Money at this scale isn't really "money" anymore. It's gravity. When we talk about the 500 richest people in the world, we're basically looking at a small group of humans who, combined, own more than the GDP of most developed nations. As of mid-January 2026, the collective net worth of these 500 individuals has hit a staggering $11.9 trillion. To put that in perspective, that is roughly seven times the entire GDP of South Korea.

It's wild. Truly.

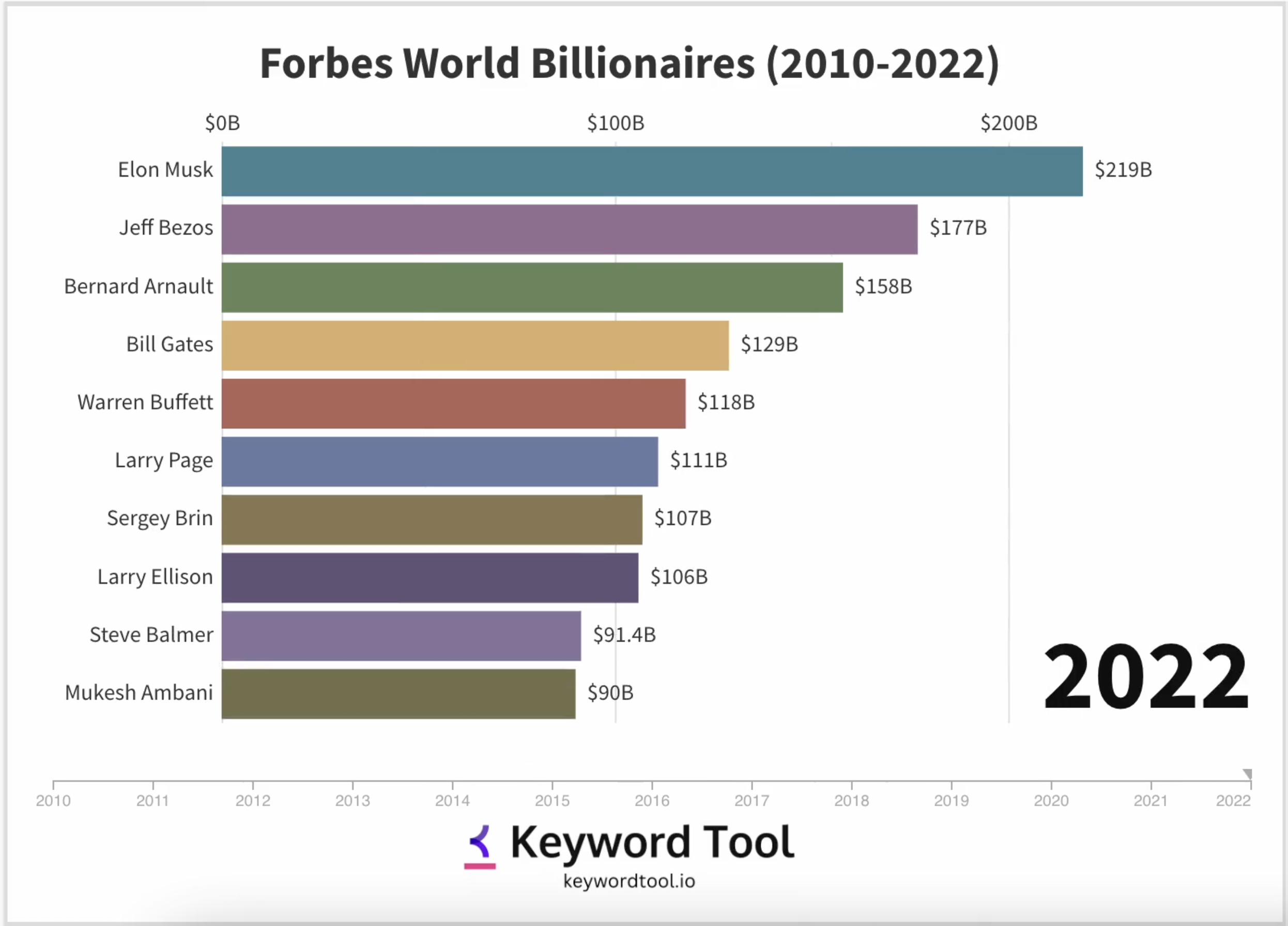

Most people check these rankings to see who's winning the horse race between Elon Musk and whatever tech founder had a good Tuesday. But if you look closer, the list is actually a heat map of where humanity is putting its chips. Right now, those chips are piled high on Silicon Valley, AI chips, and luxury handbags.

The 500 richest people in the world and the $700 billion ceiling

For a long time, the idea of a "centibillionaire" felt like the final boss level of capitalism. Then came 2025. Now, we’re looking at the world’s first potential trillionaire. Elon Musk has pushed the boundaries of personal wealth into a territory that feels almost fictional. By early 2026, his net worth surged past $714 billion.

How?

