Ever sat there staring at your brokerage app at 4:30 PM, wondering why a stock you own just fell 8% in ten minutes? It feels like a glitch. Honestly, it’s kinda terrifying if you aren't used to it. You've probably heard the term after hour movers stock tossed around in Discord chats or on CNBC, usually accompanied by some frantic chart with jagged red and green lines.

Basically, the stock market doesn't actually sleep when the 4 PM bell rings. It just gets weird.

For the average person, "the market" is a 9:30 AM to 4:00 PM Eastern Time affair. But for the big players—and increasingly for retail traders with the right apps—the period between 4:00 PM and 8:00 PM is where the real drama happens. This is the realm of the after hour movers stock, where low volume meets high stakes, and where a single earnings report can wipe out or double a company's market cap before you've even finished dinner.

✨ Don't miss: Ameris Bank Lake City FL: What You Should Know Before Walking In

Why Do Stocks Move So Much After Hours?

Most of the time, the regular trading day is a slog of incremental moves. But the after-hours session is reactive. Companies aren't allowed to release major news like earnings or CEO departures while the market is open because it would cause total chaos. So, they wait until 4:01 PM.

When NVIDIA or Apple drops a quarterly report, the reaction is instant. Because there are way fewer people trading—basically, the "liquidity" is thin—the price swings are exaggerated. If a big institutional fund wants to sell a million shares and there are only a few thousand buyers active, the price has to drop significantly to find a match.

This thin volume is exactly why you'll see a stock jump 10% on a Tuesday night, only to open on Wednesday morning up a measly 2%. The "after hour movers stock" reflects the gut reaction of the few, not necessarily the consensus of the many.

💡 You might also like: WSJP Rate Today: What Most People Get Wrong

The Catalysts Behind the Spikes

It isn't just earnings, though that's the big one. You've also got:

- FDA Approvals: Biotech stocks are notorious for this. One minute a penny stock is flat; the next, a press release about a Phase 3 trial success sends it into the stratosphere.

- M&A Rumors: Mergers and acquisitions often leak or get announced late in the day.

- Secondary Offerings: This is the one investors hate. A company decides it needs cash and sells more shares after hours, usually at a discount, which instantly drags the price down.

The Risks: It’s Kinda the Wild West

Trading after hour movers stock is not for the faint of heart. Seriously. One major issue is the "bid-ask spread." During the day, the difference between what someone wants to pay and what someone wants to sell for is usually pennies. After hours? That gap can be huge. You might try to buy a stock at $50, but the lowest seller is at $52.

You also have the "Internalization" problem. Some brokers don't even send your after-hours order to the big exchanges; they try to match it with another one of their own customers. If they can’t, your order just sits there while the price moves away from you.

✨ Don't miss: How Much Does a Share of Apple Stock Cost: Why the Price Is Only Half the Story

Also, keep in mind that "fake-outs" are a real thing. It’s very common to see a stock surge 5% in the after-market on a "beat" in earnings, but then as soon as the conference call starts and the CFO mentions "headwinds" or "cautious guidance," the stock craters. If you bought during that initial 5% spike, you're now holding a heavy bag by 6 PM.

