You’re standing at the Sangster International Airport in Montego Bay. The sun is beating down, you’ve got a suitcase full of swimsuits, and you’re looking at a glowing LED board that says 1 USD to Jamaica dollar is worth significantly less than what Google told you on the plane. It’s a gut-punch. Honestly, if you don't understand how the Jamaican Dollar (JMD) breathes, you’re basically just handing away your vacation budget to middle-men who bank on your confusion.

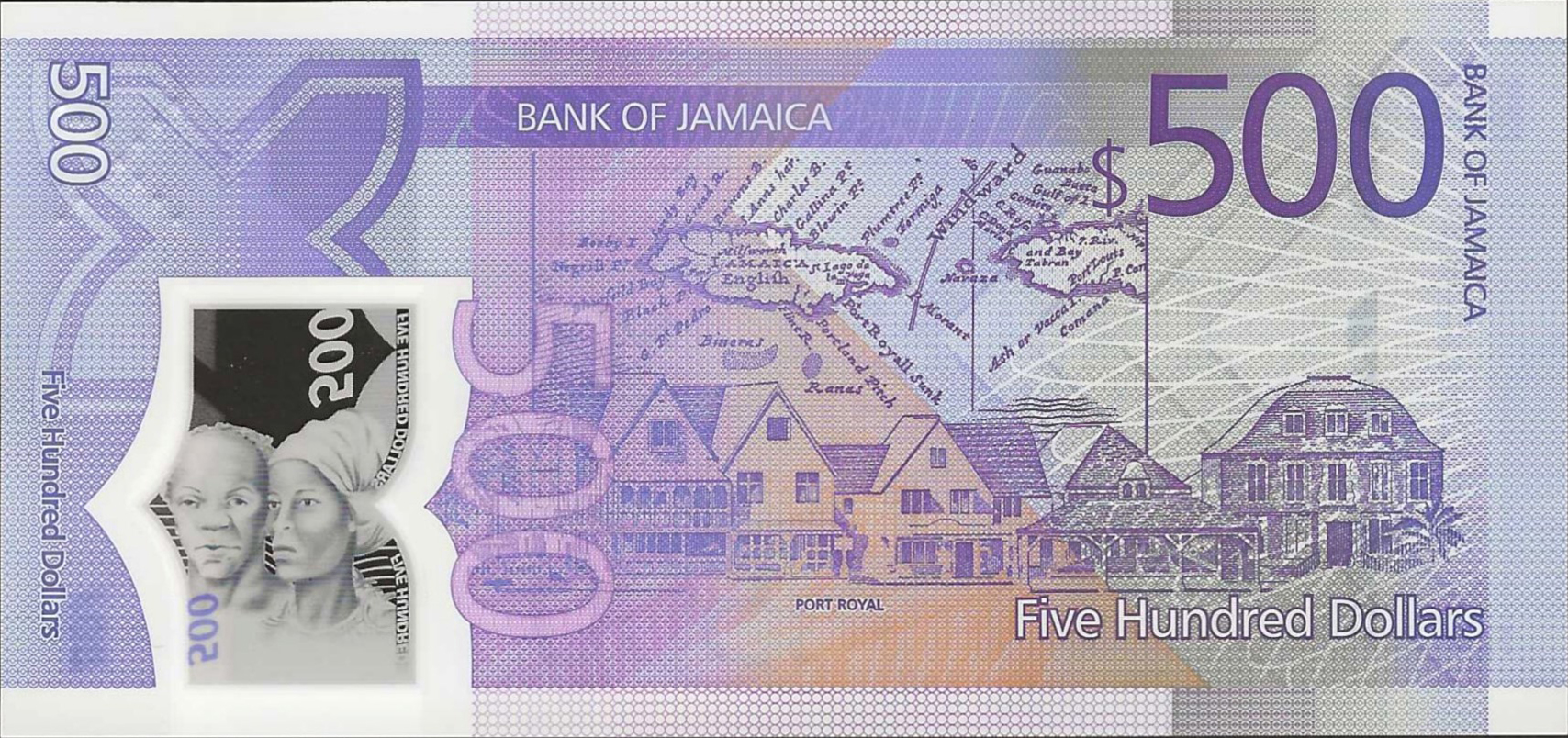

The Jamaican currency market isn't a static thing. It’s a "managed float." This means the Bank of Jamaica (BOJ) lets the market decide the value, but they’ll jump in with a "B-FXITT" intervention if things get too crazy.

