to a retailer (your local bar or liquor store).

Each of these steps often carries its own tax or fee. By the time that IPA reaches your hand, it’s been taxed at the federal level, the state level, and sometimes the local level. In Chicago, for example, you’re paying a federal tax, an Illinois state tax, a Cook County tax, AND a city of Chicago tax.

🔗 Read more: Cost of gold per gram in india today: Why the price is literally exploding right now

Honestly, it’s a miracle the beer stays cold with all that paperwork attached to it.

Why Some States Are Hitting the Gas

In early 2026, the World Health Organization (WHO) started sounding the alarm. They claim alcohol has become "too affordable" globally because taxes haven't kept pace with inflation. Some states are listening.

Take Utah. They’ve always been strict, but in 2026, they’ve doubled down. They aren't just looking at the tax; they’re looking at the buyer. New laws require bars to check every single ID—doesn't matter if you look 21 or 91. If you've got a history of "extreme DUI," your license might even have a red stripe that forbids you from buying alcohol at all.

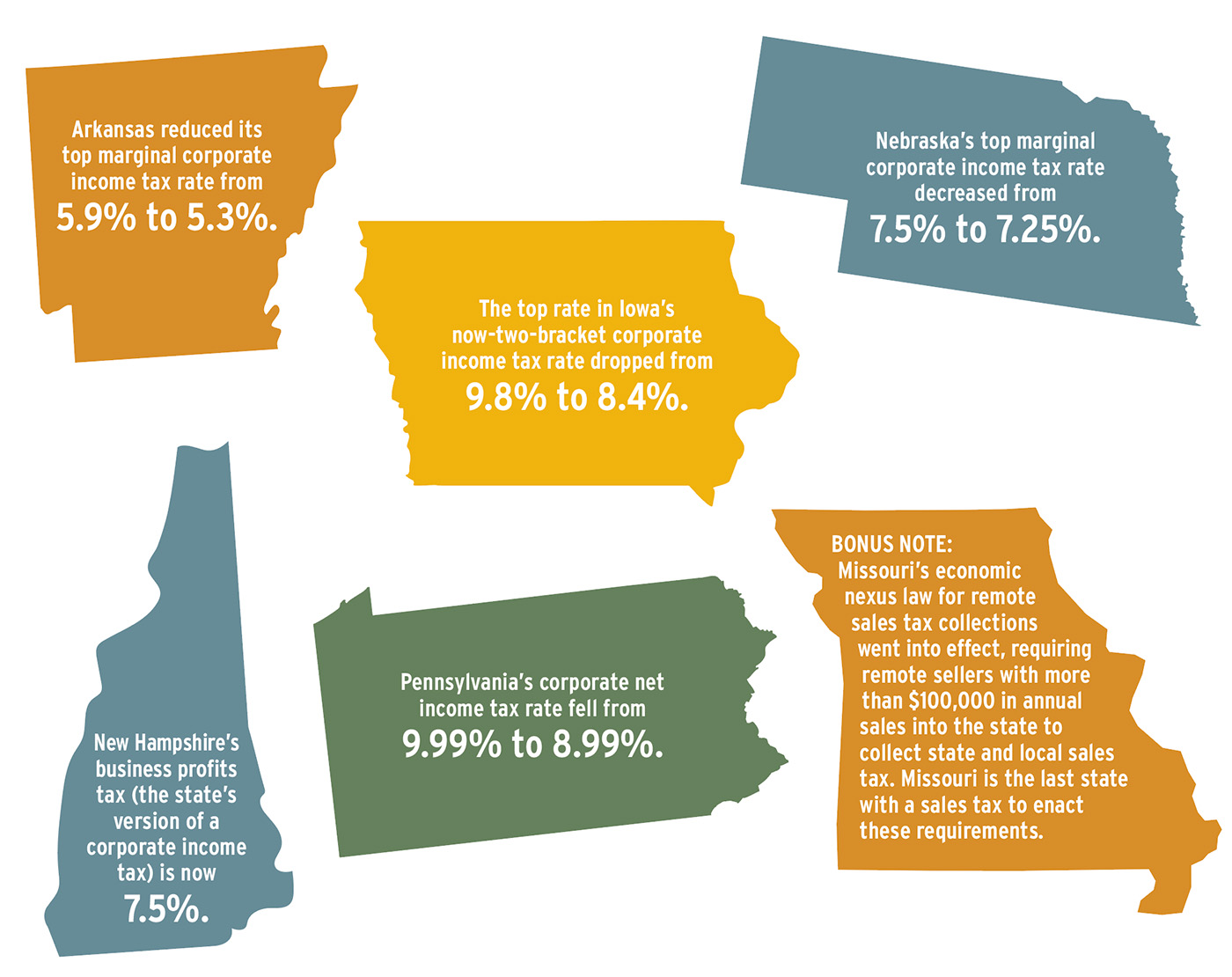

Arkansas and North Carolina also bumped their rates recently. It’s usually sold to the public as a way to curb "harmful consumption," but let’s be real: it’s also a very reliable way to fill a budget hole.

The "Seltzification" of Tax Law

Hard seltzers and ready-to-drink (RTD) cocktails have broken the brains of state tax collectors. Traditionally, tax was simple: beer was low, wine was medium, spirits were high.

But what is a 5% ABV canned Margarita?

If it’s made with malt, it’s taxed like beer.

If it’s made with actual tequila, some states tax it like a bottle of 80-proof whiskey.

This creates a weird situation where two cans with the exact same alcohol content have wildly different prices. Industry groups like the Distilled Spirits Council (DISCUS) are constantly lobbying for "tax parity"—the idea that alcohol should be taxed based on its volume, not its "source." So far, it’s a tough sell in statehouses.

The Real-World Impact on Your Wallet

It’s easy to look at a chart and shrug. But for a small business owner, these numbers are life or death.

Imagine you’re a craft brewer in Oregon (taxed at $0.08 per gallon) vs. a brewer in Tennessee ($1.29). The Tennessee brewer starts every day with a massive overhead disadvantage. They have to charge more, which makes them less competitive against the big national brands that can absorb the cost.

