You've probably noticed that everything costs more lately. From eggs to electricity, the "inflation tax" is real. But there is a weird silver lining buried in the IRS tax code that actually works in your favor for once. Every year, the IRS adjusts the 2024 federal income tax tables to prevent something called "bracket creep." Basically, if they didn't do this, your cost-of-living raise would push you into a higher tax bracket, and you'd actually end up poorer despite making more money.

For the 2024 tax year—the one you're filing for right now in early 2026—the IRS boosted the tax brackets by about 7%. That’s a massive jump. Usually, these adjustments are tiny, maybe 1% or 2%. But because inflation went haywire, the thresholds moved significantly. This means you can earn more money before hitting the next tax percentage. It’s not exactly a "tax cut" in the legislative sense, but for your wallet, it sort of feels like one.

Understanding the Brackets Without the Math Headache

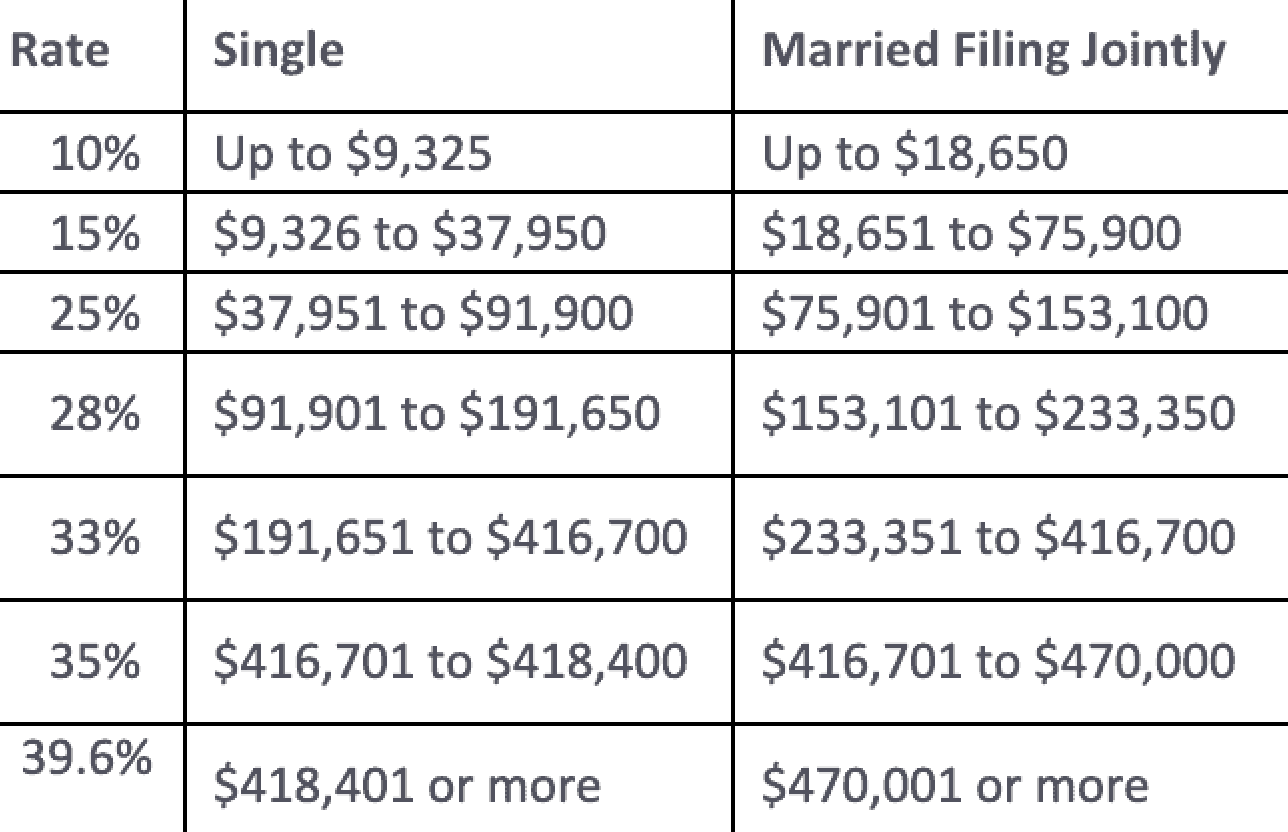

Most people think that if they fall into the 22% bracket, the government takes 22% of everything they make. Honestly? That’s just not how it works. We have a progressive system. It’s like a series of buckets. You fill the 10% bucket first, then the 12% bucket, and so on. Only the money that spills over into the next bucket gets taxed at the higher rate.

For single filers using the 2024 federal income tax tables, the 10% rate applies to the first $11,600 you earn. If you make $11,601, only that one extra dollar is taxed at 12%. It’s a common misconception that getting a raise can "lower" your take-home pay by putting you in a higher bracket. It's mathematically impossible. You always keep more of the raise, though the IRS definitely takes a bigger bite of the "new" money.

Let’s look at the actual breakdown for individuals. For 2024, the 12% bracket starts at $11,600 and goes up to $47,150. If you’re a mid-career professional making $100,000, you’re sitting in the 22% bracket, which covers income between $47,150 and $100,525. If you're married filing jointly, those numbers basically double. The 22% bracket for couples starts at $94,300 and climbs all the way to $201,050.

The Standard Deduction Secret

Before you even look at those brackets, you have to subtract your standard deduction. This is the amount of money the IRS says is "free" from federal income tax. For 2024, the standard deduction for single filers jumped to $14,600. For married couples, it’s a whopping $29,200.