Currency isn't just numbers. It’s history. It’s the price of a beef patty in Half Way Tree. It’s the cost of a gallon of gas in Negril. When you look at the exchange rate, you aren't just looking at a conversion; you’re looking at the economic pulse of an island that imports almost everything it consumes.

Why the 1 USD to Jamaica Dollar Rate Moves Every Single Day

Markets hate silence. In Jamaica, the exchange rate is driven by a massive tug-of-war between earners and spenders. On one side, you have the tourism sector and people sending "remittances" back home from places like New York or London. These folks are selling USD. On the other side, you have the manufacturing and energy sectors. They need USD to buy oil and raw materials. When the oil price goes up globally, the demand for USD in Kingston spikes.

The rate slides.

Currently, the rate hovers in a range that would have seemed impossible twenty years ago. Back in the late 70s, the Jamaican dollar was actually stronger than the US dollar. Hard to believe, right? But decades of inflation, IMF structural adjustments, and shifting trade balances have led us to where we are now. Usually, the rate sits somewhere between $150 and $160 JMD for a single greenback, though that fluctuates based on "liquidity"—which is just a fancy way of saying how much cash is actually sitting in the vaults on any given Tuesday.

The Tourism Trap and the "Street" Rate

You’ll hear people tell you that you can just use US dollars everywhere in Jamaica. Technically? Sure. Most tourist traps—sorry, "attractions"—will gladly take your Benjamins. But look closely at the receipt. If the official bank rate is 155, the gift shop might "generously" offer you 140. You just paid a 10% convenience fee without even realizing it.

That’s a lot of missed Red Stripes.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

Local businesses have to go to the bank to exchange those US dollars back into JMD to pay their staff and light bills. They pass that hassle on to you. If you’re staying in a high-end resort in Rose Hall, you might not care. But if you’re eating at a roadside jerk shack or taking a route taxi, you need the local "blue money."

Understanding the "Spread" (How Banks Make Their Cut)

When you check the 1 USD to Jamaica dollar rate on a site like XE or Bloomberg, you’re seeing the "mid-market" rate. This is the "real" value, but it’s not the price you get. Banks and cambios use a "buy" and "sell" rate.

- The Buy Rate: What the bank gives you for your US dollars.

- The Sell Rate: What the bank charges you to get US dollars back.

The difference is the spread. In Jamaica, this spread can be quite wide compared to more "stable" currencies like the Euro or the Yen. Why? Risk. The Jamaican dollar is a volatile currency. If a bank buys a million USD today and the JMD crashes tomorrow, they lose out. So, they build in a cushion.

If you want the best bang for your buck, you stay away from airport kiosks. They have the highest overhead and the worst rates. Commercial banks like NCB (National Continental Bank) or Sagicor are better, but the absolute winners are usually the licensed "Cambios." These are small, regulated exchange houses you’ll find in shopping plazas. They live and die by high volume and low margins, so they usually offer a rate much closer to the official BOJ daily weighted average.

Why Does the Rate Jump in December?

It’s actually kinda predictable. Jamaica has a "demand cycle." In the weeks leading up to Christmas, the JMD usually comes under pressure. Why? Because every shopkeeper on the island is importing toys, electronics, and ham to stock their shelves. They need US dollars to pay their suppliers in Miami and China.

Then, January hits.

The tourists arrive in droves for the winter season. They bring USD. The supply of foreign exchange goes up, and the rate often stabilizes or "revalues" slightly. It’s a rhythmic dance. If you’re a business owner in Kingston, you learn to time your currency purchases like a surfer timing a wave at Boston Beach. If you get it wrong, your profit margins evaporate.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

The Role of the Bank of Jamaica (BOJ)

Governor Richard Byles and his team at the BOJ don't just sit around. They have a mandate to keep inflation low. In Jamaica, inflation is almost perfectly correlated with the exchange rate because the island imports so much food and fuel. If the 1 USD to Jamaica dollar rate jumps from 155 to 165 in a week, the price of bread in the supermarket goes up the following Monday.

To stop this, the BOJ uses "B-FXITT." This is an auction system. When the BOJ thinks the JMD is falling too fast, they’ll "sell" millions of US dollars from the national reserves into the banking system to soak up excess JMD. It’s like putting a thumb on the scale.

