You’re checking the mail, expecting maybe a local pizza coupon or a water bill, and there it is. A crisp, white envelope from a company you did some work for six months ago. Inside sits a 1099 tax form. If you’ve spent your whole life as a W-2 employee, this little piece of paper can feel like a summons from the IRS. It’s different. It’s confusing. Honestly, it’s a bit of a headache if you aren't prepared.

But here is the thing: a 1099 is just an information return. It’s basically the IRS’s way of saying, "Hey, we know you got paid this money, so make sure you tell us about it." It isn't a bill. It's a record.

The most common version people see is the 1099-NEC. This is for non-employee compensation. If you did freelance graphic design, drove for a ride-share app, or even just did a one-off consulting gig that paid more than $600, you’re getting one. The 1099 system is huge. It covers everything from gambling winnings to interest from your savings account.

The Big Difference Between W-2 and 1099

When you work a "normal" job, your boss is your tax collector. They take a chunk of your check every two weeks for Social Security, Medicare, and income tax. You never see that money. It goes straight to the government. By the time you get your W-2 in January, most of the "paying" is already done.

1099s are the Wild West of the tax world.

When a client pays a contractor, they pay the gross amount. They don't take a cent out for taxes. This feels amazing in July when you get a $5,000 check and keep all $5,000. It feels significantly less amazing in April when you realize you owe the IRS about 25% to 30% of that money because nobody was withholding it for you.

You’re responsible for the "Self-Employment Tax." Since you are technically both the employer and the employee, you pay both halves of the Social Security and Medicare contributions. That’s 15.3% right off the top before you even get to regular income tax. It's a heavy lift. Most people don't realize that until their first year of freelancing hits them like a freight train.

Why the $600 Threshold Matters (and Why It Sometimes Doesn't)

There is a huge misconception that if you made $599, you don't have to pay taxes. That is completely wrong.

The $600 rule is for the payer. If a business pays you $600 or more during the calendar year, they are legally required to send you a 1099 and file a copy with the IRS. If they pay you $400, they aren't required to send the form.

But you? You still have to report that $400.

The IRS expects you to report all income, whether you got a formal piece of paper for it or not. If you get audited and they see $10,000 in Venmo transfers from various clients but you only filed 1099s totaling $4,000, you're going to have a very long, very expensive conversation with a tax examiner.

The Different Flavors of 1099s

Not all 1099s are created equal. In fact, there are nearly 20 different versions. Here are the ones you’ll actually see in the real world:

1099-NEC (Non-Employee Compensation)

This is the king of the gig economy. It replaced the old 1099-MISC (Box 7) a few years ago. If you provided a service—coding, writing, plumbing, lawn care—this is your form.

1099-K (Payment Card and Third Party Network Transactions)

This one has been a massive source of drama lately. It’s for money received through apps like PayPal, Venmo, or Etsy. For years, the threshold was $20,000 and 200 transactions. The IRS tried to drop it to $600, which caused total chaos. As of now, they've delayed the strict $600 implementation several times, but it's trending toward more transparency for digital payments.

1099-INT and 1099-DIV

These are for your "passive" money. If your high-yield savings account actually yielded something or your stocks paid out dividends, your bank or brokerage sends these. Usually, these are much simpler because there are no business expenses to deduct against them.

