If you're holding a bill with the word "Franc" on it and trying to figure out if you're rich or just holding a colorful piece of paper, you've hit the right spot. Honestly, the term "Franc" is one of the most confusing things in the world of finance because it doesn't just mean one thing. Most people searching for 500 francs to usd are usually thinking about the Swiss Franc, but if you've got an old French note from a basement or a handful of West African currency, the math changes completely.

Let’s get the big one out of the way first.

As of early 2026, the Swiss Franc (CHF) is basically the heavyweight champion of the currency world. If you want to convert 500 francs to usd and those francs are from Switzerland, you are looking at roughly $624.68.

That is not a small chunk of change.

In fact, the Swiss Franc has been on a tear lately. While the US dollar has been wobbling a bit—partly due to some wild political drama in Washington involving threats against the Federal Reserve's independence—the Swissie has remained the "safe haven" everyone runs to when things get weird.

The Many Faces of the Franc

You've gotta be careful here. Not all Francs are created equal, and mistaking one for another is a quick way to realize your "fortune" is actually worth less than a cup of coffee.

The Swiss Powerhouse (CHF)

Switzerland is the only major European economy that stuck with the Franc. They didn't jump on the Euro bandwagon. Because Switzerland has low inflation (sitting around 0.3% for 2026) and a massive current account surplus, their currency is incredibly strong.

👉 See also: Who Actually Owns the US National Debt? It’s Not Who You Think

- 500 CHF = ~$625 USD

- Status: Active and very valuable.

