The closing bell rings at 4:00 PM EST, but honestly, that’s usually when the real chaos starts. Most retail investors pack up their bags, check their gains for the day, and head to dinner. They’re missing the point. If you want to know where a stock is actually heading tomorrow, you have to watch the after hour stock movers like a hawk.

It’s wild.

The volume drops off a cliff. Spreads widen. Suddenly, a company like Nvidia or Tesla drops an earnings report and the stock swings 12% in three minutes. You’re sitting there watching your portfolio value evaporate or skyrocket, and you can’t even trade easily through some of the "discount" apps. This isn't just a side show. It’s the primary engine of price discovery for the modern market.

The Mechanics of After-Hours Volatility

Most people think the stock market is a 9:30 to 4:00 thing. It’s not. Electronic Communication Networks (ECNs) allow trading to continue until 8:00 PM EST. But here is the kicker: there is no central specialist. There’s no market maker forced to provide liquidity.

Because of this, after hour stock movers often experience "slippage." That’s a fancy way of saying you might try to sell at $50, but because there are only three buyers left in the room, the next available price is $48. You just lost 4% because the room was empty.

Institutional players—the "smart money" at firms like Goldman Sachs or BlackRock—use this time to reposition based on news that breaks after the bell. They have the tools. They have the direct access. You? You're probably refreshing a finance app on your phone. If you see a stock moving 5% on 2,000 shares of volume, don't freak out. That is a "thin" move. It might not hold until the morning.

Why Earnings Reports Rule the Night

Earnings season is the Super Bowl for anyone tracking after hour stock movers. Why do companies wait until the market closes to release their numbers? It’s simple: they want to give the market time to digest the data.

Imagine if Apple released a terrible iPhone sales forecast at 1:30 PM on a Tuesday. The panic would be instantaneous and catastrophic. By releasing at 4:05 PM, the "cooling off" period begins.

📖 Related: Kimberly Clark Stock Dividend: What Most People Get Wrong

The Whisper Number Trap

Every analyst on Wall Street has an estimate. But then there’s the "whisper number"—what traders actually expect. This is why you’ll see a company beat its official earnings per share (EPS) goal but the stock still tanks in the after-hours session. It didn’t beat the whisper.

Take a look at historical data from companies like Netflix. They are notorious for massive after-hours swings. One bad subscriber growth number and the stock is down 15% before you’ve even finished your first drink at happy hour.

The Conference Call Pivot

The initial move is usually a knee-jerk reaction to the press release. The real move happens 30 minutes later during the conference call.

If a CEO sounds shaky during the Q&A session, or if the CFO mentions "macroeconomic headwinds" (which is corporate speak for "we have no idea why sales are slowing"), the stock can reverse its initial gains instantly. This is why chasing after hour stock movers is so dangerous. You might buy the "beat" at 4:10 PM, only to get crushed by the "guidance" at 4:45 PM.

Regulatory Filings and the Friday Night Dump

Not everything is about earnings. Sometimes, it’s about the stuff companies want to hide.

Lawyers and PR teams love the "Friday Night Dump." If a company has to disclose a major lawsuit, a resignation of a key executive, or a scathing SEC filing, they often wait until the after-hours session on a Friday. They hope everyone is at the bar or headed out for the weekend.

By the time Monday morning rolls around, they hope the news is "old," but the after hour stock movers tell the truth. If you see a sudden 8% drop on a Friday at 6:00 PM, someone knows something.

👉 See also: Online Associate's Degree in Business: What Most People Get Wrong

Is After-Hours Trading Right for You?

Honestly? Probably not if you're a beginner.

The risks are massive. You have to use "limit orders," which means you set a specific price you’re willing to pay or sell for. If you use a "market order" (which most brokers won't even let you do after hours), you could get filled at a price that ruins your month.

But there is opportunity here.

If you see a stock overreacting to "noise"—maybe a small miss in one sector that doesn't affect the company’s long-term moat—you can sometimes snag shares at a "discount" before the general public wakes up and realizes the news wasn't that bad.

The "Morning After" Effect

Does an after-hours move always stick?

Not always. There is a phenomenon called the "fade." A stock might be up 10% at 7:00 PM, but by the time the 9:30 AM opening bell rings, it’s only up 2%.

What happened?

✨ Don't miss: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Retail investors saw the move, got excited, and placed "market on open" orders. The big players, who bought in low the night before, use that morning surge of retail buying to sell their shares and take profits. This is why you should never, ever chase a stock that is already up big in the pre-market or after-hours without looking at the volume.