They also use interest rates. If they raise the "policy rate," it makes holding Jamaican dollars more attractive for investors. If you can get a 7% or 8% return on a JMD deposit, maybe you won't be so quick to swap it for a US dollar account that pays 1%.

Practical Realities: Cash vs. Card

A lot of travelers ask if they should even bother with cash. Here’s the deal: Jamaica is still very much a cash-heavy society once you leave the gated resorts.

Credit cards are fine for the big stuff—hotels, car rentals, high-end dinners. Most of these transactions will be processed in JMD at your bank’s internal rate. Check your bank's "foreign transaction fee" before you go. If your bank charges 3%, you’re losing money on every swipe.

But for the "real" Jamaica? You need cash.

- Route Taxis: These are the backbone of island transport. They have set JMD prices. If you try to pay in USD, expect to be overcharged.

- Markets: Whether it's the Coronation Market in Kingston or a craft market in Ochi, JMD is king.

- Tips: While locals appreciate USD, getting a tip in JMD is often more practical for them because they don't have to spend their lunch break standing in a bank line to exchange it.

How to Calculate the Rate in Your Head

You don't need a PhD in math. Just think in chunks. If the rate is roughly 150 to 1, then $10 USD is $1,500 JMD. $20 USD is $3,000 JMD.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

A quick trick:

Multiply the US amount by 1.5, then add two zeros.

$4 USD x 1.5 = 6.

Add two zeros = $600 JMD.

It’s not perfect, but when you’re trying to figure out if that coconut is overpriced while standing in the humidity, it’s close enough to keep you from getting fleeced.

The Psychological Impact of Devaluation

For an outsider, a shifting exchange rate is a curiosity or a minor vacation expense. For a Jamaican, it’s a constant weight. The "slide of the dollar" is a frequent topic on talk radio and in the letters to the editor in the Gleaner.

When the JMD weakens, the "standard of living" takes a hit. People who earn a fixed salary in Jamaican dollars find their purchasing power shrinking month by month. This is why many Jamaicans try to save in USD if they can. It’s seen as a "hedge."

There’s a certain pride in the national currency, but there’s also a pragmatic realization that the US dollar is the global reserve. In times of global uncertainty—like a pandemic or a hurricane—people flock to the USD. This "flight to safety" is what causes those sudden, sharp devaluations that make headlines.

Actionable Steps for Managing Your Money

Don't just walk into a situation blind. If you're dealing with 1 USD to Jamaica dollar conversions, you need a strategy.

- Check the BOJ Daily Rate: Go straight to the source. The Bank of Jamaica website posts the "Weighted Average Selling Rate" every afternoon. This is your benchmark. If a cambio is offering you something significantly lower, walk away.

- Use Local ATMs: Usually, the best way to get JMD is to use a local ATM (like Scotiabank or NCB). The machine will give you JMD at a decent bank rate. Just be aware of the "ATM fee" and your own bank’s "out-of-network" fee. Take out large amounts at once to minimize these hits.

- Avoid Airport Exchanges: I’ve said it before, but it bears repeating. Unless you literally have zero cash for a taxi, wait until you get into town to exchange your money.

- Pay in the Local Currency: If a restaurant gives you a bill with both USD and JMD totals, almost always choose the JMD option if you’re paying by card. Your home bank’s conversion rate is nearly always better than the "Dynamic Currency Conversion" the merchant's terminal uses.

- Spend Your JMD Before You Leave: Converting JMD back into USD is a losing game. You’ll pay the spread again, and many US banks won't even accept JMD coins or small bills. Use your remaining JMD to buy coffee or rum at the duty-free shop before you fly out.

The Jamaican economy is resilient, and the currency reflects that. It’s a complex, living system influenced by everything from the price of bauxite to the number of cruise ships docking in Falmouth. By understanding the mechanics behind the 1 USD to Jamaica dollar rate, you aren't just saving a few bucks—you're navigating the island with a level of respect and savvy that most visitors never achieve.

Stop thinking about it as "funny money." It’s the lifeblood of the island. Treat it with the same tactical mindset you’d use for any other business transaction. Calculate your costs, find the right exchange partners, and keep an eye on the BOJ's moves. That’s how you handle the Jamaican dollar like a pro.