Markets are weird right now. If you woke up and checked the 10 year treasury note rate today, you probably saw a number staring back at you that feels a bit stubborn. As of January 17, 2026, the yield on the benchmark 10-year note is hovering around 4.23%.

It’s a bit of a head-scratcher.

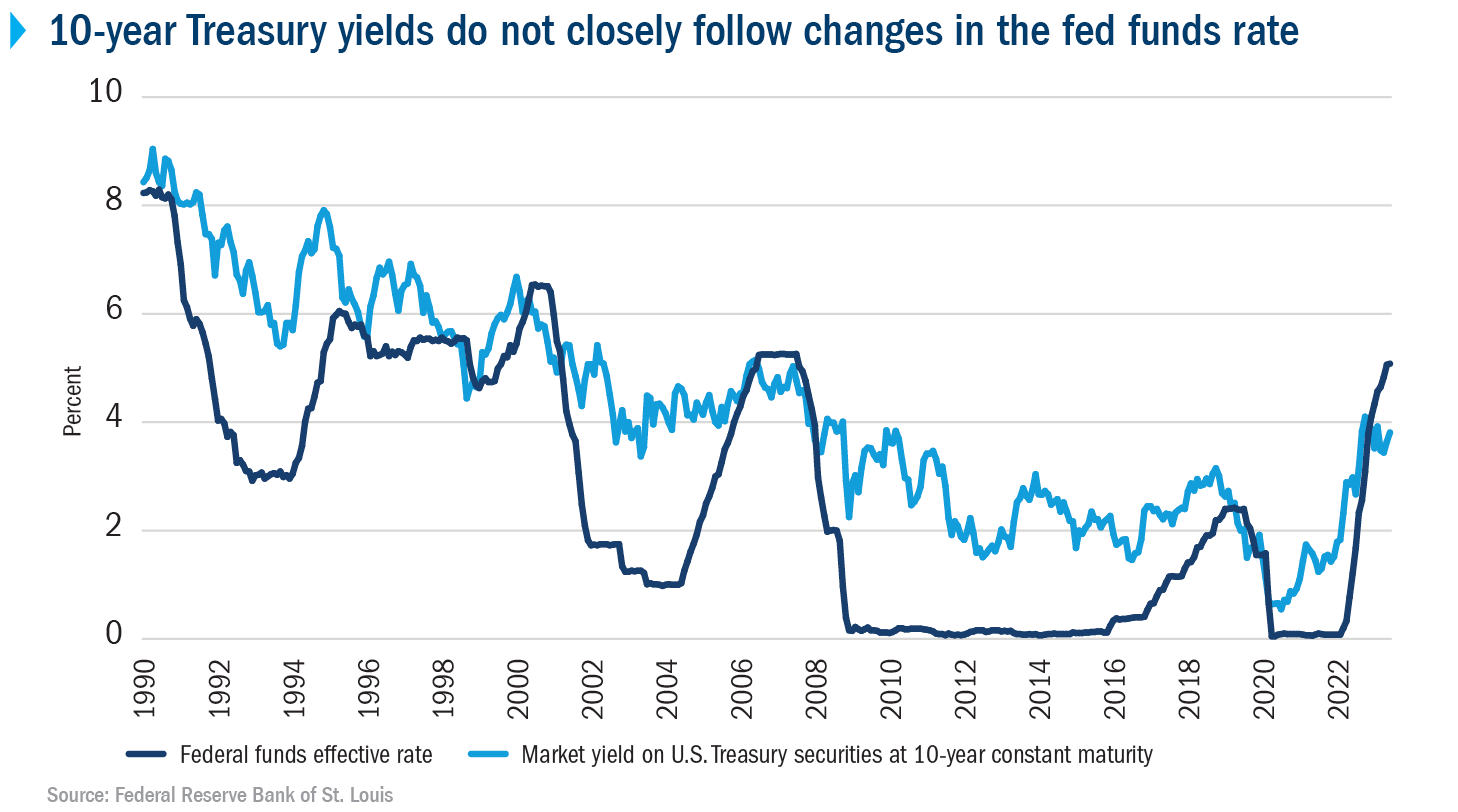

The Federal Reserve has already spent months trimming away at the federal funds rate. Usually, when the Fed cuts, yields should slide down the slide like a kid at recess. But instead, the 10-year is just... hanging out. It actually ticked up from the 4.16% and 4.18% levels we saw earlier this week. Honestly, it feels like the bond market is having a completely different conversation than the one happening in Washington.

