You’re probably looking at your savings account and feeling a little insulted. Let’s be real. Most big banks are still offering pennies for your loyalty, even when the Federal Reserve has kept the cost of money pretty high. That’s why 1 year certificate of deposit rates have suddenly become the talk of the town again. It’s not just for your grandma anymore. Honestly, if you have cash sitting in a standard checking account, you’re basically letting inflation eat your lunch every single day.

A CD is essentially a deal. You tell the bank, "Hey, hold onto my five grand for exactly twelve months," and in exchange, they give you a guaranteed return that usually beats out any standard savings vehicle. No market volatility. No checking your portfolio at 2 AM. Just a steady, predictable climb.

What’s Actually Happening with 1 year certificate of deposit rates Right Now?

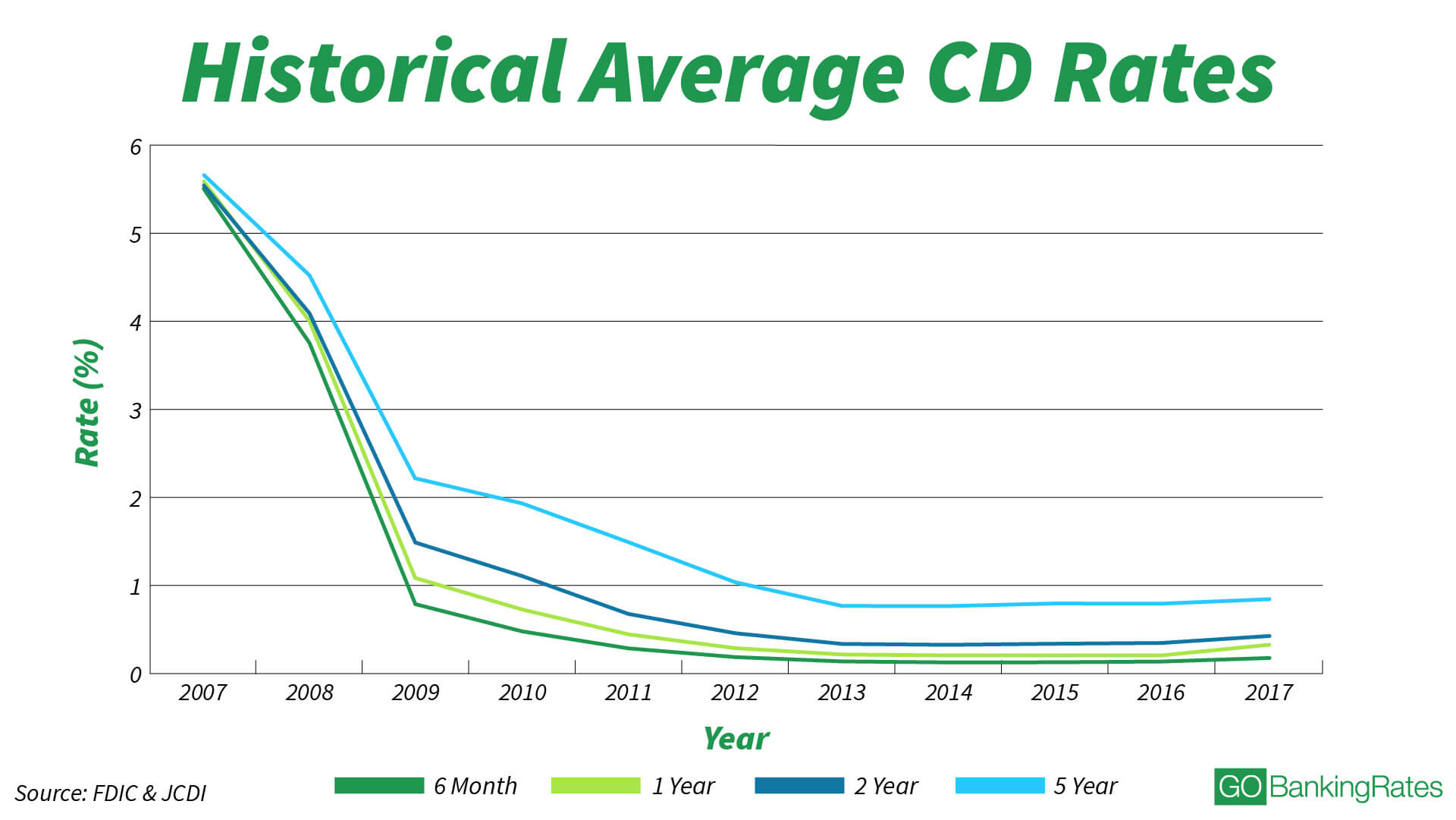

The market is in a weird spot. For a long time, interest rates were basically zero, and CDs were about as exciting as watching paint dry. But things changed. Fast. As the Fed hiked rates to fight inflation, banks had to start competing for your deposits. We saw a massive surge where 1-year CDs were hitting 5% or even 5.5% APY at online-only banks like Marcus by Goldman Sachs or Ally Bank.

But here is the kicker. Rates don't stay up forever.

When you look at the landscape in early 2026, we are seeing a "plateau" effect. Some experts, like those at Bankrate or Investopedia, have noted that while the peak might be behind us, the rates are still historically high compared to the last decade. It’s a game of chicken. Do you lock in a rate now, or do you wait? If the Fed starts cutting rates, that 5% you see today might be a 3.5% by next Christmas.

It’s about timing. Or, more accurately, it’s about not missing the window.

The Myth of the "Big Bank" Superiority

You might think your local Chase or Wells Fargo branch is the safest place for your money. Sure, they have nice buildings and ATMs on every corner. But if you look at their 1 year certificate of deposit rates, you’ll often find they are shockingly low—sometimes under 1%. Why? Because they don't need your money. They have millions of customers who just leave their cash there out of habit.

If you want the real meat, you have to look at credit unions and online banks. Organizations like Alliant Credit Union or Synchrony Bank don't have the overhead of physical branches, so they pass those savings on to you in the form of higher yields. It’s a trade-off. You lose the ability to walk into a lobby and complain to a teller, but you gain hundreds of dollars in interest.