What Most People Get Wrong

People often assume that high taxes mean fewer people drink. The data is... messy. While "sin taxes" do generally reduce consumption in the long term, they also encourage "cross-border shopping."

If you live in Vancouver, Washington, you probably know a guy who drives across the bridge to Portland, Oregon, to buy his liquor. Why wouldn't he? He’s saving nearly $37 a gallon. The state of Washington loses the tax revenue, the local store loses the sale, and the guy still gets his gin.

Actionable Insights for the Savvy Consumer

If you're looking to navigate the alcohol tax per state maze without going broke, keep these things in mind:

- Check the "Effective" Rate: Don't just look at the excise tax. States like Kentucky have a lower excise tax but hit you with a 10% wholesale tax and a 6% sales tax. Always look at the total "out the door" price.

- Control States Aren't Always Cheaper: Just because New Hampshire has a $0 excise tax doesn't mean the liquor is free. The state markups can be just as high as a tax; they just call it "profit." However, because they buy in such massive bulk, they do often have lower prices than neighboring states.

- Buy Local (Sometimes): Some states, like Georgia, have historically offered lower tax rates for wines produced within the state. It’s a "protectionist" move that can save you a few bucks while supporting a local vineyard.

- Watch for "Hidden" Sales Taxes: Many states exempt "groceries" from sales tax but specifically include alcohol. In Maryland, you’re looking at a 9% sales tax on booze, which is significantly higher than their general 6% rate.

- Calculate the Per-Ounce Cost: If you're a fan of RTDs (canned cocktails), check the label. If it’s spirit-based, you might be paying a premium for the convenience. If you’re on a budget, buying the spirits and mixer separately is almost always cheaper because of how the "categorical" tax system works.

The bottom line? The price on the shelf is a lie. Between the federal excise, state excise, wholesale markups, and local sales taxes, your drink is one of the most heavily regulated and taxed consumer goods in the country. Understanding these nuances won't make the tax go away, but it’ll at least explain why your wallet feels a little lighter after a trip to the liquor store.