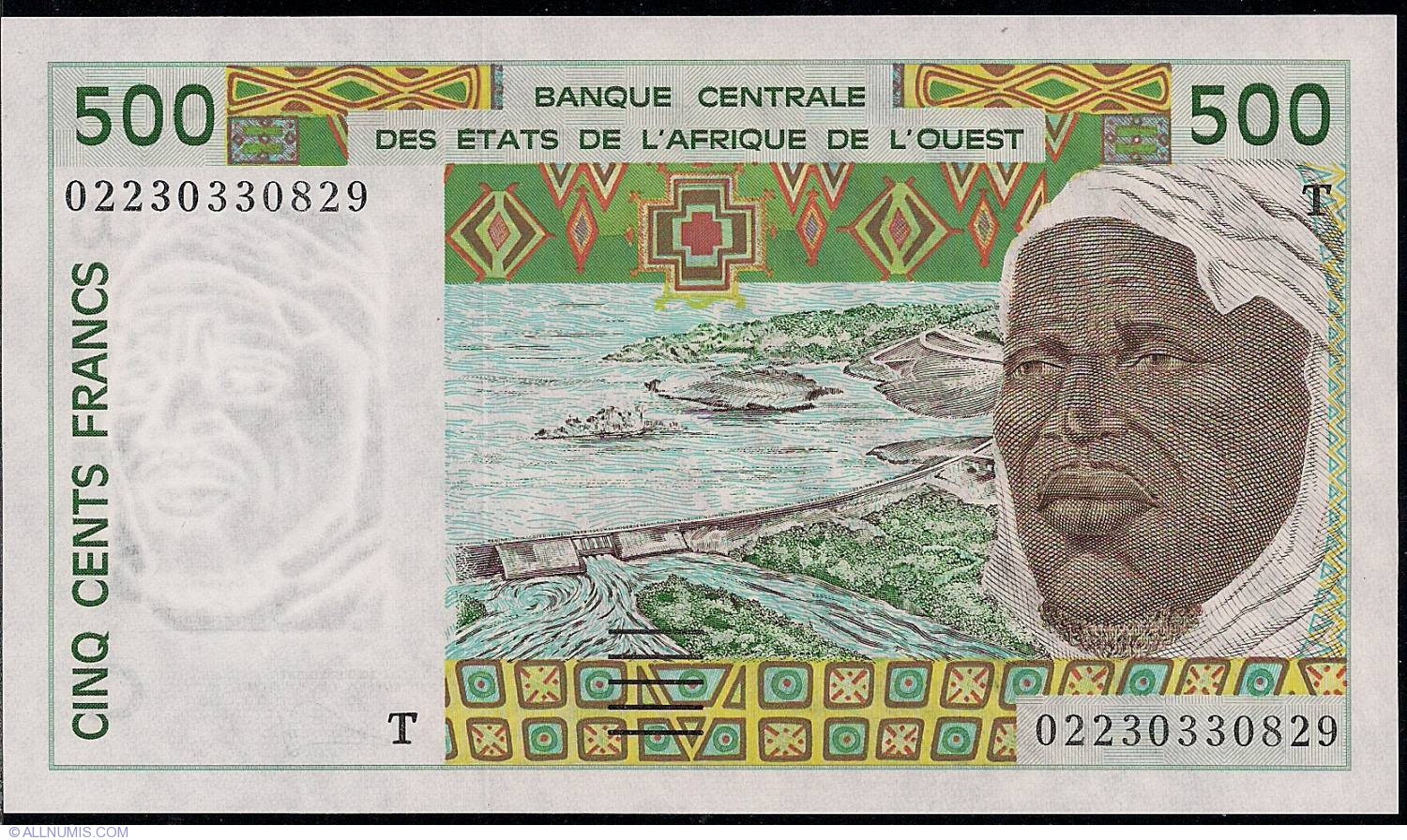

The CFA Franc (XOF/XAF)

This is used in various parts of Africa, like Senegal, Ivory Coast, and Cameroon. It's a completely different beast. It’s pegged to the Euro, which means it doesn't fluctuate as wildly, but its value relative to the dollar is much lower.

- 500 XOF/XAF = ~$0.89 USD

- Status: Active, but you'll need a lot more than 500 to buy dinner.

The CFP Franc (XPF)

If you’re vacationing in French Polynesia or New Caledonia, you’re using the CFP Franc.

- 500 XPF = ~$4.88 USD

- Status: Active.

The French Franc (FRF)

This is the one that trips up history buffs and people cleaning out their grandparents' attics. France switched to the Euro way back in 2002. You cannot spend these in a shop in Paris anymore.

- 500 FRF = ~$88.77 USD (Theoretical value)

- Status: Obsolete. You generally can't exchange these at banks anymore, though collectors (numismatists) might pay a premium if the bill is in mint condition.

Why the Swiss Franc is Winning in 2026

The exchange rate for 500 francs to usd has shifted significantly over the last twelve months. If you had done this trade in early 2025, you would have only received about $550. Why the jump?

Essentially, the US dollar has been catching some heat. Recently, markets were spooked by reports of the Trump administration's friction with Fed Chair Jerome Powell. When investors get nervous about the US central bank, they dump dollars and buy Swiss Francs. Switzerland's National Bank (SNB) has kept interest rates near 0%, which usually makes a currency less attractive, but because the rest of the world is so volatile, the "safety" of Switzerland outweighs the lack of interest.

Experts like Thomas Stucki from St. Gallen and Jane Foley at Rabobank have been watching this closely. The consensus is that the Franc isn't weakening anytime soon. Switzerland’s economy is innovative, their debt is low, and they just settled some trade disputes with the US that were hanging over their heads.

Buying vs. Selling: The "Hidden" Cost

If you go to a Google search and see that 500 francs to usd is $624, don't expect to walk into an airport kiosk and get $624 in cash. Kinda sucks, right?

Banks and exchange hubs take a "spread." This is basically a fee disguised in a worse exchange rate. A typical airport booth might only give you $580 for that same 500 CHF.

If you're looking to get the most bang for your buck, you've got a few better options:

- Wise or Revolut: These digital banks usually give you the "mid-market" rate—the one you actually see on Google—and just charge a tiny, transparent fee.

- ATM Withdrawals: Usually better than a physical exchange desk, provided your bank doesn't hit you with massive international fees.

- Local Credit Cards: If you're in Switzerland, just use a card with no foreign transaction fees. Let the bank handle the math.

What You Should Do Next

If you are actually holding 500 Swiss Francs, you are sitting on a strong asset. Given the current upward trend of the CHF against the USD, holding onto it isn't a bad idea if you don't need the cash immediately. However, if you're dealing with CFA Francs or old French Francs, the strategy changes.

Check the Serial Numbers: If you have an old 500 French Franc note (like the famous "Pierre et Marie Curie" bill), don't just look at the exchange rate. Check eBay or a collector's site like Heritage Auctions. Some of these notes are worth way more than their face value to collectors.

Watch the Fed: Keep an eye on the Federal Reserve meetings in 2026. If the US starts cutting rates aggressively—which some analysts expect in the second half of the year—the dollar will likely drop further, making your Swiss Francs even more valuable in comparison.

Verify the Currency: Before you head to a bank, look at the bill. If it says "Banque Nationale Suisse," you're in the money. If it says "Banque de France," it's a souvenir. If it says "Banque Centrale des États de l'Afrique de l'Ouest," it's pocket change for a snack.

The most important takeaway? In the current 2026 climate, the Swiss Franc is a powerhouse. Treat it with respect, avoid the airport exchange desks, and use a digital-first platform to ensure you aren't losing 10% of your money to a middleman.