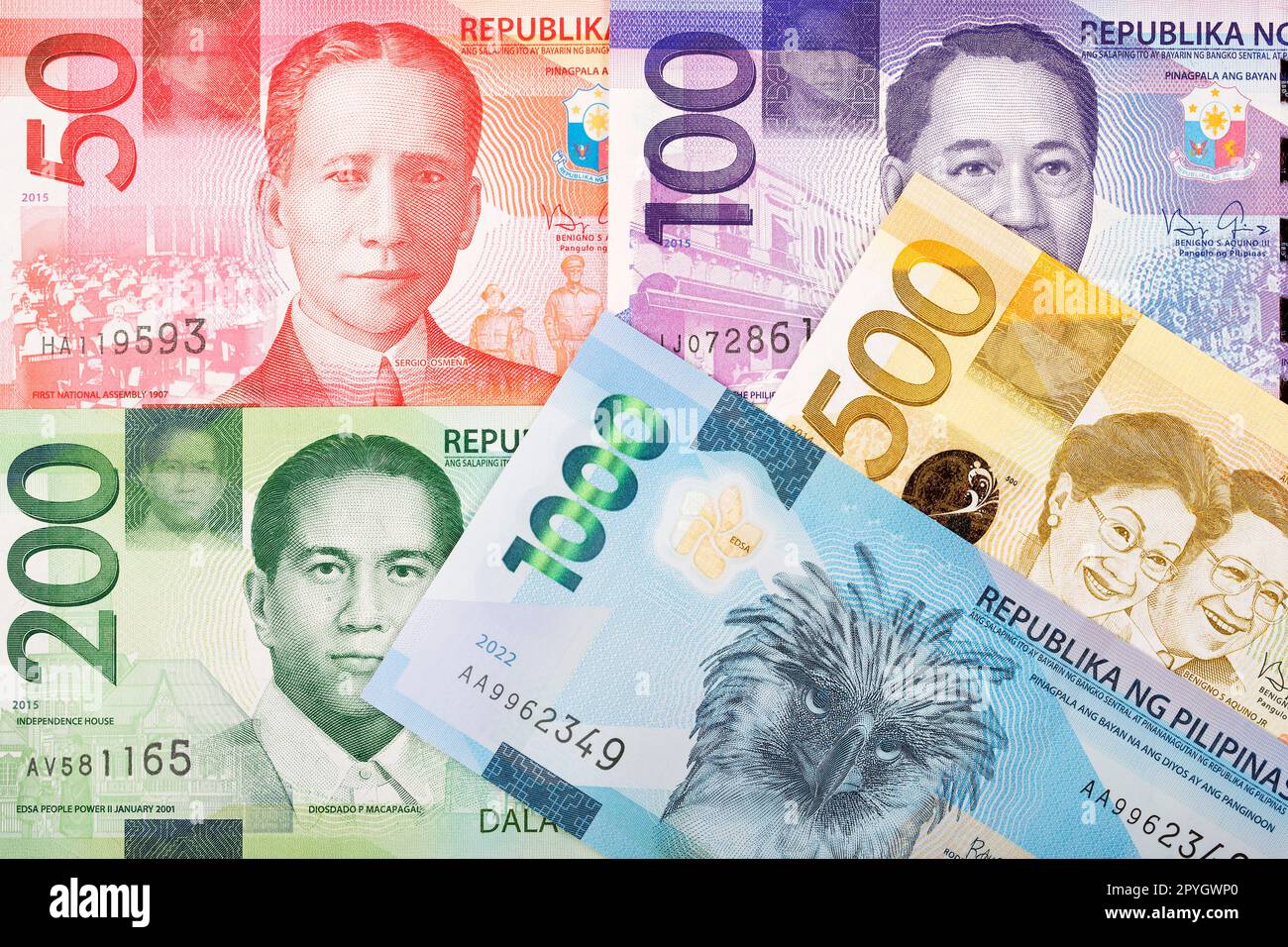

Money is a weird thing. One minute you've got two crisp $100 bills in your pocket in Los Angeles, and the next, you’re trying to figure out if that same amount can cover a week's worth of groceries in Cebu. If you're looking at 200 dollars to PHP peso right now, you’re likely seeing a number around 11,887.80 PHP.

That is the mid-market rate as of January 14, 2026.

But here’s the kicker: nobody actually gets that rate. Unless you are a high-frequency trading bot or a massive central bank, the "official" rate is mostly a teaser. By the time you factor in the "convenience" fees, the hidden spreads, and the local pickup charges, that 11,800 might look more like 11,400. Or worse.