How to Track These Movers Like a Pro

You don't need a Bloomberg Terminal, though it helps. Most retail platforms like Charles Schwab, Fidelity, or even Robinhood now show extended-hours data.

- Watch the Volume: If a stock is moving on low volume, ignore it. It’s noise.

- Check the Spread: If the difference between the "bid" and the "ask" is more than a few cents, stay away.

- Verify the News: Use sites like Business Wire or PR Newswire to find the actual document that triggered the move. Don't rely on Twitter (or X) rumors.

Actionable Steps for Tomorrow

If you want to start utilizing the data from after hour stock movers without losing your shirt, change your routine.

Stop checking your portfolio at 3:59 PM. Start checking it at 4:15 PM.

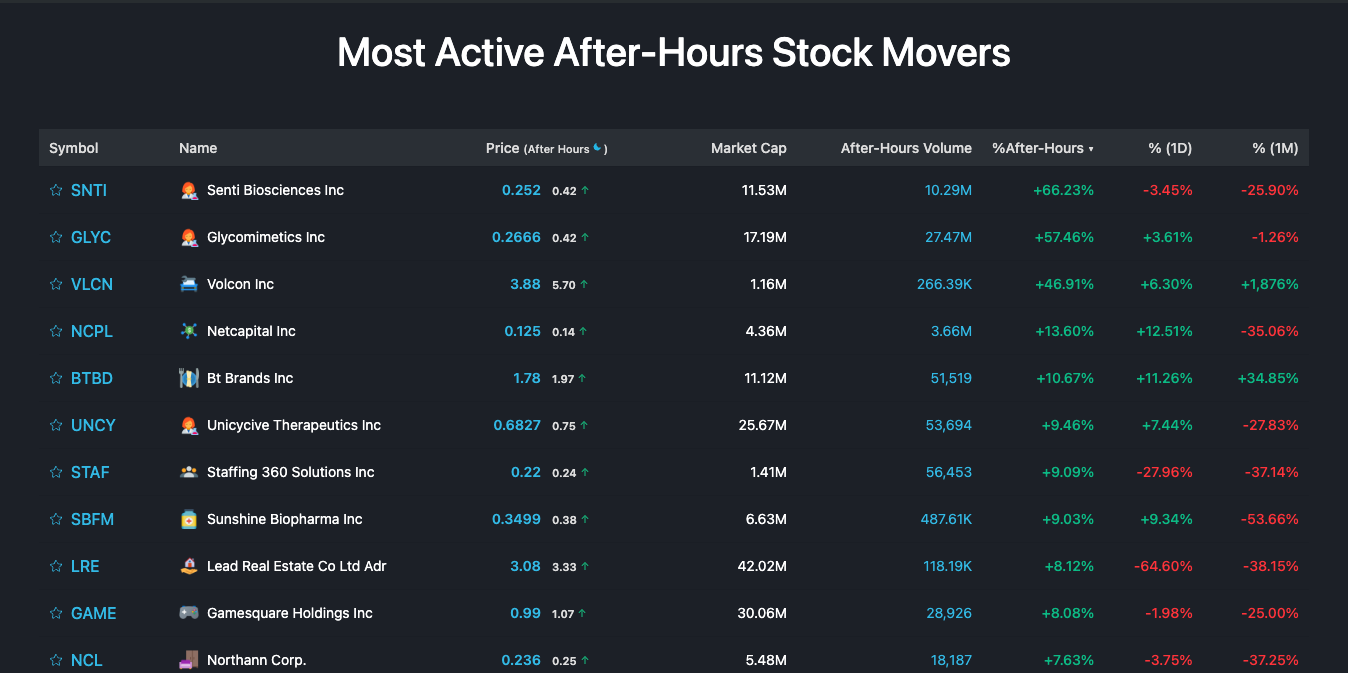

Look for the "outliers." Identify the three biggest gainers and three biggest losers every evening. Research the "why." Was it an earnings beat? A merger? A random tweet from an activist investor?

By understanding the why behind the night moves, you start to see patterns. You'll notice that certain companies always "recover" their after-hours losses by the next afternoon. Others never do.

Start by "paper trading"—pretend you bought or sold during the after-hours session and see how it would have played out by noon the next day. You’ll quickly realize that the after-hours market is a different beast entirely. It’s faster, meaner, and far more honest than the daytime market.

Keep your eye on the SEC's EDGAR database for real-time filings. If a stock starts moving and there’s no news on the wires, it’s almost always an 8-K filing that just hit the SEC servers. Being five minutes faster than the news cycle is how the pros make their money.