Math isn't always scary. Sometimes it's just small.

If you are looking for 6 percent of 10, the answer is 0.6. That’s it. Move on, right? Well, maybe not. While the raw calculation is a simple elementary school exercise, the way our brains process these tiny fractions—and where they show up in your actual bank account or daily life—is where things get interesting. Honestly, most people look at a number like 0.6 and think it’s negligible. They’re wrong.

Let's look at the math first. To find 6 percent of 10, you're basically shifting a decimal point. Percent means "per hundred." So, 6% is $6/100$, or 0.06. When you multiply $0.06 \times 10$, you get 0.6. If you’re a visual person, imagine ten dollars sitting on a table. Six percent of that is sixty cents.

It's a handful of change. But that change adds up.

Why 6 percent of 10 is more than just 0.6

You've probably seen this number in places you didn't expect. Think about sales tax. In some jurisdictions, a 6% tax rate is the standard. If you buy a small $10$ item—maybe a fancy coffee or a notebook—you aren't paying $10$. You're paying $10.60$. That 0.6 is the "extra" that everyone forgets to account for until they're at the register.

There's also the psychological side of things. Behavioral economists like Dan Ariely have often pointed out how humans are terrible at conceptualizing small percentages. We tend to round down to zero when a number feels small enough. But 6% isn't zero. In the world of investing, a 6% return on a small $10$ micro-investment (thanks to apps like Acorns or Robinhood) feels like nothing. Yet, that's the foundation of compound interest.

✨ Don't miss: How to Sign Someone Up for Scientology: What Actually Happens and What You Need to Know

The shift in perspective

Think about a blood alcohol concentration (BAC) limit or a concentration of a specific ingredient in a solution. In those contexts, 0.6 is massive. If a liquid is 6% of something else, it can be the difference between a cleaning product and a poison. Context is everything.

People often struggle with "percent of" vs. "percentage points." If you have a $10%$ interest rate and it goes up by 6%, you aren't at $16%$. You're at $10.6%$. Because 6 percent of 10 is 0.6. This is a common trap in financial news reporting. Journalists sometimes use these terms interchangeably, and it leads to massive misunderstandings about how much money is actually being moved around.

How to calculate percentages in your head

You don't need a calculator for this. Ever.