🔗 Read more: ROST Stock Price History: What Most People Get Wrong

Think about that. If you and your spouse together make $100,000, you aren't actually taxed on $100,000. You subtract that $29,200 first. Now you're only being taxed on $70,800. Suddenly, you aren't in the 22% bracket anymore; you’ve dropped down into the 12% range. This is where people get confused when they try to estimate their taxes on the back of a napkin. They forget the deduction. It’s the biggest "gift" the tax code gives to the average person.

The 2024 Federal Income Tax Tables for Every Filing Status

Tax law loves categories. Depending on whether you're single, married, or "head of household," your tax bill can fluctuate by thousands. It’s kinda wild how much your marital status dictates your lifestyle costs, and the IRS reflects that.

If you are Single:

The bottom 10% covers $0 to $11,600. The 12% tier hits from $11,600 to $47,150. Then you jump to 22% for income up to $100,525. The 24% bracket is a big one, stretching from $100,525 to $191,950. High earners hit 32% at $191,950, 35% at $243,725, and the top 37% rate kicks in for anything over $609,350.

Married Filing Jointly:

Couples get more breathing room. That 10% rate lasts until $23,200. The 12% rate goes up to $94,300. The 22% rate ends at $201,050. The 24% rate covers you up to $383,900. If you’re lucky enough to need the 32% bracket, that starts at $383,900. The 35% tier begins at $487,450, and the top 37% doesn't hit until your combined income surpasses $731,200.

Head of Household:

This is for the single parents or people supporting dependents. It’s the middle ground. Your 10% bracket goes to $16,550. The 12% rate goes up to $63,100. The 22% rate hits at $63,100 and ends at $100,500. It’s designed to give a break to people carrying the financial load of a family on one income.

💡 You might also like: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Why Capital Gains Change the Game

We can't talk about the 2024 federal income tax tables without mentioning investments. If you sold stock or crypto in 2024, you might not be paying these rates at all. Long-term capital gains (assets held for over a year) have their own special, much lower brackets. Most people pay 0% or 15% on their gains. Only the very wealthy pay 20%.

If your total taxable income is under $47,025 as a single person, your capital gains tax rate is 0%. Zero. You could sell a stock for a $5,000 profit and owe the IRS nothing on that gain if your total income is low enough. This is a massive loophole that many middle-class families overlook when they're rebalancing their retirement accounts or selling off a few shares of Apple to pay for a vacation.

Surprising Details Most People Miss

There’s a weird quirk called the "Marriage Penalty," though it doesn't hit most people anymore. It really only kicks in at the very top of the 2024 federal income tax tables. Notice that the top 37% bracket for singles starts at $609,350, but for married couples, it starts at $731,200. If it were truly "double," the married bracket would start at $1.2 million. So, high-earning power couples actually pay more in taxes together than they would if they stayed single and just lived together. Kinda messed up, right?

Also, don't forget the Alternative Minimum Tax (AMT). It’s like a shadow tax system. The AMT exemption for 2024 rose to $82,500 for individuals and $128,500 for married couples. It’s designed to make sure the wealthy don't use too many deductions to pay nothing, but as inflation rises, it starts to snag more regular people. Fortunately, the 2024 adjustments were high enough that most people won't have to worry about it.

Credits vs. Deductions: The Real Winners

People use these terms interchangeably, but they are totally different. A deduction (like the standard deduction we talked about) lowers the amount of income you are taxed on. A credit is way better. It's a dollar-for-dollar reduction of your tax bill.

📖 Related: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

The Child Tax Credit remains a huge factor for 2024. Even if the tables say you owe $5,000, a couple of kids could wipe that out entirely. Then there’s the Earned Income Tax Credit (EITC). For 2024, the maximum EITC is $7,830 for filers with three or more children. That’s actual cash in your pocket.

Actionable Steps to Handle Your 2024 Taxes

Don't just stare at the tables and stress. Do something.

- Max out your 401(k) or IRA: This is the easiest way to "lower" your bracket. If you're on the edge of the 22% bracket, contributing to a traditional IRA can pull your taxable income back down into the 12% range. For 2024, the contribution limit for a 401(k) was $23,000. That’s a lot of shielded income.

- Check your withholding: If you got a massive refund last year, you’re basically giving the government an interest-free loan. Use the IRS Tax Withholding Estimator. Adjust your W-4 so you get more money in your paycheck every month instead of waiting for a lump sum in April.

- Gather your 1099s early: If you have a side hustle, those earnings are added to your regular job's income. This can easily push you into a higher bracket in the 2024 federal income tax tables. You need to know that number before you start filing so you aren't blindsided by a bill.

- Look into the HSA: If you have a high-deductible health plan, the Health Savings Account is the "triple threat" of tax savings. Contributions are tax-deductible, growth is tax-free, and withdrawals for medical stuff are tax-free. For 2024, the limit was $4,150 for individuals and $8,300 for families.

The most important thing to remember is that these tables are just the starting point. Between credits, deductions, and adjustments, your "effective" tax rate—what you actually pay—is almost always lower than the bracket you see on paper. Take a breath. Look at the numbers. And maybe talk to a pro if your situation involves more than just a standard W-2.

If you're self-employed, remember that you're responsible for both the employer and employee side of Social Security and Medicare. That's an extra 15.3% on top of the income tax tables. It’s a bitter pill, but you can deduct half of it on your 1040. Small wins matter. Keep your receipts, track your mileage, and don't let the complexity of the code keep you from claiming what's yours.