You've probably looked at that two-page form and felt a slight headache forming. It's understandable. When it comes to the 1040 schedule e instructions, most people just want to get through it without the IRS knocking on their door. Rental real estate, royalties, partnerships—it all lands here.

It’s messy.

Basically, Schedule E is where you tell the government how much money you made (or lost) on "passive" activities. But here's the kicker: the IRS doesn't always agree with your definition of passive. If you’re a landlord, you’re dealing with a specific set of rules that can either save you thousands or trigger an agonizing audit. Most of the mistakes happen because people treat their rental property like a hobby rather than a business.

Why 1040 Schedule E Instructions Feel Like a Maze

The IRS isn't exactly known for clear prose. When you dig into the official 1040 schedule e instructions, you'll find a lot of talk about "at-risk rules" and "passive activity loss limitations."

Essentially, the government wants to make sure you aren't using a rental property loss to wipe out your entire salary from your 9-to-5 job. There are limits. If you make over a certain amount, those losses might be "suspended," meaning you can't use them this year. You have to carry them forward. It feels like losing money twice, honestly.

The Real Estate Professional Loophole

One thing the standard instructions don't emphasize enough is the "Real Estate Professional" status. Most people are "passive" investors. That means they can only deduct up to $25,000 in losses against their other income, and even that phases out once your Adjusted Gross Income (AGI) hits $100,000.

But if you spend more than 750 hours a year in real estate? Everything changes.

Suddenly, those losses are non-passive. You can use them to offset your spouse's high-salary W-2 income. It’s a massive tax shield. But you have to document every single minute. The IRS hates this one trick, seriously. They will ask for your logs. If you don't have a calendar showing those hours, they’ll disqualify the whole thing in a heartbeat.

Breaking Down the Income Categories

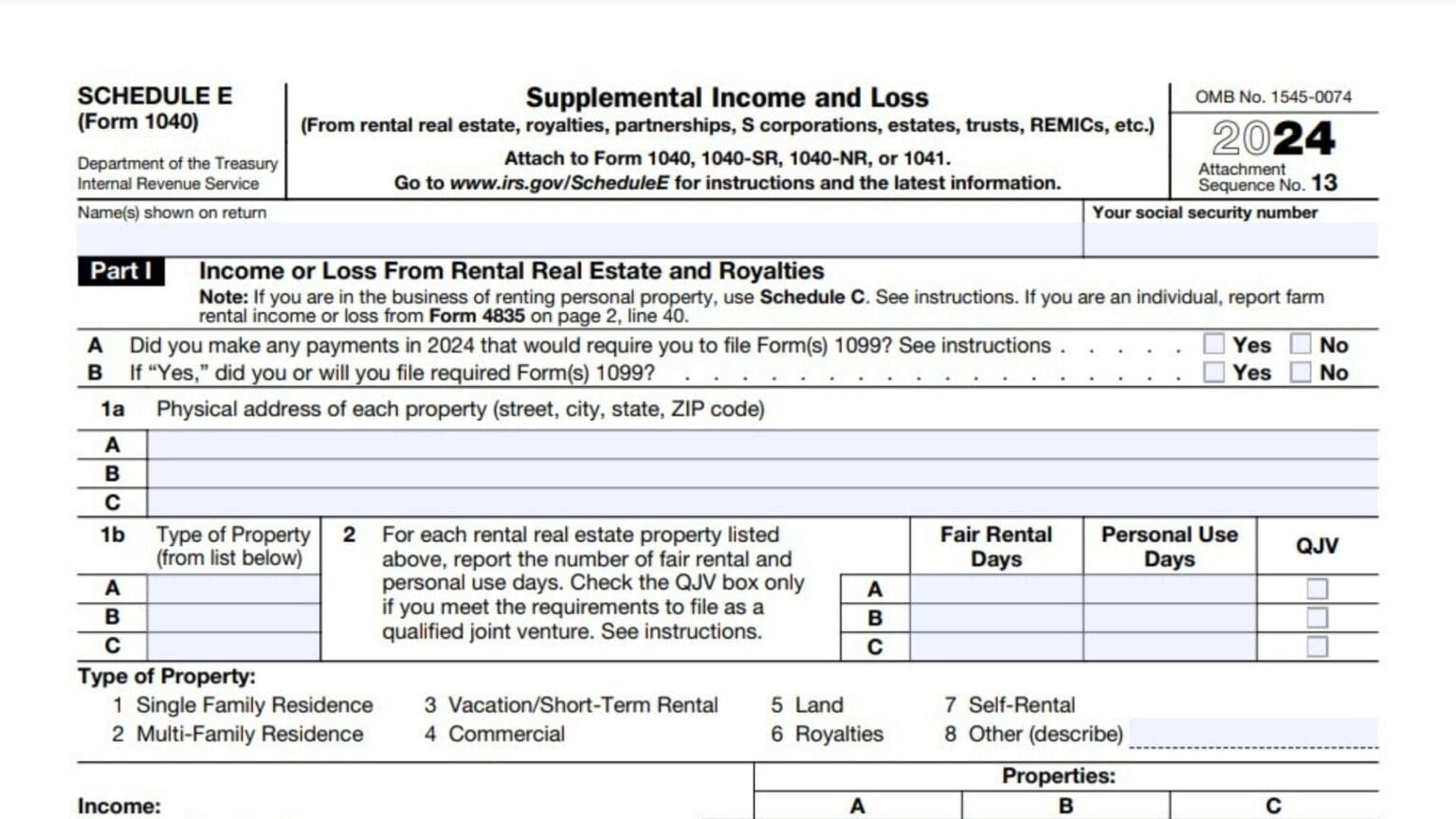

When you’re filling out the form, you’ll see columns for different properties. Property A, Property B, Property C.

