Sending money home to India from the UAE isn't just about clicking a button on an app. Honestly, it's a high-stakes game of timing. If you've lived in Dubai or Abu Dhabi for a while, you know the drill. You wait for the AED to INR rate to hit a "sweet spot" before transferring your hard-earned dirhams.

But here’s the thing. Most people are looking at the wrong numbers.

👉 See also: Why Urban Outfitters Inc Stock Still Moves the Needle for Investors

They see a rate on Google and expect to get exactly that at the exchange house. It doesn't work like that. Today, on January 15, 2026, the mid-market rate is sitting around 24.58 INR. That sounds great compared to last year's averages of 23.34, but what you actually pocket depends on a messy web of margins and fees.

Why your AED to INR rate never matches Google

The rate you see on a search engine is the "interbank" rate. Basically, it's the price at which big banks trade with each other. You? You're a retail customer. Exchange houses like Al Ansari or digital platforms like Remitly and Wise (now supporting more corridor options) take that interbank rate and shave a bit off.

This "spread" is how they make money. Some might offer a "zero fee" transfer but then give you a terrible exchange rate. Others give you a great rate but hit you with a 20 AED service charge.

✨ Don't miss: Time Off for Voting by State: What Most People Get Wrong

You've got to look at the "Effective Rate." That is the total amount of Rupees that actually land in the Indian bank account divided by the Dirhams you sent.

The 2026 shift in the Rupee

Since early 2025, we’ve seen the Indian Rupee under a fair bit of pressure. Back in January 2025, one Dirham would get you about 23.35 INR. Fast forward to right now, and we are looking at 24.57. That’s a significant jump for the NRI community.

Why is this happening?

