You've filed the paperwork. You’ve double-checked the math. Now, you’re just staring at your bank account waiting for that notification that your Alabama state tax refund has finally hit. It’s a frustrating waiting game, honestly. Most people think once they hit "send" on their tax software, the money should magically appear within a few days.

Reality is a bit messier.

The Alabama Department of Revenue (ALDOR) isn't exactly operating on Silicon Valley time. While the state has made massive strides in digitizing their systems, there are still plenty of human-shaped bottlenecks and security protocols that can turn a two-week wait into a two-month saga. If you’re sitting there wondering where your cash is, you aren’t alone. Thousands of Alabamians are refreshing the "Where’s My Refund?" portal every single morning, hoping for a status change that isn't "Your return is still being processed."

How the Alabama Department of Revenue Actually Processes Your Money

Let's get into the weeds of how ALDOR works. They don't just see your return and cut a check. It’s a multi-layered verification process designed primarily to stop identity thieves from stealing your money before you can claim it.

First, your return enters the system. If you filed electronically, this happens almost instantly. If you’re one of the few still mailing in paper forms, you've basically added three weeks to your timeline before a human even looks at the envelope. Once in the system, it goes through a "fraud filter." These filters look for red flags—oddly high deductions, mismatched W-2 data, or banking info that’s been used on multiple returns.

If you pass the filters, you move to the "validation" phase. This is where the state confirms that the numbers you reported match what your employer reported. If there’s even a $5 discrepancy, the system might kick your return to a manual reviewer. That’s the "purgatory" phase. A real person in Montgomery has to look at your file, compare it to the records, and decide if it’s a simple mistake or something worth a phone call.

🔗 Read more: How Do I Get a EIN Number for My LLC Without Paying a Pro

The Identity Quiz Surprise

Lately, Alabama has been leaning heavily into the "Identity Confirmation Quiz." You might get a letter in the mail asking you to log into a secure portal and answer questions about your past addresses or car loans. It feels like a pop quiz you didn't study for. Don't ignore this. If you get that letter and don't take the quiz, your Alabama state tax refund will sit in a frozen state indefinitely. They won't call you. They won't email you. You have to be the one to move it forward.

Timeline Realities: When Will You Actually See the Cash?

ALDOR generally tells people to wait 8 to 12 weeks. That’s a huge window.

Early filers—the people who have their W-2s ready in late January—often get their refunds the fastest. If you file by February 1st, you might see your money in 3 to 4 weeks. But if you wait until the April 15th rush, you are entering the peak of the bottleneck. During the middle of tax season, the sheer volume of data entering the Alabama servers slows everything down.

- E-filed returns with Direct Deposit: These are the gold standard. Generally 2–6 weeks, assuming no fraud flags.

- Paper returns: Expect 8–12 weeks minimum. Seriously, just don't do it.

- Refunds with Earned Income Tax Credit (EITC) or specific business credits: These often undergo extra scrutiny, which can add another 14 days to the clock.

People often confuse their federal refund with their state refund. They are two completely different machines. The IRS might be fast one year and slow the next, but Alabama’s timeline is its own beast. Just because your federal money landed in your account doesn't mean the state is even halfway through your file.

Common Reasons for Delays (That Aren't Fraud)

Sometimes, the delay is boring. Maybe you moved and didn't update your address with the state. Maybe you owe back taxes or have an outstanding debt to a state agency. Alabama has a "Treasury Offset Program." If you owe money for child support, student loans, or even certain court fees, the state will snatch your refund to pay those debts before you ever see a dime.

You’ll get a notice explaining the offset, but usually, that notice arrives after the refund was supposed to hit.

Another big one? Simple math errors. Even with software, people sometimes fat-finger their Social Security number or mistype their bank’s routing number. If the bank rejects the direct deposit because of a typo, ALDOR has to cancel that transaction and issue a paper check. That process alone adds about 2 to 3 weeks to your wait time.