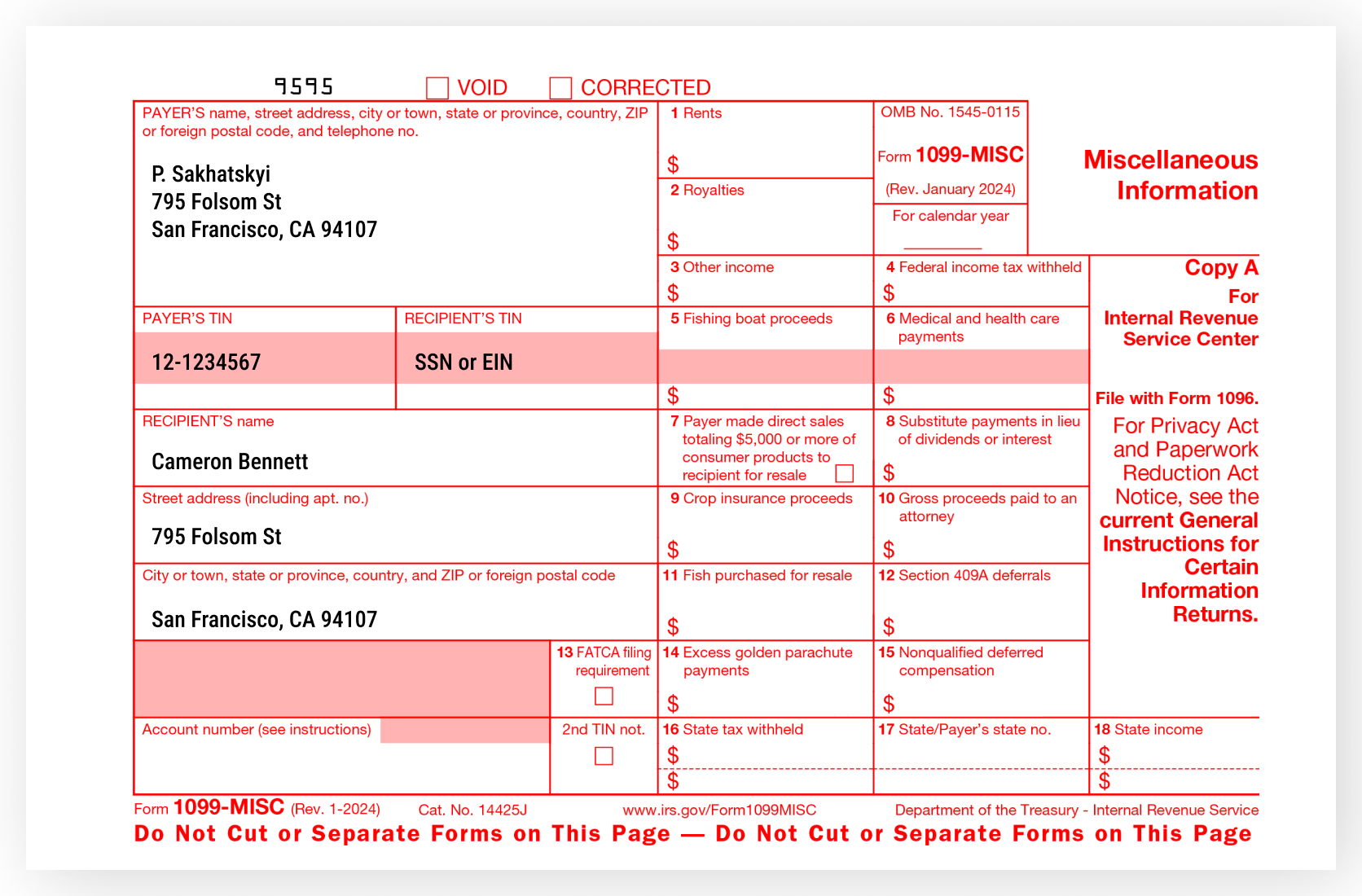

1099-MISC

Wait, didn't the NEC replace this? Sorta. The MISC is now for "miscellaneous" stuff like rent payments, prizes, awards, or medical and health care payments. If you won $1,000 in a local sweepstakes, you’re looking at a 1099-MISC.

The Silver Lining: Deductions

If the W-2 is a steady, safe harbor, the 1099 is a mountain trek. It's harder, but you get to keep more of what you find if you're smart.

Because you are treated as a business, you only pay tax on your profit, not your total income. This is where people win. If you earned $50,000 on 1099s but spent $10,000 on a new laptop, office rent, and travel, you only pay tax on $40,000.