It wasn't just Tesla. In fact, while Tesla remains a massive part of his portfolio, the real "moonshot" (literally) has been SpaceX. With the private company’s valuation hovering near $150 billion—and rumors of a Starlink IPO always swirling—Musk has decoupled his fortune from the standard stock market volatility that plagues other billionaires.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

But he isn't alone at the top. The leaderboard is a revolving door of tech titans:

- Larry Page and Sergey Brin (Google) have seen their fortunes rocket back up to the $250 billion+ range. Why? Because Alphabet finally figured out how to monetize generative AI without breaking their search monopoly.

- Jeff Bezos remains a constant, though he's been spending more time on his "Day 1" philosophy at Blue Origin than checking Amazon's daily stock price.

- Mark Zuckerberg has pulled off one of the greatest corporate pivots in history, turning the "Metaverse" punchline into a massive AI and hardware play that added $50 billion to his pocket in a single year.

It’s easy to get lost in the top ten. But the real story of the 500 richest people in the world is found further down the list, where the "new" money is being made in places most people aren't looking.

Why the wealth gap is widening in 2026

If you feel like the world is getting more expensive while these guys get richer, you're not imagining it. 2025 was a "turbocharged" year for the mega-rich. Market analysts point to a few specific reasons why the top 500 added $2.2 trillion to their collective pile in just twelve months.

First, the AI "S-Curve." We are no longer just talking about chatbots. We’re talking about the infrastructure. Jensen Huang, the CEO of NVIDIA, is the poster child for this. His wealth grew from a "modest" $4.7 billion in 2020 to over $160 billion by 2026. If you own the shovels in a gold rush, you don't need to find the gold.

Second, the luxury paradox. You’d think in a tight economy, people would stop buying $3,000 bags. Nope. Bernard Arnault, the man behind LVMH (Louis Vuitton, Moët, Hennessy), proves that the ultra-wealthy will always buy status. Even when he slips from the #1 spot, he’s still sitting on nearly $200 billion.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

The shift toward private equity and "dark" wealth

A huge chunk of the 500 richest people in the world are moving their money out of public markets. Why deal with the SEC and quarterly earnings calls if you don't have to? We're seeing more billionaires like the Koch family or the heirs to the Mars candy fortune keep their operations private. This makes tracking the true 500 richest people in the world a bit of a guessing game for outlets like Forbes and Bloomberg. They’re basically looking through a keyhole at a massive mansion.

Breaking down the geography of the top 500

The United States still dominates the list. Kinda boring, right? About 8 of the top 10 call America home. But if you look at the full 500, the map is shifting.

India has become a massive engine for new billionaires. Beyond the household names like Mukesh Ambani and Gautam Adani, we are seeing a surge in software-as-a-service (SaaS) founders and renewable energy moguls from the subcontinent.

China, on the other hand, is a bit of a rollercoaster. Regulatory crackdowns a few years ago slowed things down, but the rise of TikTok’s parent company ByteDance and EV battery giants like CATL has kept Chinese names firmly in the top 100. Zhang Yiming is a name you should know—his influence on global culture through Bytedance is arguably bigger than any other person on this list.

What most people get wrong about these rankings

The biggest misconception? That these people have this money in a bank account.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

If Elon Musk wanted to buy a $100 billion island tomorrow, he couldn't just swipe a debit card. Most of this wealth is "paper wealth." It's tied up in shares of the companies they founded. If they sell too much at once, the stock price crashes, and their net worth vanishes.

This is why you see so many of the 500 richest people in the world taking out massive loans against their stock. It's a way to get cash without paying capital gains taxes. It's a legal loophole that the G20 has been trying to close for years, but when you have that much gravity, you tend to make your own weather.

Actionable insights: What can we learn?

Looking at the 500 richest people in the world shouldn't just be about envy. It’s about spotting patterns. If you want to build your own wealth—even on a much smaller scale—there are a few takeaways:

- Ownership is everything. You don't get on this list by drawing a salary. You get there by owning equity in an asset that scales while you sleep.

- Tech isn't a sector; it's the foundation. Whether it's retail (Amazon), cars (Tesla), or luxury (LVMH's digital supply chain), the winners are always the ones who leverage technology better than their peers.

- Diversify your "legacy." Notice how Bezos and Musk aren't just doing one thing? They have their hands in energy, transport, media, and space. Once you have a base, you expand.

- Ignore the daily noise. The people on this list who stay on this list for decades (like Warren Buffett) are the ones who don't panic when the market dips.

The list of the 500 richest people in the world is a snapshot in time. By the time you finish reading this, a stock swing in Tokyo or New York might have already shifted the rankings. But the underlying truth remains: wealth in 2026 is about being the platform, not just a player on it.

To stay ahead of the curve, keep a close eye on the SEC Form 4 filings of these individuals. They tell you exactly where the "smart money" is moving before it hits the headlines. Following the moves of the top 500 isn't just about celebrity gossip; it's the closest thing we have to a crystal ball for the global economy.

Next Steps:

- Monitor the Bloomberg Billionaires Index daily to see real-time shifts in net worth based on market close.

- Research the "Nvidia Effect" to understand how AI infrastructure is creating the next wave of billionaires in the bottom half of the top 500.

- Track the IPO calendar for Starlink or other private "unicorn" companies owned by these individuals, as these events are the primary catalysts for massive rank jumps.