👉 See also: Southern Current Charleston SC: Why This Solar Giant is Changing

How to Check Your Status Without Losing Your Mind

You don't need to call the Department of Revenue. In fact, calling them usually won't speed anything up, and you’ll likely sit on hold for an hour just to be told exactly what the website says.

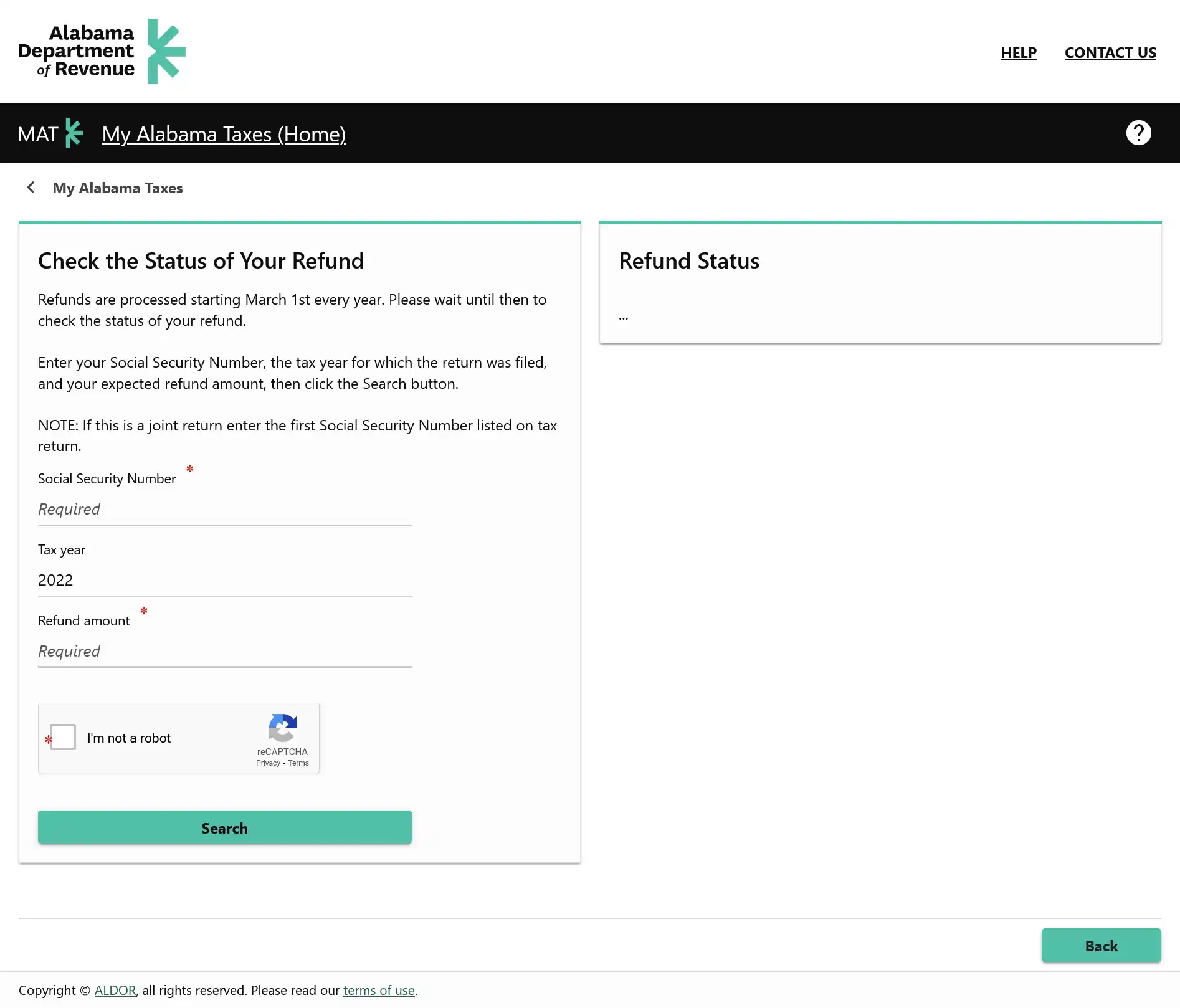

The "My Alabama Taxes" (MAT) portal is your best friend here. You'll need:

- Your Social Security Number.