The weird tug-of-war behind the 10 year treasury note rate today

Why isn't the rate lower? You’ve got to look at the "term premium." Basically, investors are demanding more "hazard pay" for locking their money up for a decade. Even though inflation is cooling—the December CPI print came in at a manageable 2.7%—there’s this nagging fear that it could bounce back.

Think about it this way.

✨ Don't miss: General Electric Stock Price Forecast: Why the New GE is a Different Beast

The economy is surprisingly beefy. Real GDP is humming along with forecasts pointing toward 2.5% to 2.8% growth for 2026. When the economy is this strong, nobody wants to rush into safe-haven bonds. They want to be in stocks or private credit. So, to get people to buy the 10-year, the government has to offer a higher rate.

Then you have the political side of things. We’re seeing a lot of chatter about the "One Big Beautiful Bill Act" and its permanent tax extensions. Tax cuts usually mean more government borrowing. More borrowing means a flood of new Treasury supply. When there’s more supply than people want to buy, prices drop and yields—you guessed it—go up.

What the "experts" are actually saying (and where they disagree)

If you ask five different economists where the 10 year treasury note rate today is headed, you’ll get six different answers. It’s a mess.

- The Optimists: Folks like David Mericle at Goldman Sachs are leaning into a "jobless growth" narrative. They think productivity (thanks, AI) will keep growth high but inflation low. They’re betting the 10-year eventually settles closer to 3.25% or 3.5% by the end of the year.

- The Skeptics: Over at J.P. Morgan, Michael Feroli has been pretty vocal about the Fed maybe staying on hold longer than people want. If the Fed doesn't keep cutting, there's no floor to pull the 10-year down.

- The "Surprise" Crowd: Some analysts are even floating the idea that the Treasury Department might start manipulating the "back end" of the curve by issuing fewer long-term bonds to force rates down and help the housing market.

It’s all speculation until the data hits the tape, but the 4.2% level seems to be the "sticky" point for now.

🔗 Read more: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

Why this number actually matters for your wallet

Most people don't trade bonds for fun. You’re likely looking at the 10 year treasury note rate today because you want to know if you can finally refinance your mortgage or if your car loan is going to stay expensive.

Here is the cold truth: mortgage rates are married to the 10-year yield. They aren't identical twins, but they definitely live in the same house. With the 10-year at 4.23%, 30-year fixed mortgages are still hovering around 6.1% to 6.4%.

If you were hoping for 5% mortgage rates by Valentine's Day, you might want to lower your expectations. We need to see the 10-year drop below 3.8% before the housing market really feels a "thaw."

The yield curve isn't "broken" anymore

For years, we talked about the "inverted yield curve"—where short-term rates were higher than long-term ones. It was the recession omen everyone loved to hate.

💡 You might also like: Exchange rate of dollar to uganda shillings: What Most People Get Wrong

Well, that’s over.

The 10-year is now comfortably above the 2-year note (which is sitting around 3.59%). This "steepening" is actually a sign of a "normal" economy. It means investors expect the future to be busier than the present. It’s good for bank profits, which is why you’ve seen financial stocks doing okay lately, but it’s annoying for anyone trying to borrow long-term money.

Real-world moves you should consider right now

Since the 10 year treasury note rate today is staying high, you’ve actually got some decent opportunities if you have cash sitting around.

- Stop ignoring your "boring" savings. If you have money in a big-name bank earning 0.01%, you’re literally lighting money on fire. High-yield savings accounts and 1-year CDs are still hitting that 3.5% to 4% range.

- Bond ladders are back in style. Instead of trying to guess if rates will fall in June or September, some people are "laddering"—buying bonds that mature at different times. It smooths out the risk.

- Watch the Fed's January 28 meeting. This is the big one. If the Fed sounds "hawkish" (meaning they’re worried about inflation), the 10-year could easily spike toward 4.5%. If they sound "dovish" (worried about jobs), we could see a slide toward 4.0%.

The 10-year isn't just a number on a screen; it's the "gravity" of the financial world. When it’s high, it pulls everything down—home prices, stock valuations, and your ability to breathe easy on your credit card bill. Right now, gravity is still pretty strong.

Next Steps for Your Portfolio:

Check your exposure to "duration." If you own long-term bond ETFs like VGLT or TLT, a rising 10-year rate means the value of those funds will drop. Conversely, if you're looking to lock in income for the next decade, 4.23% is the highest "guaranteed" return we've seen in weeks. Review your high-interest debt first; if your credit card is at 24%, no 4% Treasury note is going to save your balance sheet.