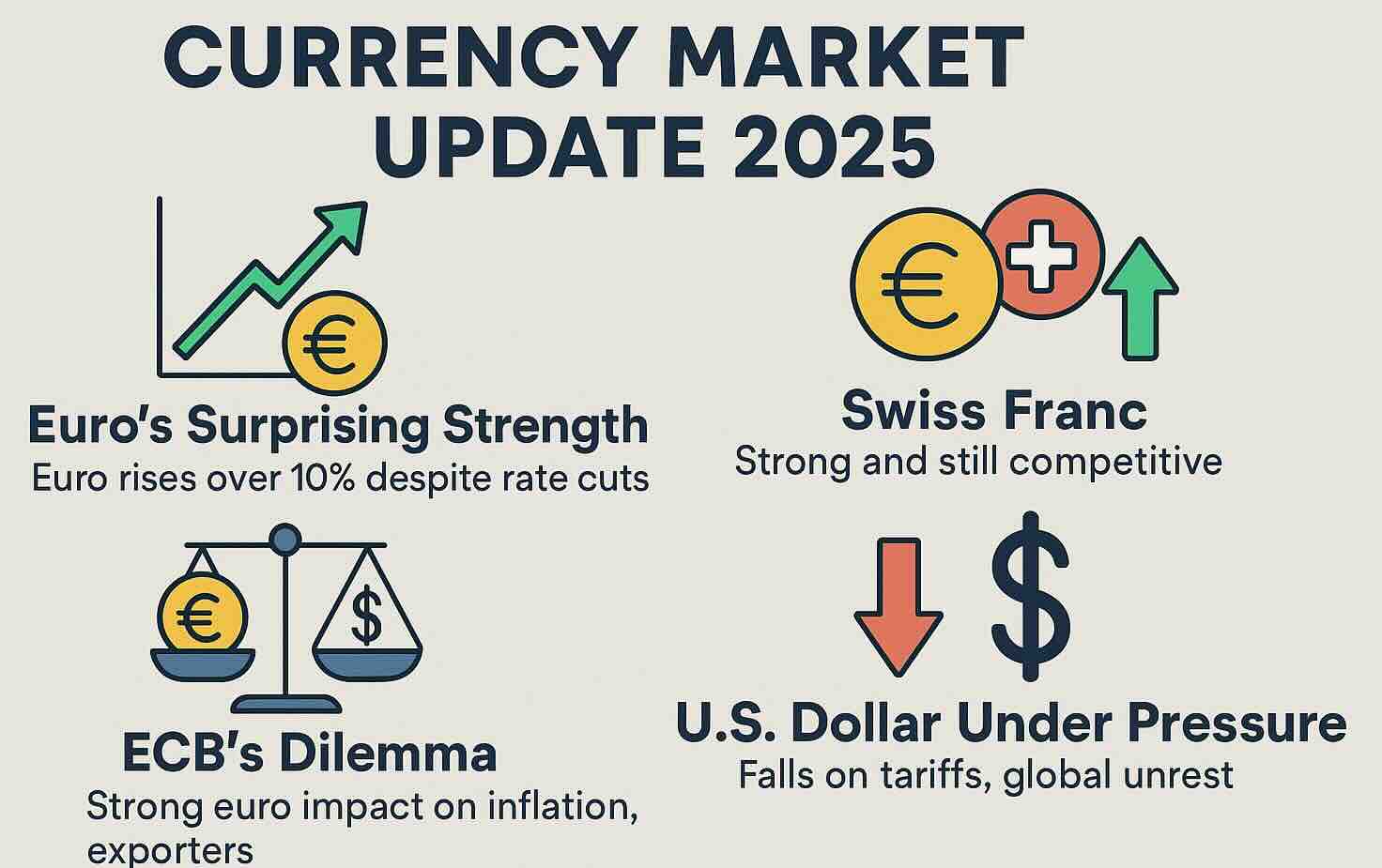

It’s a mix of global oil prices—which always hit India hard—and the strength of the US Dollar. Since the UAE Dirham is pegged to the Dollar ($1 = 3.6725 AED$), whenever the Greenback gains strength, your Dirhams naturally buy more Rupees. It’s a bit of a silver lining for expats even if the global economy feels shaky.

Stop making these 3 remittance mistakes

Most of us are creatures of habit. We go to the same exchange house every month because it’s near the grocery store. Bad move.

📖 Related: South Korea to INR: Why the Won is Acting So Weird Lately

First, stop sending money on weekends. The forex markets are closed. To protect themselves from "gaps" when markets open on Monday, many providers widen their margins. You’re essentially paying for their insurance.

Second, the "First Transfer" trap is real. Apps like Remitly or Western Union often give you a spectacular rate for your first transaction—maybe even 24.70 when the market is at 24.55. They lose money on that to get you through the door. If you don't check the rate for the second transfer, you’ll likely find it’s much worse than the competition.

Third, ignore the "Zero Fee" marketing. Honestly, it's kinda deceptive. If a bank says "No Fees," check their rate against a transparent provider like Wise or Aspora. You’ll usually find the "fee" is hidden in a 1% markup on the rate.

Where to get the most Rupees for your Dirham

If you're looking for the best way to handle AED to INR transfers in 2026, the landscape has changed. It's not just about the big exchange houses anymore.

- Digital Apps: Platforms like Remitly and Aspora are currently dominating the "fast and cheap" category. For a 5,000 AED transfer today, you’re likely to see about 122,800 INR after all is said and done.

- Direct Bank Transfers: Emirates NBD's "DirectRemit" and Emirates Islamic's "QuickRemit" are incredibly fast. We're talking 60 seconds to HDFC or SBI. The rates are usually 0.10 to 0.15 lower than the specialized apps, but the convenience is hard to beat.

- Physical Exchange Houses: Al Ansari and Lulu Exchange still hold the crown for cash-to-cash. If your family in India doesn't have easy access to a bank branch in a rural area, these are your best bet. Just be prepared to pay a higher service fee of 15-25 AED.

The 2026 outlook: Should you wait?

Predicting the AED to INR exchange rate is like trying to catch smoke. However, looking at the trend from the last twelve months, the Rupee has been on a slow, steady decline.

If you don't need the money in India immediately, some experts suggest "layering" your transfers. Instead of sending 10,000 AED in one go, send 2,500 AED every week. This averages out your exchange rate and protects you from a sudden "correction" where the Rupee might strengthen for a few days.

Current resistance levels suggest that the rate might hover between 24.40 and 24.80 for the first quarter of 2026. If you see it tip over 24.75, that’s usually a signal to send.

Real-world impact

Think about it this way: the difference between a rate of 23.50 and 24.50 on a monthly remittance of 4,000 AED is 4,000 Rupees. That’s a utility bill paid or a nice dinner for the family back home just by picking the right day to transfer.

Actionable steps for your next transfer

- Check the mid-market rate on a neutral site first so you know the "true" price.

- Compare at least three providers using their mobile apps before walking into a physical store.

- Use a rate alert tool. Most apps now let you set a "ping" for when the rate hits your target.

- Verify the recipient's details. In 2026, UPI-linked transfers are the fastest, but a single digit error in an IFSC code can still tie up your funds for days.

- Watch the oil prices. If oil spikes, the Rupee usually dips, giving you a better Dirham conversion.

The most important thing to remember is that the "best" service is the one that balances cost with speed. If your family needs the money for an emergency, don't chase an extra 50 Rupees at the cost of a three-day delay. But for regular savings, being picky about your AED to INR provider is basically giving yourself a small monthly raise.