- The exact whole-dollar amount of the refund you're expecting.

- The tax year you're inquiring about.

The status updates are generally "Received," "Processing," or "Issued." If it says "Issued," it usually takes about 3-5 business days for the bank to actually show the credit in your account. If it's been "Processing" for more than 10 weeks, that’s when it’s time to start looking for a letter in the mail or trying to reach a representative.

The 2024-2025 Tax Changes in Alabama

It’s worth noting that Alabama has been making some tweaks to its tax code that might affect your bottom line. For instance, the state recently started exempting overtime pay from state income tax for certain hourly workers. This is a huge win for folks in manufacturing or healthcare, but it also adds a new layer of complexity to the tax forms. If your employer didn't report the overtime correctly, or if you didn't use the right codes on your return, that’s a guaranteed ticket to the "manual review" pile.

The state is also slowly adjusting its "standard deduction" to help with inflation. While these changes are meant to put more money in your pocket, any change to the tax law means the state’s software has to be updated. Historically, when tax laws change, the first year of implementation is always a bit slower as the bugs get worked out of the automated systems.

Practical Steps to Get Your Money Faster Next Time

If you’re currently waiting, there isn't much you can do besides monitor the MAT portal. But for next year, you can set yourself up for a much smoother ride.

First, stop waiting for the paper W-2. Most employers provide digital copies. As soon as you have that, file. The "January 31st" rule is real—filing before the masses gives your return the best chance of sailing through the automated filters before the human reviewers get overwhelmed.

✨ Don't miss: Are Trumps Tariffs Working? What Most People Get Wrong

Second, double-check your bank info. Triple-check it. A single digit error turns a 21-day wait into a 60-day ordeal involving a paper check being mailed through a postal service that isn't exactly known for its speed in rural Alabama.

Third, keep your "Identity Quiz" info handy. If you’ve moved recently or bought a new car, keep those records in a folder. If ALDOR sends you that verification letter, you want to be able to answer those questions instantly rather than digging through old boxes.

What to Do If Your Refund Is Significantly Lower Than Expected

It’s a gut-punch when you expect $800 and get $450.

Usually, this happens for one of three reasons. First, the state may have corrected a math error on your return. Second, they may have found that you claimed a credit you weren't actually eligible for. Third, the "Debt Offset" mentioned earlier.

If this happens, Alabama is legally required to send you a "Notice of Adjustment." This letter will outline exactly why they changed the amount. You have the right to appeal this, but you have to do it within a specific window—usually 30 days. Don't just ignore it if you think they’re wrong. The Alabama Department of Revenue does make mistakes, especially when it comes to reconciling income from other states if you worked across the border in Georgia or Mississippi.

Moving Forward With Your Alabama Taxes

Basically, your Alabama state tax refund is a test of patience. The state is more concerned with accuracy and fraud prevention than they are with speed. While that’s annoying when you have bills to pay, it’s also what keeps the state’s budget in check.

To stay on top of things, make sure you are registered for a My Alabama Taxes (MAT) account long before you actually file. Having an established account makes it much easier to track correspondence and respond to those "Identity Quizzes" that trip so many people up. If you haven't seen a status change in 12 weeks, that's your cue to reach out. Otherwise, keep an eye on the portal and keep your records organized.

The best way to handle the wait is to expect the full 8-to-12-week window. If it comes earlier, it's a pleasant surprise. If it doesn't, you've already planned your budget around the delay.

Log into the My Alabama Taxes (MAT) portal once a week—not once a day. Daily checking just adds to the stress. If the status hasn't moved from "Processing" after the 90-day mark, call the ALDOR Individual and Corporate Income Tax Division. Be prepared with your tax return copy and your Social Security number. Having your documentation ready can turn a frustrated conversation into a productive one, often revealing a simple fix that’s holding up your funds. Keep your mailing address updated with the state even after you file, as any physical notices they send are the only way they will officially communicate a problem with your Alabama state tax refund.