If you have more than three properties, you’re going to need multiple Schedule Es. It gets redundant fast. You have to categorize the type of property—is it a single-family home? A multi-family? Vacation rental? This matters because of the "14-day rule."

If you live in your rental for more than 14 days (or 10% of the days it’s rented), it’s considered a personal residence. You can't claim a loss. You can only deduct expenses up to the amount of income you made. Essentially, you can't use your beach house to lower your tax bill if you’re hanging out there every other weekend.

What Counts as Rental Income?

It’s not just the monthly check.

- Advance rent: If a tenant pays you January's rent in December, it counts as income in December.

- Security deposits: Usually not income—unless you keep it because they trashed the place. Then it’s income the moment you decide to keep it.

- Tenant-paid expenses: If your tenant pays the water bill directly but it's legally your responsibility, that’s technically income to you. Then you deduct the expense. It's a wash, but it has to be on the form.

The Expense Game: What You Can Actually Deduct

This is where the 1040 schedule e instructions get interesting. Everyone knows about mortgage interest and property taxes. Those are easy.

But what about the "other" stuff?

Travel is a big one. You can deduct the cost of driving to the property to collect rent or do repairs. But you can't deduct the drive from your house to your regular job. Only the business miles count.

Repairs vs. Improvements. This is the biggest battlefield in tax law.

A repair keeps the property in good condition. You fix a leaky faucet. You replace a broken window pane. You can deduct the full cost this year. An improvement adds value or extends the life of the property. You replace the whole roof. You put in a brand-new HVAC system. You can't deduct that all at once. You have to "depreciate" it over 27.5 years.

It’s frustrating to spend $10,000 on a roof and only get a $363 deduction this year. But that's the law.

Depreciation: The "Phantom" Expense

Depreciation is the best thing about Schedule E. It’s an expense that doesn't require you to actually write a check. The IRS assumes the building is wearing out. So, you get to deduct a portion of the building's value every year.

Note: You can't depreciate land. Land doesn't wear out. You have to look at your property tax bill or an appraisal to figure out how much of your purchase price was for the "structure" versus the "dirt."

Avoiding the Red Flags

The IRS uses automated systems to flag "abnormal" returns. If your Schedule E shows $50,000 in income and $49,000 in "Other Expenses," a human is probably going to look at that.

Be specific. Don't dump everything into the "Other" category.

Management fees are a common deduction. If you pay a company 10% to deal with your tenants, put that in the "Management Fees" line. Professional fees (like paying an accountant to read these 1040 schedule e instructions for you) go on the "Legal and Professional" line.

Partnerships and S-Corps (Part II)

The back of Schedule E is for "Pass-Through" entities. If you own a piece of a business through a K-1, this is where it goes.

It’s a different world back here. You aren't listing individual expenses. You’re just taking the final number from your K-1 and plugging it in. The trick is making sure your "basis" is high enough to take the loss. If you haven't actually put enough money into the business, the IRS won't let you claim the loss on your personal return.

It’s a "pay to play" system.

🔗 Read more: Rite Aid Alturas CA: What’s Actually Happening With the Only Big Pharmacy in Modoc County

Actionable Steps for Tax Season

To get through your filing without losing your mind, follow these steps:

- Separate the land value immediately. Look at your closing statement or tax assessment. If your property cost $300,000 and the land is worth $50,000, your depreciation is based on $250,000. Divide that by 27.5. That’s your annual "magic" deduction.

- Categorize your "Repairs." If you did a lot of work this year, look at each invoice. If it’s "maintenance" (painting, fixing things), it's a current deduction. If it's a "capital improvement" (new floors, new appliances), it goes on a depreciation schedule.

- Check your participation level. Most landlords meet the "Active Participation" standard. This is easier than being a "Real Estate Professional." It just means you made management decisions—like approving tenants or picking the paint color. This allows you to claim up to $25,000 in losses if your income is low enough.

- Keep a mileage log. Don't guess in April. Use an app or a notebook. "Drive to Home Depot for Property A" is a legitimate business expense.

- Reconcile your 1099s. If you use a property manager, they will send you a 1099-MISC or 1099-K. Ensure the "Gross Rent" on your Schedule E matches that form exactly. If they don't match, the IRS computers will flag it automatically.

Understanding the 1040 schedule e instructions isn't about memorizing the tax code; it's about organization. If you have a clean paper trail for every dollar that left your account, you've already won half the battle. Taxes are only scary when you're guessing.

Verify your totals, double-check your depreciation math, and make sure you aren't claiming rental losses on a vacation home you used for half the summer.