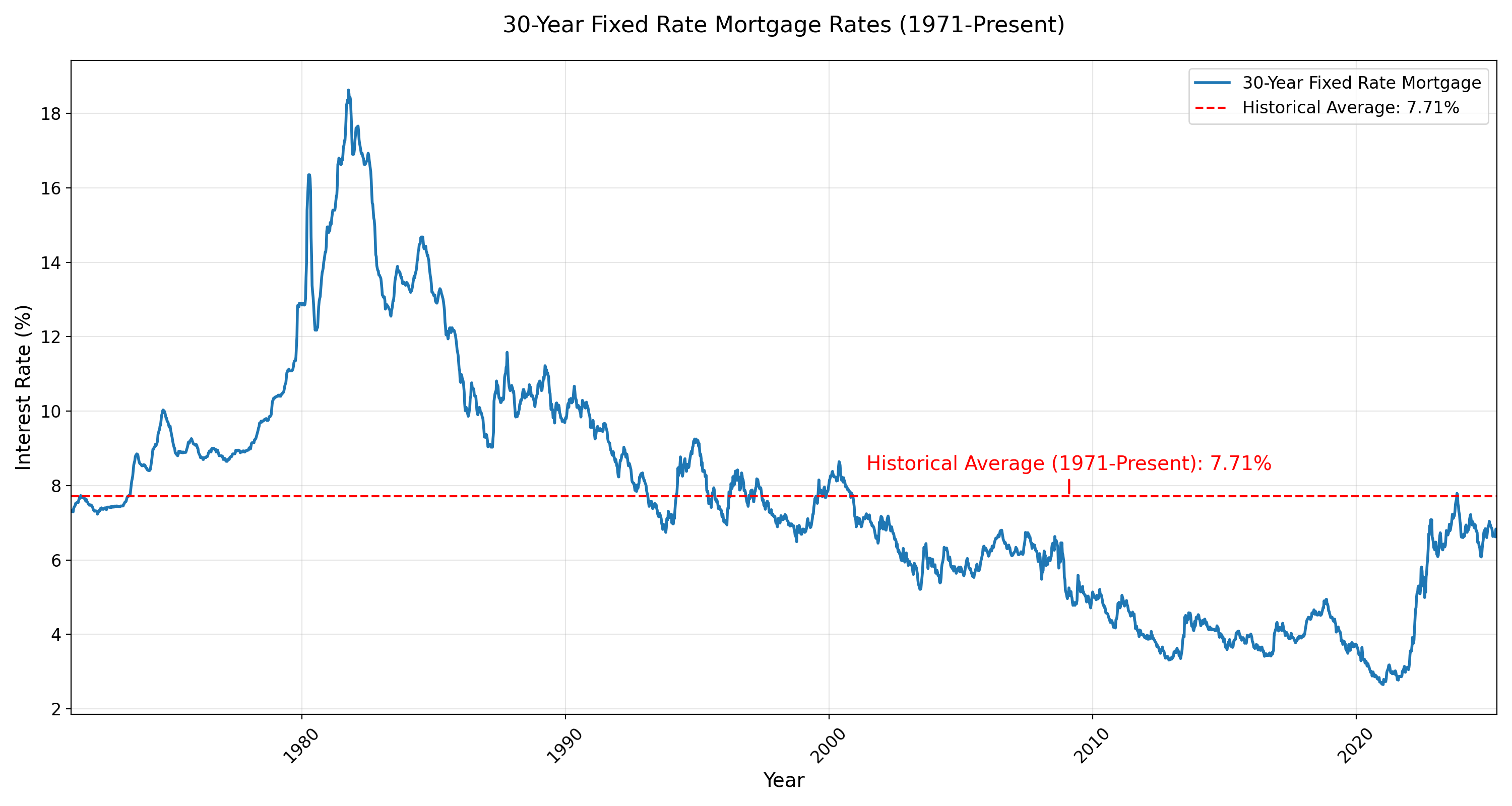

If you look at a 30 year mortgage rates history chart today, your eyes probably dart straight to the right-hand side. You're looking at those spikes from the last few years and feeling a bit of vertigo. It's understandable. We spent a decade being coddled by rates that felt more like errors in a spreadsheet than actual economic data points.

But history is long. It's messy.

Most people buying a home right now compare today’s rates to 2021. That’s a mistake. It’s like comparing the price of a steak dinner today to what your grandpa paid in 1955; it feels bad, but it doesn't give you the full picture of the market's "normal" behavior. To really get what’s happening, you have to look back at the 1970s, the 80s, and the post-2008 era.

The Great Inflation and the 18% Nightmare

Let's talk about 1981. Honestly, it was a brutal time for housing. If you think 7% is high, imagine signing a contract for 18.45%. That is the absolute peak on the 30 year mortgage rates history chart.

Why did this happen? Paul Volcker.

Volcker was the Chair of the Federal Reserve, and he had a singular, somewhat aggressive mission: kill inflation. To do it, he cranked the federal funds rate through the roof. It worked, but it basically put the housing market in a chokehold. People who bought homes in the early 80s weren't "investing" in the way we think of it today; they were just trying to survive the monthly payment.