How to Track These Moves Without Losing Your Mind

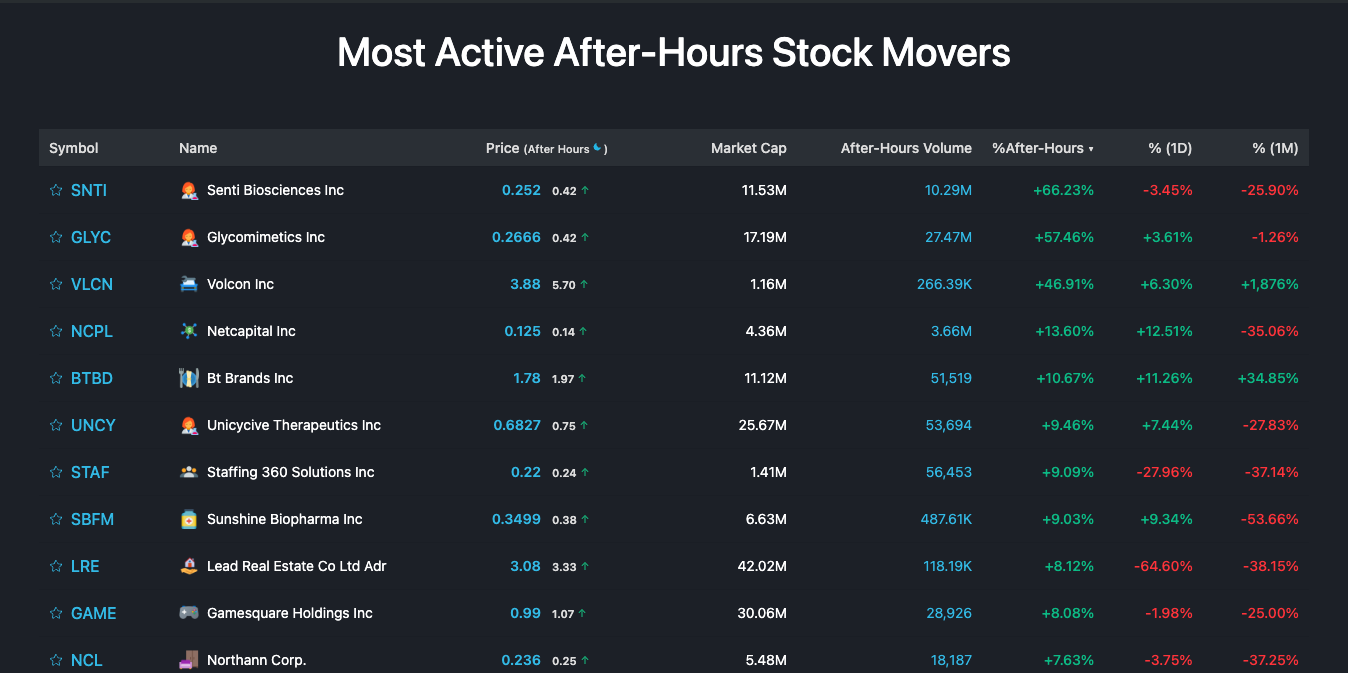

If you're looking for the actual after hour movers stock of the day, you don't need a Bloomberg Terminal. Most free sites like MarketChameleon, Investing.com, or even Yahoo Finance have a "Top Movers" tab specifically for the extended session.

What to Look For:

- Relative Volume: If a stock is up 10% but only 500 shares have traded, ignore it. That’s probably just one person making a weird trade. You want to see thousands, if not millions, of shares moving.

- The "Why": Never buy an after-hours mover without knowing the catalyst. Use Google News or Twitter (X) to see if there’s a press release.

- The Trend: Does the move hold? Usually, if a stock stays up for the full four hours of the session, it has a better chance of a strong open the next day.

Real Examples from 2025 and 2026

We've seen some wild swings recently. Just look at the volatility in the tech sector during the 2025 "Tariff Scare." Stocks like Western Digital (WDC) and Micron (MU) were frequently the top after hour movers stock as trade policy news dropped late in the evening.

More recently, in early 2026, PNC Financial and Goldman Sachs saw significant post-close activity following their Q4 reports. Goldman, for instance, beat expectations by nearly $900 million in revenue, causing a late-day spike that actually held through the pre-market. On the flip side, we've seen "meme-adjacent" stocks like Reddit (RDDT) take massive 9% hits after hours when growth numbers didn't meet the sky-high hype of the retail crowd.

Actionable Insights for the Savvy Investor

If you’re going to mess with after hour movers stock, you need a plan. Don’t just "market buy" into a spike.

- Use Limit Orders Only: Never, ever use a market order after hours. You could end up paying a price way higher than you intended because of those wide spreads.

- Wait for the Conference Call: If the move is based on earnings, wait at least 30 minutes into the executive call. That’s where the "real" info comes out.

- Check the Premarket: Often, the move that happens at 4:30 PM is totally reversed by 7:30 AM the next morning. If the stock is still moving in the same direction when the sun comes up, the move might be legitimate.

- Mind the "Wash": Sometimes a big move is just institutional rebalancing. If there's no news, it's usually just big banks moving furniture.

Understanding the mechanics of after-hours trading turns a terrifying price drop into a manageable data point. It’s about separating the noise of thin-volume trades from the signal of actual, market-shifting news.

Next Steps:

- Audit your brokerage: Make sure your current platform (like Fidelity, Schwab, or Robinhood) actually allows for extended hours trading; some require you to manually toggle a setting or agree to a risk disclosure.

- Set "Price Gap" Alerts: Instead of watching the screen, set alerts for 3% or 5% moves after 4:00 PM so you only engage when something significant is happening.

- Study the Volume: Before placing a trade, compare the after-hours volume to the stock's average daily volume (ADV). If the late-day volume is less than 1% of the ADV, the price move is likely unreliable.