You’ve probably seen the headlines. Rates are up. Then they're down. Then they're "sideways." But if you actually look at the 15 year mortgage rate history, you start to see a much weirder, more interesting story than just a line on a graph. Most people obsess over the 30-year fixed. It’s the standard. It’s the "safe" bet for monthly cash flow. But the 15-year is where the real wealth-building happens, and honestly, the history of this specific rate explains why some generations got rich off real estate while others are just barely hanging on.

It’s about the spread.

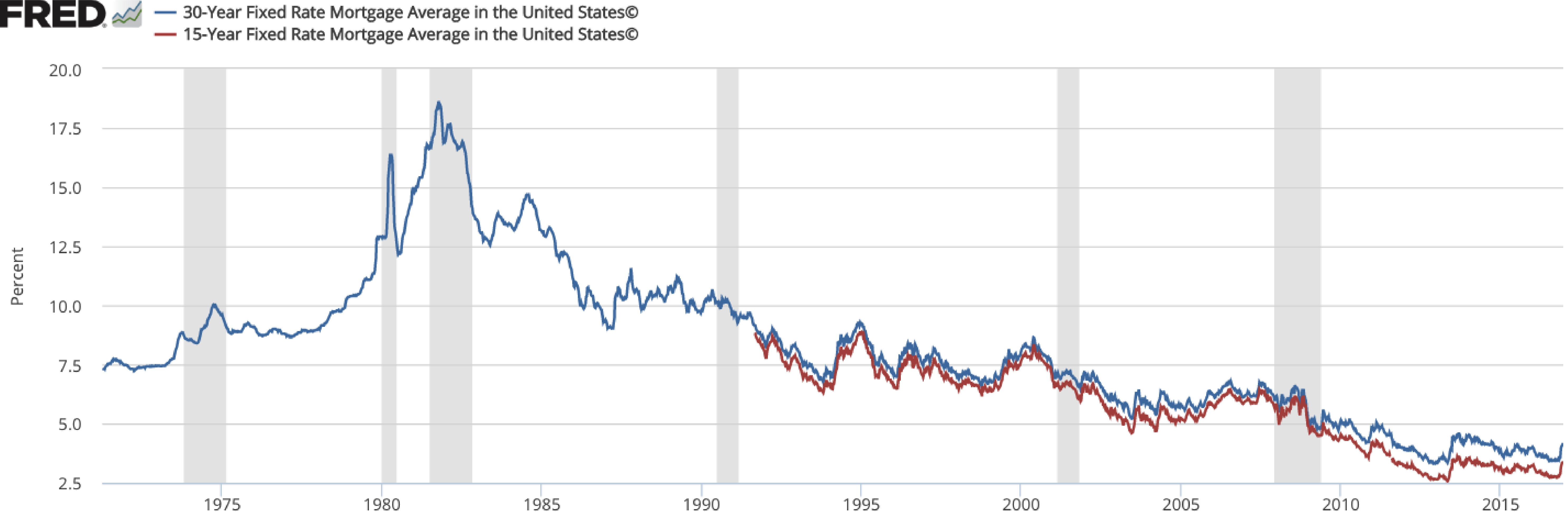

Historically, the 15-year rate usually sits about 0.5% to 1% below its 30-year big brother. Why? Because you’re less of a risk to the bank if you’re paying it off in half the time. But that gap hasn't always been consistent. Looking back at data from Freddie Mac’s Primary Mortgage Market Survey, which has been tracking this stuff since the early 90s, you see wild swings that tell the story of the American economy.

When 8% Felt Like a Total Steal

Let’s go back. Way back.

In the early 1990s, specifically around 1991 when Freddie Mac started specifically highlighting the 15-year fixed-rate mortgage, rates were hovering around 8.2% to 8.5%. To a modern buyer used to the "free money" era of 2020, that sounds like a nightmare. It sounds like predatory lending. But back then? People were coming off the 1980s where rates hit 18%.

Basically, 8% felt like a bargain.

The 15-year mortgage became the darling of the "refinance boom" of the early 90s. Homeowners who had survived the Volcker era of high interest rates realized they could switch to a 15-year term and actually own their home before they retired. It wasn't just about the rate; it was about the math. If you look at the 15 year mortgage rate history during the mid-90s, you'll see a dip toward 6.5% in 1994, followed by a spike. This volatility was the norm.

The economy was finding its footing after the Cold War. Tech was starting to bubble. Money was moving.

The 2008 Crash and the Great Reset

Then we hit the 2000s. The early 2000s were a bit of a fever dream for real estate. Rates stayed relatively stable in the 5% to 6% range for the 15-year fixed. But we all know what happened in 2008. The subprime meltdown didn't just break the banks; it fundamentally altered how we view the 15 year mortgage rate history.

Post-2008, the Federal Reserve stepped in with Quantitative Easing (QE). They basically flooded the market with liquidity. By 2011, for the first time ever, 15-year rates dropped below 3.5%.

It was unprecedented.

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

Why the 2010s Were an Anomaly

If you bought a house or refinanced between 2012 and 2016, you likely caught the 15-year rate somewhere between 2.7% and 3.3%. Experts like Ben Bernanke and later Janet Yellen were steering a ship that prioritized low borrowing costs to jumpstart a dead housing market.

- 2012: Rates hit record lows at the time.

- 2013: The "Taper Tantrum" caused a brief spike, but 15-year rates stayed manageable.

- 2016: Global uncertainty kept rates low, hovering around 2.8%.

