Moving six figures across the Atlantic isn't like buying a latte. When you're looking at 100k gbp to usd, you aren't just checking a ticker on a screen; you're playing a game where a single percentage point determines whether you keep or lose $1,300. Most people just open their banking app, hit "send," and effectively set a pile of cash on fire. It's painful to watch.

Rates move. Fast.

If you look at the historical data from the Bank of England or the Federal Reserve, the GBP/USD pair—often called "The Cable" by traders—is one of the most volatile major crosses in the world. Politics, interest rate hikes by the FOMC, and even a bad retail sales report from the UK High Street can send your 100,000 pounds swinging by thousands of dollars in an afternoon.

The Interbank Rate vs. The "Real" World

Here is the thing. That price you see on Google? That is the interbank rate. It’s what banks charge each other. You? You aren't a bank.

Retail banks like Barclays or Wells Fargo usually bake a 3% to 5% spread into the conversion. If the mid-market rate says your £100,000 is worth $130,000, your bank might actually only give you $126,100. They won't call it a fee. They'll just call it "the exchange rate." It's a hidden tax on the uninformed. Honestly, it’s kind of a scam, but it’s legal because they disclose the rate before you click confirm. Most people just don't do the math.

📖 Related: Influence: The Psychology of Persuasion Book and Why It Still Actually Works

Why 100,000 Pounds is the Magic Number

At this volume, you move out of the "tourist" category and into the "private client" category. This is where you actually have leverage.

When you're converting small change, specialized apps like Wise or Revolut are great. They're transparent. But when you hit the 100k mark, you should be talking to a dedicated currency broker. Companies like Currencies Direct or OFX often provide "firm quotes" or "limit orders" for larger sums. This means you can tell them, "Hey, don't trade my money until the pound hits 1.31." They’ll sit on it until the market hits your target. You can't really do that with a standard debit card.

Timing the Market Without Losing Your Mind

You've probably heard of "Buying the Dip." In the world of 100k gbp to usd, timing is everything, but perfect timing is impossible.

The British Pound has been through a blender lately. Between post-Brexit adjustments and the shifting monetary policy of the Bank of England (BoE), the currency is sensitive. If the BoE keeps rates higher for longer than the Fed, the pound gets stronger. If the US economy shows "sticky" inflation, the dollar flexes its muscles and your 100k buys fewer greenbacks.

👉 See also: How to make a living selling on eBay: What actually works in 2026

It’s a tug-of-war.

A lot of experts, including analysts at Goldman Sachs and Morgan Stanley, often disagree on where the Cable is headed. One week they're bullish on the pound; the next, they're screaming about a dollar rally. For a regular person moving 100k, trying to "day trade" this move is a recipe for a stomach ulcer.

Forward Contracts: The Safety Net

If you’re buying a house in Florida or South Carolina and you need that money in three months, you’re at the mercy of the market. Unless you use a forward contract. This basically lets you "lock in" today's rate for a future transfer. You might pay a small premium, but it buys you certainty. If the pound crashes tomorrow, you still get the rate you agreed on. It’s insurance. Pure and simple.

The Tax Man is Always Watching

Let’s talk about the boring stuff that actually matters. Taxes and regulations.

✨ Don't miss: How Much Followers on TikTok to Get Paid: What Really Matters in 2026

Moving £100,000 into a US bank account will trigger a "red flag." Not a bad one, but a legal one. Under the Bank Secrecy Act, US banks have to report any deposit over $10,000 to FinCEN (the Financial Crimes Enforcement Network). This is Form 114, also known as the FBAR, if you’re a US person holding that money abroad.

- You must prove the source of funds.

- Anti-Money Laundering (AML) checks are mandatory.

- Expect your bank to ask for bank statements or a bill of sale if the money came from a property.

If you try to "structure" the payments—sending ten chunks of £10,000 to avoid the $10k reporting limit—you will get caught. That’s actually a crime in itself. Just be transparent. It’s way easier.

How to Actually Execute the Transfer

- Compare three sources. Check your high-street bank (for a laugh, mostly), check a digital-first platform like Wise, and call a specialist FX broker.

- Verify the total cost. Don't just look at the fee. Subtract the final USD amount you'll receive from the amount you'd get at the mid-market rate. That's your true cost.

- Check the limits. Some apps have daily transfer limits. For 100k, you might need to go through an identity verification process that takes 48 hours. Don't wait until the day you need the money to start this.