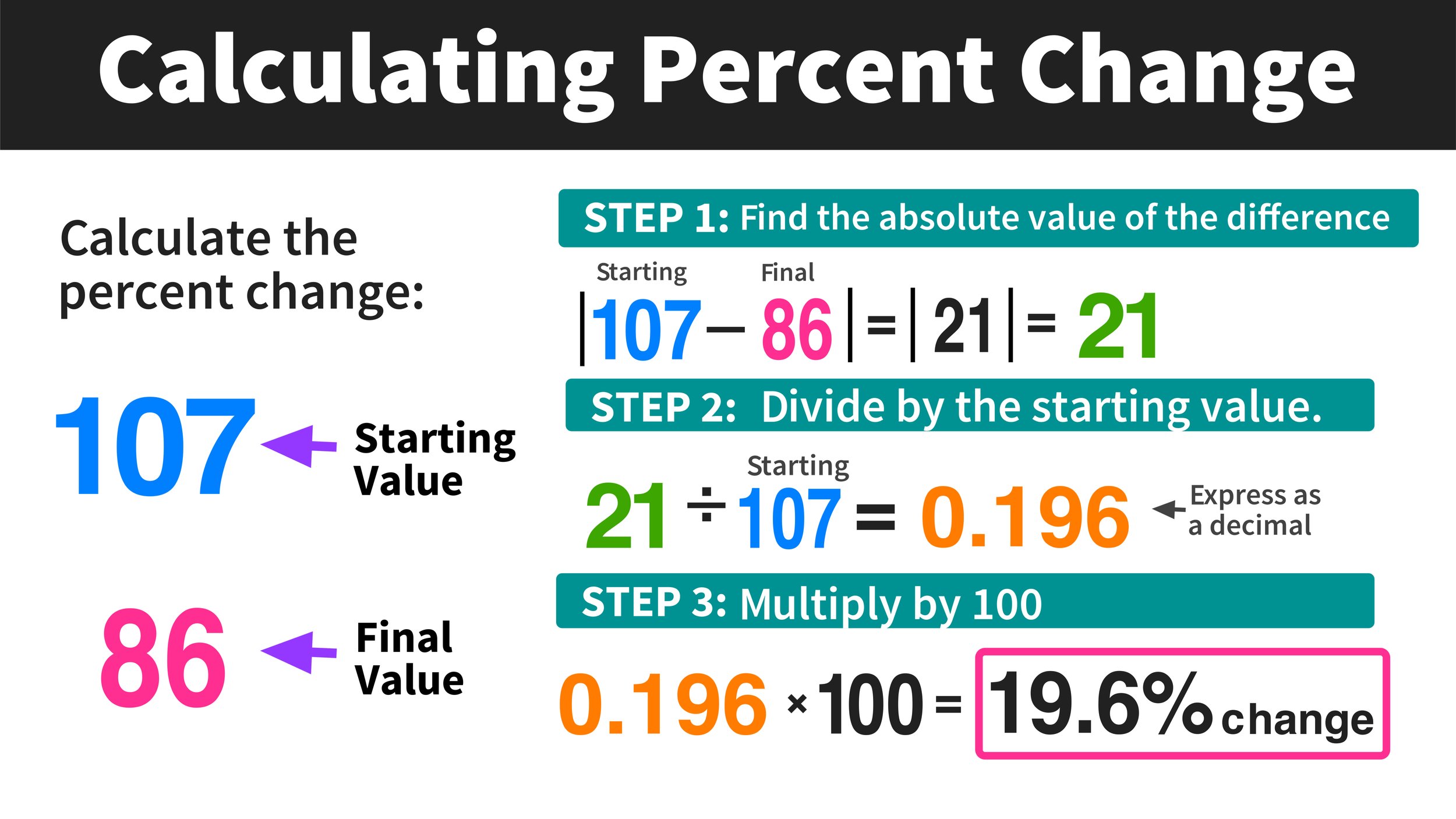

Here is the trick: Find 10% first. Finding 10% of any number is easy—you just move the decimal one spot to the left. 10% of $10$ is 1. Now, if you know 10% is 1, you know that 5% must be half of that. Half of 1 is 0.5. To get to 6%, you just need that extra 1%. Since 10% is 1, 1% is 0.1.

Add them together: $0.5 (which is 5%) + 0.1 (which is 1%) = 0.6$.

🔗 Read more: Wire brush for cleaning: What most people get wrong about choosing the right bristles

See? Simple.

You can do this with any number. If you're at a restaurant and the bill is $10$ and you want to tip 18%, you find 10% (1.00), double it to get 20% (2.00), and then subtract a little bit. Math is more about "vibes" and estimation than most teachers want to admit.

Real world applications of 0.6

- Retail Markups: Many small retailers work on thin margins. A 6% price increase on a $10$ wholesale item means the consumer pays 60 cents more. Over 1,000 units, that's $600 of pure profit or loss.

- Battery Life: If your phone is at 10% and drops by 6%, you are at 9.4%. That 0.6% might be the difference between making a call and the phone dying mid-ring.

- Precision Engineering: In manufacturing, a 6% tolerance on a 10mm part is 0.6mm. In the world of engines or medical devices, 0.6mm is a canyon. It's the difference between a part that fits and a machine that explodes.

The "Rule of 72" and tiny percentages

Financial experts often use the Rule of 72 to figure out how long it takes for money to double. You divide 72 by your interest rate. If you have an investment growing at 6%, it takes 12 years to double ($72 / 6 = 12$).

But what if you only have $10$?

In 12 years, your $10$ becomes $20$. That 6% isn't just 0.6 in a vacuum; it's 0.6 that grows. This is why people tell you to start saving early, even if it's just ten bucks. The 0.6 you earn today becomes the base for next year's 6%. It's slow. It’s boring. But it’s how wealth is actually built.

💡 You might also like: Images of Thanksgiving Holiday: What Most People Get Wrong

Common mistakes when calculating 6 percent of 10

The biggest mistake is putting the decimal in the wrong place. People see 6% and 10 and think "6." But 6 is 60% of 10. That's a huge difference.

Another error is thinking that percentages work differently when the numbers are small. They don't. The logic that applies to 6% of a million applies to 6% of ten.

- The "Zero" Fallacy: Thinking 0.6 is too small to matter.

- The Decimal Slide: Moving the decimal two spots instead of one (getting 0.06).

- The Inverse Error: Thinking 10% of 6 is different. (Wait—is it? $10% \times 6$ is also 0.6. Percentages are reversible! $x%$ of $y$ is always $y%$ of $x$.)

That last point—the reversibility of percentages—is a "life hack" that makes mental math much easier. If someone asks you for 6% of 10 and your brain freezes, just flip it. What is 10% of 6? Everyone knows that’s 0.6. It works every single time.

Actionable steps for mastering small math

Stop reaching for your iPhone every time a tip or a tax comes up. Start practicing the "10% flip" method.

Next time you see a price tag, manually calculate the 6% or 7% sales tax before you hit the register. It keeps your brain sharp. If you're looking at a $10$ item, tell yourself, "This is actually $10.60$." It changes how you spend.

For those looking at data or business metrics: don't ignore the 0.6. If your conversion rate on a website drops by 6% on a base of 10%, you aren't losing much. But if your overall revenue drops by 6%, you're in trouble. Understanding the scale of 6 percent of 10 is the first step in understanding larger, more complex financial systems.

Keep it simple. Move the decimal. Flip the numbers. Don't let the small stuff slide.