Most people don't realize that this decade of low rates was a historical outlier. If you look at the 50-year average of mortgage rates, the 2010s look like a massive valley. We got spoiled. We started thinking that a 3% mortgage was a birthright rather than a gift from a desperate central bank.

The 2020 Pivot: The Lowest It Ever Went

Then came COVID-19. Everything stopped. To prevent a total global collapse, the Fed slashed the federal funds rate to near zero.

By late 2020 and early 2021, the 15 year mortgage rate history recorded its lowest point in human history. We saw 15-year fixed rates hitting 2.1%. Some well-qualified borrowers were even seeing sub-2% quotes. It was insane. You were essentially borrowing money for free when you accounted for inflation.

But there was a catch.

While the rates were low, home prices skyrocketed. The "monthly payment" stayed low because of the interest rate, but the "total debt" was ballooning. This created a weird friction. You could get a 15-year loan at 2.2%, but the house that cost $300,000 in 2018 now cost $450,000.

The math started to get fuzzy for the average family.

The Reality Check of the Mid-2020s

Fast forward to where we are now. The "easy money" party ended with a massive hangover called inflation. The Fed started hiking rates faster than they ever had in the 80s. By 2023 and 2024, the 15-year mortgage rate had climbed back up into the 6% and 7% range.

It felt like whiplash.

Going from 2.2% to 6.5% in eighteen months is a brutal adjustment for any market. But here is what the 15 year mortgage rate history teaches us: 6% is actually quite "normal." If you look at the historical mean from 1971 to 2025, mortgage rates usually average out around 7% or 8%.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The 2020s are just a return to the mean. It just hurts because we remember the 2% days so vividly.

The Psychological Gap

There is a huge difference between "mathematically affordable" and "psychologically acceptable." Most buyers today are sitting on the sidelines because they feel they "missed out" on the lows of 2021.

But waiting can be a trap.

In the 1970s, people waited for rates to drop from 9%. They ended up seeing 15% instead. History shows us that while rates fluctuate, they rarely return to their absolute lowest points unless there is a massive global catastrophe. Hoping for 2% again is basically hoping for another pandemic-level economic shutdown. Probably not a great strategy.

How the 15-Year Rate Affects Your Wealth Long-Term

Why do people even bother with a 15-year loan when the rates are high?

It’s the interest savings. It’s staggering.

Let's say you're looking at a $400,000 loan.

On a 30-year fixed at 7%, you’ll pay roughly $558,000 in just interest over the life of the loan.

On a 15-year fixed at 6.2%, you’ll pay about $215,000 in interest.

You save over $340,000 just by shortening the term.

That’s why the 15 year mortgage rate history is so vital for investors. It's the "secret menu" of the banking world. Banks don't actually like 15-year mortgages as much because they make way less money off you. They'd much rather you stay in a 30-year debt cycle where you're mostly paying interest for the first ten years.

The Trade-Off

The downside is obvious: the payment.

A 15-year payment is usually about 30% to 50% higher than a 30-year payment. In a high-rate environment, that can be a dealbreaker for your DTI (Debt-to-Income) ratio.

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

What the Data Says About the Future

Predicting where the 15 year mortgage rate history goes next is a bit of a fool's errand, but we can look at the "spread."

Usually, mortgage rates follow the 10-Year Treasury Yield. When the Treasury yield goes up, mortgages go up. Right now, the spread is wider than usual because banks are nervous about the economy. They're charging a "risk premium."

If the economy stabilizes and the Fed stops its aggressive hiking, we might see that spread narrow. This could bring 15-year rates down even if the Fed doesn't officially cut "base" rates.

But don't expect 3% again.

Economists like Lawrence Yun at the National Association of Realtors (NAR) have suggested that we are entering a "new normal" where rates hover between 5.5% and 6.5%. It’s a stable middle ground. It’s enough to keep the market moving without fueling another massive price bubble.

Actionable Steps for Today's Borrowers

If you're looking at the current rates and feeling discouraged, here's how to actually use this history to your advantage:

- Watch the Spread: If the 15-year rate is more than 0.75% lower than the 30-year, it's a "buy" signal for the shorter term. The math almost always works in your favor there.

- Recast Instead of Refinance: If you have a low rate now but want to pay it off faster, don't refinance into a 15-year and lose your 3% rate. Just pay the 30-year loan like it's a 15-year. You get the same result without the closing costs.

- Ignore the "Loud" News: Headlines love to scream about "highest rates in 20 years." While true, it ignores the fact that 20 years ago, the economy was doing just fine with those rates.

- Check the 5/1 ARM: Sometimes, in a weird market, a 5-year Adjustable Rate Mortgage might actually have a better starting rate than a 15-year fixed. If you plan to move anyway, it's a viable play.

The 15 year mortgage rate history proves one thing: the best time to buy is usually when you can afford the monthly payment, not when the "experts" say the rate is at its bottom.

Timing the market is a myth. Mastering the math is a strategy.

If you are looking to build equity quickly, the 15-year is still the undisputed king, regardless of whether the rate starts with a 2, a 5, or a 7. History shows that those who commit to shorter terms end up with significantly higher net worths by the time they hit their 50s. It’s not about the "deal" you get today; it's about the debt you don't have tomorrow.

Your Next Steps:

- Calculate your DTI: See if your income can actually support a 15-year payment at current 6% levels.

- Run an Amortization Schedule: Compare a 30-year and a 15-year for your specific loan amount. Look at the "Total Interest Paid" line. It’s usually a wake-up call.

- Talk to a local credit union: They often hold their own loans and might offer a better "spread" on 15-year products than the big national banks.