Many of those homeowners survived by refinancing later. In fact, the downward slope from 1982 to the early 2000s is one of the most consistent trends in financial history. It created a generation of wealth. If you bought in 1983 at 13% and refinanced in 1993 at 7%, you felt like a genius. And you were.

The Long Slide into the 2000s

By the time we hit the 90s, the 30 year mortgage rates history chart started looking a lot more reasonable. Rates hovered between 7% and 9%. This was the era of the "McMansion." Credit was easy—too easy, as we’d later find out—and the economy was humming along with the tech boom.

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

Then came the 2008 crash.

The Great Recession changed everything about how we view mortgage data. The Fed stepped in with Quantitative Easing (QE), essentially buying up mortgage-backed securities to keep rates artificially low. This is where the "distortion" began. For almost 15 years, we lived in a world where a 4% mortgage was considered "high."

It wasn't high. Historically, it was a gift.

When the pandemic hit in 2020, rates bottomed out at roughly 2.65%. That's the lowest point on the chart since Freddie Mac started tracking this data in 1971. It created a frenzy. It also created a "golden handcuff" effect where people who locked in those rates now refuse to sell because they’ll never see 3% again in their lifetime.

Why the Chart Looks Different Now

Inflation came back with a vengeance in 2022. The Fed had to pivot. Fast.

When you look at the recent vertical line on a 30 year mortgage rates history chart, it represents the fastest rate hike cycle in modern history. We went from 3% to 7% in a heartbeat. It wasn't just the height of the rates that shocked the system; it was the velocity. Usually, these things happen over years. This happened over months.

Here is what most people get wrong: they think rates must go back down to 3%. There is no economic law that says that has to happen. In fact, if you look at the 50-year average, it sits somewhere around 7.7%.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

We aren't in "high" territory. We're in "normal" territory.

The Factors That Move the Needle

It's not just the Fed. While the Federal Reserve sets the short-term benchmark, 30-year fixed rates are more closely tied to the 10-Year Treasury yield. Investors look at the spread—the difference between the Treasury yield and the mortgage rate.

Usually, that spread is about 1.7 percentage points. Recently, it’s been much wider, sometimes over 3 points. Why? Risk. Banks are nervous about volatility. When banks are nervous, you pay more.

- The 10-Year Treasury: The primary driver of long-term mortgage pricing.

- Inflation Expectations: If investors think their money will be worth less in 10 years, they demand higher interest now.

- Housing Supply: While this doesn't set the rate, it dictates the "pain" of the rate. High rates plus low inventory equals the current affordability crisis.

Comparing the Decades: A Reality Check

If we break down the 30 year mortgage rates history chart by decade, the narrative shifts.

The 1970s averaged about 8.8%.

The 1980s averaged a staggering 12.7%.

The 1990s settled around 8.1%.

The 2000s dropped to 6.3%.

The 2010s gave us that 4.1% average that spoiled everyone.

Seeing these numbers in a row makes 7% look... fine? It’s not great, especially with home prices at all-time highs, but it’s certainly not the outlier that the 3% era was. We are essentially returning to the mean.

The Psychological Impact of the "Golden Handcuffs"

There is a weird side effect of this history. Because so many people locked in sub-4% rates between 2012 and 2021, the "inventory" part of the housing equation is broken.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

In the 80s, if you had a 12% rate and rates dropped to 10%, you might move. Today, if you have a 3% rate and rates are 7%, you aren't moving unless you absolutely have to—death, divorce, or a mandatory job transfer. This "lock-in" effect is keeping prices high even as rates rise, which is a divergence from historical norms. Usually, when the 30 year mortgage rates history chart goes up, home prices soften.

This time, they didn't. They just plateaued or kept climbing in hot markets. It's a supply-demand mismatch that history hasn't seen on this scale before.

Actionable Steps for Today's Market

Stop waiting for 3%. Seriously. If you’re staring at the 30 year mortgage rates history chart waiting for a return to 2021 levels, you might be waiting for a decade. Or forever.

Instead, focus on the things you can actually control.

First, look at the "Buy Now, Refinance Later" strategy with a healthy dose of skepticism. It only works if rates actually drop. If you buy at 7% and they go to 8%, you'll be glad you bought. If they go to 5%, you refinance. But you have to be able to afford the 7% payment today. Don't bank on a "future version" of the economy to save your budget.

Second, check your credit score. In a 7% environment, the difference between a 680 and a 760 credit score can be the difference between a 7.5% rate and a 6.8% rate. Over 30 years, that is tens of thousands of dollars.

Third, consider an ARM (Adjustable Rate Mortgage) if you know you're moving in five years. History shows that for short-term stays, the lower initial rate of an ARM often beats the security of a 30-year fixed, provided you have an exit strategy.

Finally, watch the spread. If you see the gap between the 10-Year Treasury and mortgage rates start to shrink, that’s your signal that the market is stabilizing. That is often a better "buy" signal than waiting for the Fed to announce a cut.

The chart isn't just a line. It’s a map of every major economic crisis and boom of the last fifty years. Use it as a guide, not a crystal ball.