How the Math Actually Works (The Simple Version)

Let’s say you have $10,000.

💡 You might also like: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

In a standard savings account at 0.01%, you’d make a whopping $1 after a year. That’s a cup of coffee if you have a coupon.

If you find 1 year certificate of deposit rates hovering around 5.00% APY, that same $10,000 nets you $500. That is a car payment. That’s a weekend getaway. That’s real money for doing absolutely nothing other than being patient.

But there’s a catch. There’s always a catch.

Early Withdrawal Penalties (EWP) are the boogeyman of the CD world. If you lock that money up for a year and then decide three months later that you desperately need a new transmission for your car, the bank is going to take a bite out of your earnings. Usually, it’s about three to six months of interest. You won't lose your initial deposit (the principal), but you’ll lose the "profit" you worked so hard to secure.

Strategy: The "Barbell" vs. The "Ladder"

Most people just dump money into a single CD and call it a day. That’s fine. It works. But if you want to be smart about it, you should look into CD Ladders.

Imagine you have $20,000. Instead of putting it all into one 1-year CD, you split it up.

- $5,000 in a 3-month CD

- $5,000 in a 6-month CD

- $5,000 in a 9-month CD

- $5,000 in a 12-month CD

Every three months, a "rung" of your ladder matures. You get access to $5,000. If rates have gone up, you reinvest it at the new, higher rate. If you need the cash, it’s right there. It gives you the high yields of 1 year certificate of deposit rates but with the "liquidity" (fancy word for "spendability") of a regular account.

Then there’s the Barbell Strategy. This is where you put half your money in very short-term CDs and the other half in long-term CDs (like 5 years). It’s a bit more aggressive and assumes you think rates are going to fluctuate wildly. For most of us? The 1-year mark is the "sweet spot." It’s long enough to get a great rate but short enough that you don't feel like your money is trapped in a dungeon for half a decade.

📖 Related: Modern Office Furniture Design: What Most People Get Wrong About Productivity

Is It Safe?

Yes. Period.

As long as the bank is FDIC-insured (or NCUA-insured for credit unions), your money is backed by the full faith and credit of the U.S. government up to $250,000 per depositor, per institution. If the bank goes belly up, you still get your money. It is arguably the safest investment on the planet, tied with Treasury bonds.