W-2 employees generally can't deduct their work shoes or their commute. 1099 workers can deduct a portion of their home internet, their software subscriptions (like Adobe or Microsoft 365), and even a portion of their housing costs if they have a dedicated home office.

The IRS is strict here. A "home office" can't be your kitchen table where you also eat dinner. It has to be a regular and exclusive place of business. If you try to claim your entire living room because you occasionally check emails on the couch, you're asking for trouble.

What Happens if You Don't Get Your Form?

Don't celebrate just yet.

If it's February 15th and you haven't received a 1099 you were expecting, you need to reach out to the client. Sometimes they have the wrong address. Sometimes they're just lazy.

The IRS already has a copy of that form. If you file your taxes without including that income, their automated system will flag the discrepancy. Usually, you’ll get a letter called a CP2000 a year or two later. It will list the "missing" income and calculate the tax, plus interest, plus penalties. It’s never a small amount.

If the client is unresponsive, just report the income anyway. You don't technically need the physical form to file; you just need to know the amount you were paid. Use your bank statements. They don't lie.

Estimated Quarterly Payments: The Trap

This is where most first-time freelancers fail.

If you expect to owe more than $1,000 in taxes for the year, the IRS wants their money in four installments. These are called Estimated Quarterly Tax Payments.

- April 15

- June 15

- September 15

- January 15 (of the following year)

If you wait until April to pay the full year's tax on your 1099 income, the IRS will hit you with an "underpayment penalty." It’s basically interest they charge you for "borrowing" the money that should have been theirs months ago.

Common Mistakes to Avoid

Honestly, 1099 taxes aren't that bad once you get a system. But people trip up on the same few things every single year.

Mixing personal and business money. If you are getting 1099s, open a separate bank account. Even a basic checking account will do. When a client pays you, put it in the "business" account. Pay yourself a "salary" by transferring money to your personal account. This makes bookkeeping a breeze and keeps the IRS happy if they ever come knocking.

Forgetting about state taxes. Most people focus so hard on the federal 1099 tax form that they forget their state wants a cut too. Depending on where you live (looking at you, California and New York), that can be a significant extra chunk.

Ignoring the 1099-B. If you sold crypto or stocks, you'll get a 1099-B. These are notoriously messy. They often don't show your "basis" (what you originally paid for the asset). If you don't provide that basis, the IRS might assume your cost was $0 and try to tax you on the entire sale price.

Real-World Action Steps

If you’ve got a stack of 1099s sitting on your desk, here is exactly what you need to do right now.

First, organize by type. Separate your NECs (work) from your INTs (bank interest). They go in different places on your tax return. Your business income goes on Schedule C, while your interest goes on Schedule B.

Second, hunt for expenses. Go through your bank statements for the last year. Look for every single dollar you spent to earn that 1099 income. Did you pay for a LinkedIn Premium account? Did you buy pens? Did you pay a subcontractor to help you? Every dollar you find is a dollar you don't have to pay taxes on.

Third, check for backup withholding. Look at Box 4 on your 1099. Usually, it's $0. But if a client didn't have your correct Taxpayer Identification Number (TIN), they might have withheld 24% of your pay. If they did, make sure you claim that on your return so you get credit for what's already been paid.

The 1099 tax form is just a tool for transparency. It's the government's way of keeping everyone honest in a gig-driven economy. Treat it with respect, keep your receipts, and always—always—set aside 30% of every check. You’ll sleep a lot better in April.

✨ Don't miss: Kamala Harris Net Worth 2024: What Most People Get Wrong

Immediate Next Steps:

- Download a digital copy of every 1099 you receive and save them in a folder labeled "2025 Tax Year."

- Match the amounts on the forms against your own invoices or bank deposits to ensure the payer didn't make a typo.

- If you find an error, contact the issuer immediately to request a "Corrected" 1099 before you file.