If you look at a 50 year gold price chart today, it looks like a rocket ship taking off. In early 2026, gold is hovering around $4,600 an ounce. That sounds insane compared to the $125 or so it cost back in 1976. But honestly? Looking at just the raw numbers is the quickest way to misunderstand what gold actually does for your money.

Most people see that massive climb and think they’ve missed the boat, or they assume gold is some kind of get-rich-quick scheme. It’s not. When you peel back the layers of the last five decades, you realize gold isn't really a "growth" asset like a tech stock. It’s more like a mirror. It reflects how much faith we have in the dollar, how scared we are of inflation, and how messy the world feels at any given moment.

The 1970s: When the Training Wheels Came Off

To understand why gold is sitting at record highs now, you’ve got to go back to when the modern market actually started. Before 1971, the price was basically fake—the government kept it pinned at $35. When Nixon "closed the gold window," he essentially told the world the dollar wasn't exchangeable for the yellow metal anymore.

By 1976, we were in the middle of a wild experiment with "fiat" currency. Inflation was starting to eat everyone’s lunch. Gold prices actually dipped a bit in '76, hitting a low of about $103, but then the late 70s happened.

📖 Related: Towne Mall Middletown Ohio: The Real Story of What's Left and What's Coming

You had the oil crisis. You had the Iran hostage crisis. You had double-digit inflation that made a gallon of milk feel like a luxury. Investors panicked. By January 1980, gold spiked to a then-unthinkable $850. If you adjust that 1980 peak for today’s inflation, it would be somewhere north of $3,500. So, even with today's $4,600 price tag, we aren't quite as "expensive" in real terms as you might think.

The Long Nap (1980–2001)

Here is the part of the 50 year gold price chart that most gold bugs hate to talk about. For twenty years, gold was a terrible investment. Seriously.

Paul Volcker, the Fed Chair at the time, jacked up interest rates to 20% to kill inflation. When you can get 15% or 20% interest just by sitting your cash in a bank account, nobody wants to hold a heavy bar of metal that pays zero dividends. Gold went into a brutal "bear market."

By 1999, gold hit a "generational low" around $252. The world was obsessed with the Dot-com bubble. Why buy gold when Pets.com was going to the moon? Central banks were even dumping their gold reserves because they thought it was a "barbarous relic" that had no place in a modern economy.

It’s a great lesson: gold thrives on fear and fails on optimism.

Why Everything Changed in the 2000s

The 2000s weren't just about one event; they were a pile-on of reasons to own gold.

- 9/11 and Geopolitics: The "War on Terror" brought back that old 70s-style fear.

- The 2008 Financial Crisis: This was the big one. When Lehman Brothers collapsed, people realized that even "safe" banks could vanish.