- Consider the "receiving" fee. Some US banks charge a "wire incoming fee" ($15-$30). It's small, but annoying.

The difference between a bad rate and a great rate on 100k gbp to usd is often the cost of a decent second-hand car. Don't be lazy with your math.

Actionable Steps for the Big Move

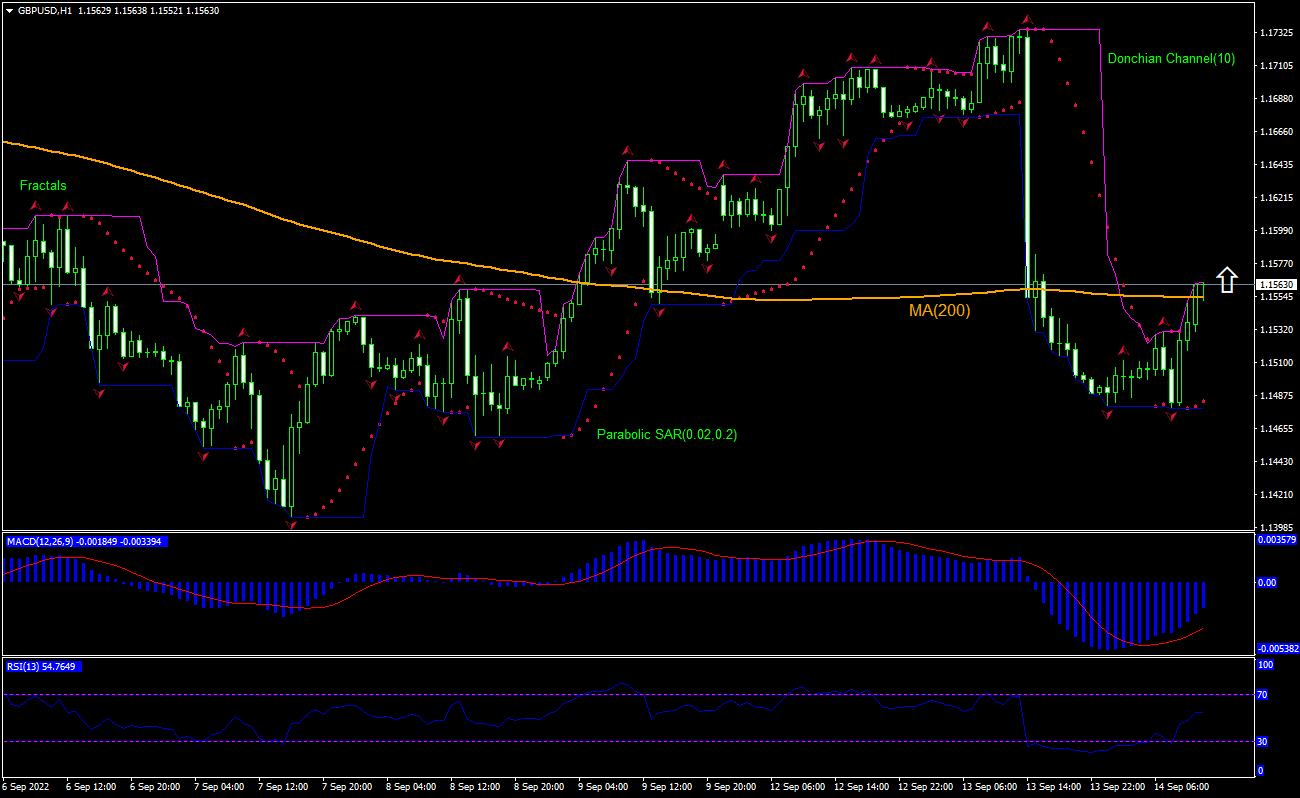

Start by opening a multi-currency account. This allows you to hold the GBP and wait for a "spike" in the exchange rate without being forced to convert immediately. Monitor the "Relative Strength Index" (RSI) of the GBP/USD pair; if it’s over 70, the pound might be overbought and due for a drop. If it’s under 30, it might be a great time to buy dollars.

Sign up for "rate alerts." Most major platforms let you set a ping for when the rate hits a certain level. Once it hits, move. Don't second-guess or wait for "just five more pips." Take the win and secure the funds. Finally, always ensure the platform you use is FCA regulated in the UK and FinCEN registered in the US. If they aren't, run the other way.