The Reality of 200 Dollars to PHP Peso Today

When you convert 200 dollars to PHP peso, you aren't just swapping paper. You are participating in a global tug-of-war between the Federal Reserve and the Bangko Sentral ng Pilipinas. Currently, the exchange rate is hovering near 59.44 PHP for every 1 USD.

This is high.

Historically, the Peso has seen some wild swings. If you sent this same amount a few years ago, you might have only snagged 10,000 pesos. Now, that extra 1,800 pesos—nearly two thousand—is the difference between a basic dinner and a full-blown family feast at Jollibee with buckets of Chickenjoy to spare.

Why the Rate Moves While You Sleep

Currency markets don't care about your weekend plans. They move because of:

- Interest Rate Spreads: If the US keeps rates high to fight inflation, the Dollar stays strong.

- Remittance Season: During Christmas or graduation months, the influx of USD can actually strengthen the Peso temporarily because of high demand.

- Geopolitics: Any sneeze in global trade usually results in investors running back to the US Dollar as a "safe haven," pushing the PHP down.

Honestly, the rate can change by 20 or 30 centavos in a single afternoon. On a $200 transfer, that’s only 60 pesos, but if you’re a regular sender, those "onlys" add up to a plane ticket over a year.

Where Your Money Actually Goes (The Fee Trap)

Most people just head to the nearest Western Union or click "send" on PayPal without a second thought. That’s a mistake.

Let’s look at the math. If the mid-market rate is 59.44, but your provider offers you 58.10, they are pocketing 1.34 pesos for every dollar. On $200, that’s 268 pesos gone before you even pay the transfer fee.

Digital wallets like GCash and Maya have changed the game. You can now use apps like Sendwave or Remitly to send directly to a mobile wallet. Often, these digital-first players offer better rates because they don't have to pay rent for a physical booth in a mall.

Expert Note: Always check the "Total Amount Received." Some companies scream "Zero Fees!" but then give you an exchange rate so bad it costs more than a $10 fee would have. It’s a classic bait-and-switch.

Comparing the Big Players for a $200 Transfer

- Wise (formerly TransferWise): They usually give the real mid-market rate but charge a transparent fee (around $8-12 depending on how you pay).

- Western Union: Great for cash pickup in remote provinces like Leyte or Samar, but you pay for that footprint with lower rates.

- WorldRemit: Often has promos for first-time senders where they waive the fee entirely.

- Revolut: Good for tech-savvy users, but watch out for weekend markups when the markets are closed.

What Can 11,800 Pesos Actually Buy in 2026?

Inflation is a global headache, and the Philippines isn't immune. However, $200 still carries significant weight.

In Manila, 11,800 pesos is roughly half the monthly rent for a decent studio apartment in a non-prime area. In the provinces? That’s a month of rent plus utilities. If you’re a tourist, that’s about five to seven nights in a mid-range boutique hotel in Palawan or Boracay.

For a local family, this amount is a lifeline. It covers a massive grocery haul, electric bills that have skyrocketed lately, and likely some school supplies. It is not "wealth," but it is definitely "security."

Stop Losing Money on the Conversion

If you want to maximize your 200 dollars to PHP peso conversion, stop using your local bank. Traditional banks are notorious for the worst exchange rates on the planet. They treat currency exchange like a premium service rather than a basic transaction.

📖 Related: What Did Ford Invent? Why Most People Get the Story Wrong

Instead, use a comparison tool. Sites like RemitFinder or even just a quick Google search for "USD to PHP comparison" can save you enough for a fancy coffee or a taxi ride.

Also, try to send mid-week. Mondays and Fridays are notoriously volatile. Tuesday through Thursday usually sees the market settle into a rhythm, giving you a more predictable "bang for your buck."

Actionable Steps for Your Next Transfer

- Download two apps: Compare the "Total Received" amount between Wise and Remitly before hitting send.

- Avoid Credit Cards: Paying for a transfer with a credit card often triggers "cash advance" fees from your bank. Use a debit card or a direct bank link (ACH) instead.

- Check the Pickup Method: Sending to a bank account is usually cheapest, but sending to a GCash wallet is the fastest.

- Verify the Identity: Make sure the recipient's name matches their ID exactly. One typo in a middle name can lock that $200 in "transfer limbo" for a week.

The market isn't going to get less complicated, but you can get smarter about how you navigate it. Keep an eye on the 59.00 support level—if it drops below that, it might be worth waiting a few days to see if the Dollar bounces back.

Actionable Insight: Check the current live rate on a site like Revolut or XE right now. If the rate is above 59.40, it is a historically strong time to convert your USD. Use a digital-first provider to ensure at least 11,700 PHP lands in the recipient's hands after all costs are settled.