What to Watch Out For in the Fine Print

Not all CDs are created equal. You’ll see "No-Penalty CDs" popping up lately. These are tempting. They let you break the term early without paying that nasty fee I mentioned earlier. The trade-off? The interest rate is usually a bit lower. It’s basically "flexibility insurance."

Then there are Callable CDs. Stay away from these unless you really know what you’re doing. A callable CD means the bank has the right to "call" or cancel the CD if interest rates drop. So, if you locked in a great 5.5% rate and then the market rates tank to 2%, the bank can say, "Just kidding, here’s your money back," leaving you stuck trying to reinvest in a low-rate environment. You want a Non-Callable CD. You want to be the one in control of the timeline.

Real World Example: The "Found Money" Effect

I knew a guy—let’s call him Mark—who kept $50,000 in a "high yield" savings account that he hadn't checked in three years. He thought he was doing great. When we actually looked at the statement, the bank had lowered his rate to 0.50% without him noticing. He was making $250 a year.

He moved that money into a 1-year CD at 5.15%.

Suddenly, he was making $2,575.

He literally "found" over $2,300 just by moving his money from one digital bucket to another. It took him twenty minutes of paperwork online. That is the power of paying attention to 1 year certificate of deposit rates.

👉 See also: US Stock Futures Now: Why the Market is Ignoring the Noise

Inflation: The Silent Killer

We have to talk about the elephant in the room. If inflation is at 3% and your CD is paying 5%, you are technically only "growing" by 2% in terms of purchasing power. But look at the alternative. If you leave that money in a 0.05% account, you are effectively losing nearly 3% of your wealth every year.

CDs aren't meant to make you a millionaire overnight. They aren't Nvidia stock. They are a defensive play. They are about wealth preservation. They ensure that your "safe money"—the money for a house down payment, a wedding, or an emergency fund—doesn't shrink while you're not looking.

Why 2026 is a Turning Point

We are entering a phase where the "easy money" from high interest rates might start to dry up. The economy is showing signs of cooling. If the labor market softens, the Fed will likely drop rates to stimulate growth.

When that happens, 1 year certificate of deposit rates will be the first to fall.

This creates a "lock-in" opportunity. If you grab a 1-year CD today, you are guaranteed that rate for the next 12 months, regardless of what happens to the economy. If the world goes sideways and rates plummet to 1% in six months, you’ll still be sitting pretty on your 5% contract. It’s one of the few times the consumer actually has the upper hand against the banking system.

Steps to Take Right Now

- Audit your current accounts. Look at your "Statement APY." If it starts with a zero followed by a decimal point, you’re losing money.

- Shop the "Boutiques." Check sites like Raisin or Ken Tumin’s DepositAccounts. These aggregators show you the obscure credit unions in Iowa or online banks in Utah that are offering "teaser" rates to get new customers.

- Check the minimums. Some of the best 1 year certificate of deposit rates require a $10,000 or $25,000 minimum deposit. Others, like Capital One 360, often have no minimum at all.

- Decide on your "Buffer." Don’t put every cent you own into a CD. Keep your "oh crap" money in a liquid savings account. Only commit the cash you are certain you won't need for the next 365 days.

- Turn off "Auto-Renewal." This is a classic bank trap. When your CD matures, many banks will automatically roll it into a new CD at the current rate, which might be terrible. Make sure you set an alert to move the money manually once the term ends.

The reality is that 1 year certificate of deposit rates are a tool. Like any tool, they only work if you actually pick them up and use them. Stop letting the big banks profit off your inertia. Spend the afternoon comparing yields, lock in a solid rate, and let the bank do the heavy lifting for once.

Next Steps for Your Money

- Compare Top Rates: Visit a reputable comparison site like Bankrate or CNBC Select to see the current top 10 list for 1-year terms.

- Verify Insurance: Ensure any institution you choose has the FDIC logo on their site.

- Calculate the Yield: Use a simple compound interest calculator to see exactly how much you'll have in 12 months after taxes.

- Open the Account: Most online applications take less than 10 minutes and only require a Social Security number and a linked bank account for the initial transfer.