You're sitting there, staring at a little flickering cursor on a website that promises to tell you when you can finally quit your job. You've typed in your salary. You've guessed your contribution percentage. You hit "calculate." Suddenly, a big, beautiful number like $2,450,000 pops up in bright green text. It feels great. It feels like a plan. But honestly? That number is probably a lie. Or at the very least, it's a very optimistic version of the truth that ignores how money actually works over thirty years.

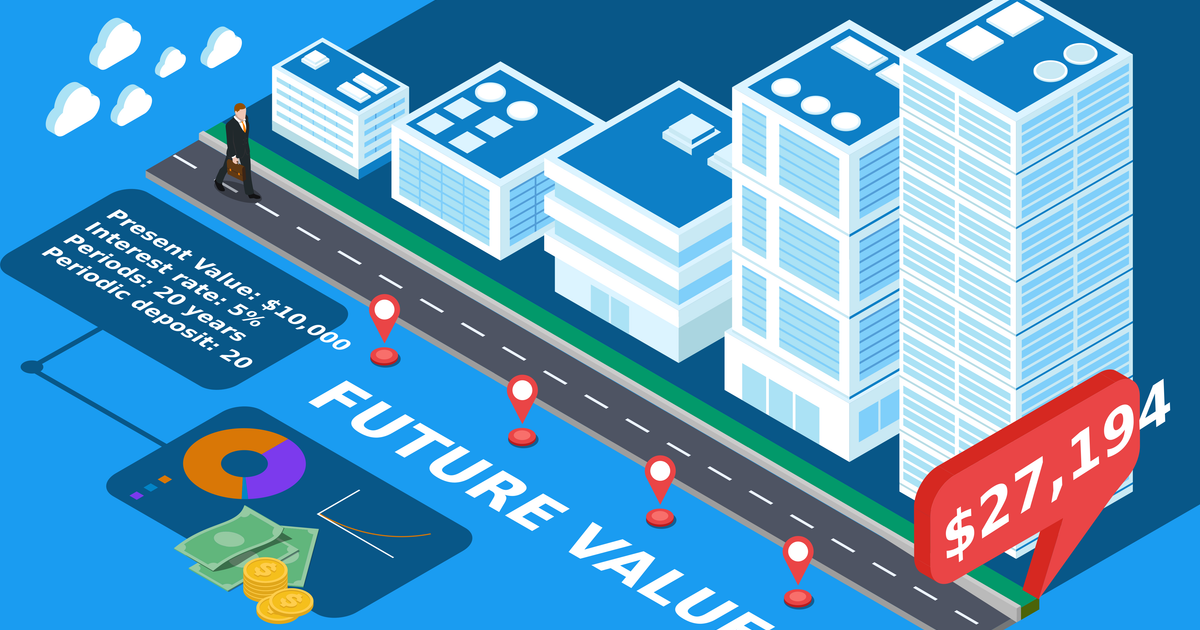

A 401k future value calculator is a math tool, not a crystal ball. It’s basically just a compounded interest formula wrapped in a pretty user interface. While the math behind it is solid—usually some variation of the formula $FV = P \times \frac{(1 + r)^n - 1}{r}$—the inputs we shove into these boxes are often total guesses. We assume the stock market will behave. We assume we’ll never get laid off. We assume inflation won't eat our lunch.

If you want to actually retire, you have to stop looking at that final number as a guarantee and start looking at it as a baseline for adjustment.

The 7% Lie and the Variance Problem

Most people go to a 401k future value calculator and plug in 7% or 8% as their expected return. Why? Because that’s what the "experts" say is the historical average of the S&P 500 after inflation. But the market doesn't return 7% every year. It returns 22% one year and negative 14% the next. This is called sequence of returns risk, and it can absolutely wreck your retirement if the "bad" years happen right as you’re trying to stop working.

Think about it this way. If you have a massive market crash in year 25 of a 30-year career, your "future value" isn't just a slightly smaller number. It’s a crater. A standard calculator won't show you that. It assumes a smooth, linear climb up a mountain that, in reality, is full of jagged cliffs and sudden drops.

Then there’s the inflation factor. If your calculator tells you that you’ll have $2 million in the year 2055, you need to realize that $2 million in 2055 might buy what $800,000 buys today. If your calculator doesn't have an "inflation-adjusted" toggle, the number it gives you is essentially monopoly money. You can’t plan a life on nominal dollars; you have to plan on purchasing power.

Fees: The Silent 401k Killer

You might think a 1% fee sounds small. It isn't. It's massive. Over a 35-year career, a 1% fee can strip away nearly 25% to 30% of your final nest egg. Most people using a 401k future value calculator completely forget to account for the internal expense ratios of the mutual funds they’ve chosen.