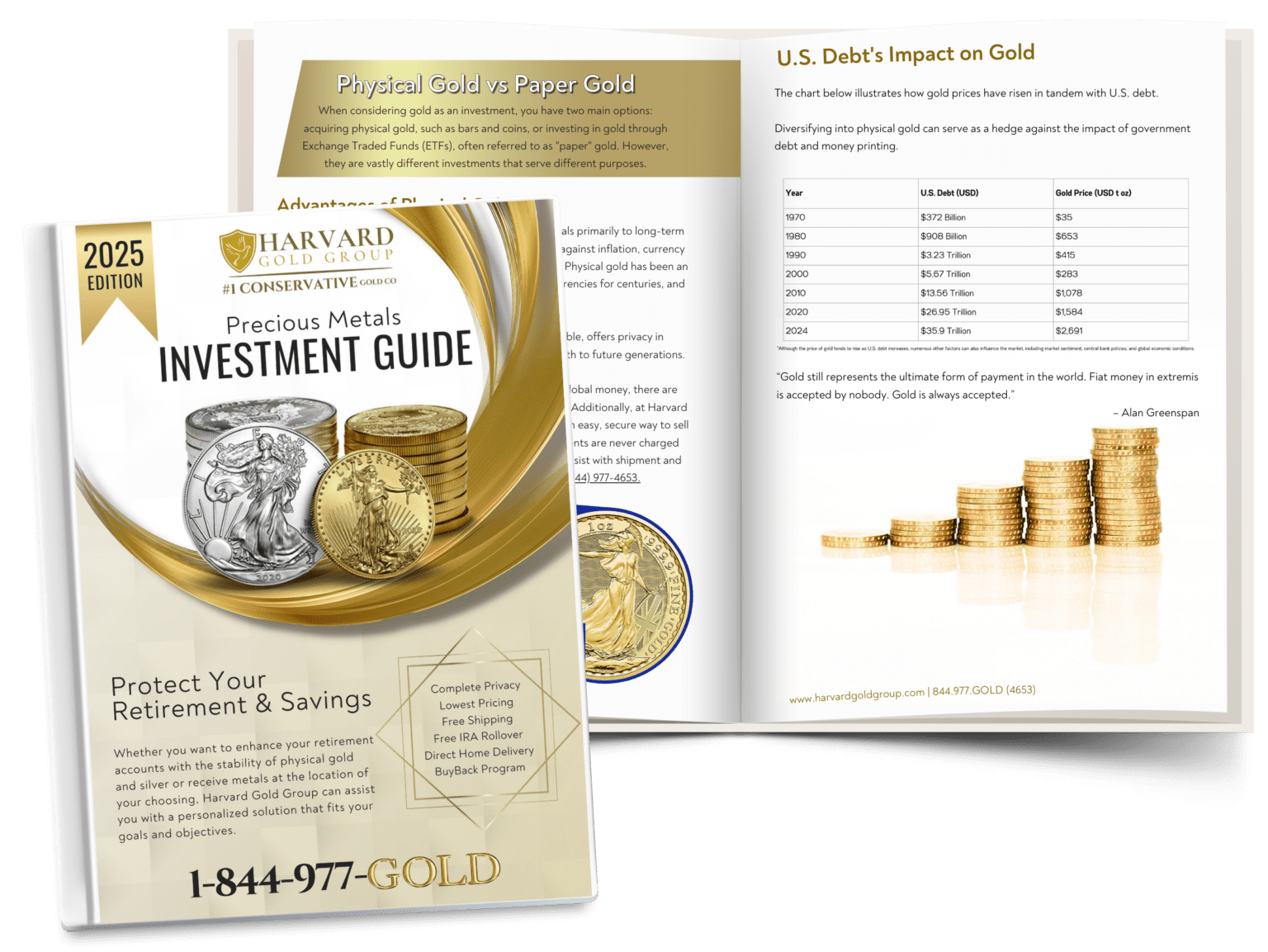

- Quantitative Easing: To save the economy, the Fed started printing trillions. People looked at the 50 year gold price chart and saw the supply of dollars going up while the supply of gold stayed basically flat.

Gold climbed steadily, hitting $1,900 in 2011. Then, as the economy recovered, it cooled off again for a few years, proving once more that gold is a cyclical beast.

The Modern Surge: 2020 to 2026

If you’re looking at the chart right now, the vertical line starting around 2020 is what catches the eye. The COVID-19 pandemic triggered a massive flight to safety. But the real "fuel" for the 2024-2026 rally hasn't just been retail investors buying coins at Costco (though that's definitely a thing now).

The real drivers are central banks. Countries like China, India, and Turkey have been buying gold at a record pace. They’re trying to "de-dollarize"—basically, they want a backup plan in case the U.S. dollar loses its spot as the world's reserve currency.

When you combine that with "sticky" inflation and massive government debt, you get the $4,600 price we see today. It’s a structural shift, not just a temporary spike.

Reading the 50 Year Gold Price Chart Like a Pro

If you're trying to figure out if gold belongs in your portfolio, stop looking at the price in a vacuum. You've gotta look at "Real Rates."

Basically, gold usually goes up when the interest you get from a bank (after inflation) is negative. If inflation is 5% and your savings account pays 3%, you're losing 2% a year. In that world, gold—even though it pays $0 in interest—suddenly looks like a genius move.

Actionable Takeaways for Your Portfolio

- Don't chase the high: Buying gold when it's at an all-time high on the 50 year gold price chart is risky. It's often better to wait for a "pullback" of 10-15%.

- Rebalance, don't just "HODL": Most experts, like those at Vanguard or BlackRock, suggest gold should only be 5% to 10% of your total wealth. If gold goes on a massive run and now makes up 20% of your money, sell some. Lock in those gains.

- Physical vs. Paper: If you want gold for a "doomsday" scenario, you want physical coins or bars. If you just want to play the price movement, an ETF like GLD is way easier to manage.

- Watch the Central Banks: Keep an eye on the World Gold Council reports. If central banks stop buying, the party might be over for a while.

Gold is a slow-motion asset. Over 50 years, it has protected wealth, but it hasn't always grown it as fast as the stock market. It’s the insurance policy you hope you never need, but you’re glad you have when the chart starts looking a little too exciting.

Check the current spot price against the 200-day moving average. If the price is way above that average, you're looking at a "heated" market where patience usually pays off better than FOMO. Compare the current price to the inflation-adjusted 1980 high of $3,500 to see if we're actually in a bubble or just catching up to 50 years of currency devaluation.