Let's say you're looking at two different funds. One is an actively managed "Growth" fund with a 1.2% expense ratio. The other is a boring S&P 500 index fund with a 0.03% ratio. On your calculator, they both look like "stocks" with a 7% return. But in the real world, the first one is taxing your future self every single year regardless of whether the fund goes up or down.

📖 Related: Why Shoplifters When the Shop is Too Heavy Often Get Caught Immediately

Why Your Employer Match is the Real Hero

If your company offers a 5% match and you aren't taking it, you're basically setting fire to a pile of cash in your driveway. In the context of a 401k future value calculator, that match is a 100% return on your investment before the market even moves an inch.

- The Traditional Match: Usually something like 50 cents on the dollar up to 6%.

- The Non-Elective Contribution: Some cool companies just put money in whether you do or not.

- Vesting Schedules: This is the "gotcha." If you leave in two years but your match doesn't vest for four, that "future value" you saw on the screen just evaporated.

The Tax Man is Coming for that Green Number

Unless you are using a Roth 401k, that big number at the end of the calculation isn't yours. It belongs to you and the IRS.

When you use a 401k future value calculator for a traditional 401k, you are looking at "pre-tax" dollars. When you start taking that money out at age 65, it is taxed as ordinary income. If you’re in the 22% or 24% tax bracket, you need to mentally chop nearly a quarter off that total. It's painful. It's the reality of the "tax-deferred" deal you made with the government.

This is why "tax diversification" matters. If you have some money in a Roth (tax-free withdrawals) and some in a Traditional (tax-deferred), you have levers to pull in retirement to keep your tax bill low. A simple calculator usually can't distinguish between these two, leading to a massive overestimation of your actual spending power.

Maxing Out vs. "Doing Enough"

In 2024, the contribution limit is $23,000 (or $30,500 if you're over 50). By 2026, those numbers will likely have adjusted higher with inflation. Most people just put in enough to get the match. That's fine for survival, but it's rarely enough for the "Retire to Hawaii" dream.

Running the numbers on a 401k future value calculator with different contribution levels is eye-opening. Increasing your contribution by just 2% of your salary when you're 25 years old can result in an extra $300,000 or more by the time you're 65. That’s the "magic" of compounding, which is really just the math of patience.

The Problem with High Earners

If you make $250,000 a year, you hit the 401k contribution limit very quickly. At that point, your 401k future value calculator becomes less useful because the 401k can only hold a fraction of what you actually need to save to maintain your lifestyle. You have to start looking at brokerage accounts, Backdoor Roth IRAs, or HSA investments.

Real-World Stress Testing

To get a number that actually means something, you should run three different scenarios on your 401k future value calculator:

- The "Doom" Scenario: Use a 4% return and assume 3.5% inflation. This shows you what happens if the economy stagnates.

- The "Status Quo": Use a 6% return. This is a safer bet than the 8% many people use.

- The "Bull" Scenario: Use 8% or 9%. This is your "everything went right" number.

If you can live on the "Doom" scenario number, you are in great shape. If you need the "Bull" scenario just to pay your rent in thirty years, you need to save more right now. It's that simple.

Actionable Steps to Take Today

Stop just looking at the calculator and start moving the needle.

First, go log into your actual 401k portal. Check your Expense Ratios. If you see anything over 0.50%, look for a cheaper index fund alternative. You are literally paying for someone else's yacht with your retirement if your fees are too high.

Second, Auto-Escalate. Most 401k platforms have a button that says "increase my contribution by 1% every year." Click it. You won't notice a 1% drop in your paycheck, but your 401k future value calculator will show a massive difference in a decade.

Third, Check Your Allocation. If you're 25 and your 401k is 50% bonds because you’re "conservative," you are killing your future self. You need growth. Conversely, if you're 60 and you're 100% in Nvidia stock, you're gambling with your ability to buy groceries in five years.

Finally, remember that the goal isn't to have the biggest number on the screen. The goal is to have enough "real" money to support the life you want. The calculator is just the map; you still have to drive the car. Revisit your calculations every single time you get a raise or change jobs. Life isn't static, so your retirement plan shouldn't be either.

Get your real numbers, account for the tax hit, subtract the fees, and adjust for inflation. That’s how you actually win.

Next Steps for Your Retirement:

- Identify your current 401k expense ratios to see how much you're losing to fees.

- Use a calculator to run a "low-growth" scenario (4%) to see if your plan still holds up in a weak market.

- Increase your contribution by at least 1% today to trigger the power of compounding.