If you just Googled 1 US dollar to Guyana dollar, you probably saw a number like 209.43. Or maybe it was 214.95. Honestly, depending on which tab you have open, the number is dancing all over the place.

It's frustrating. You want to know how much cash you’ll actually have in your pocket in Georgetown, but the "mid-market rate" is a bit of a polite fiction. In the real world—the world of Guyanese cambios, commercial banks, and bustling America Street—the price of a greenback is a moving target.

Guyana's economy is growing faster than almost anywhere else on Earth right now. We're talking double-digit GDP growth fueled by offshore oil. But interestingly, the Guyana Dollar (GYD) hasn't just shot up in value like you might expect. It’s a managed float. Basically, the Bank of Guyana keeps a tight grip on the steering wheel to make sure things don't get too wild.

What is the current exchange rate for 1 US dollar to Guyana dollar?

As of mid-January 2026, the rate is hovering. If you look at the Bank of Guyana's weighted average, you're looking at approximately $208.50 GYD to $1 USD.

But wait. If you walk into a commercial bank like Republic Bank or GBTI, you’ll see two different numbers.

💡 You might also like: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

- The Buying Rate: This is what they give you for your US dollars. It’s usually lower, around $205 to $213.

- The Selling Rate: This is what you pay them to get US dollars. This is higher, often pushing $216 to $218.

That gap? That’s the "spread." It’s how the banks make their lunch money, and if you aren't careful, it'll eat into your budget.

Why the rate varies so much between providers

It’s all about the "cambios." In Guyana, currency exchange isn't just a bank thing. There are licensed non-bank cambios all over the place. Some are in malls, like the Foodmaxx Cambio at Giftland. Others are standalone shops in the city.

The bigger banks often have the most "official" rates, but they also have the most paperwork. If you’re a tourist, you might find that a licensed cambio in a hotel or a shopping district offers a slightly better rate just to stay competitive. Just avoid the guys on the street. Seriously. Stick to the licensed spots.

The Oil Boom and Your Pocketbook

Why is the 1 US dollar to Guyana dollar rate so stable despite the massive oil finds? You'd think with billions of USD flowing in, the Guyana dollar would become super valuable.

📖 Related: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Economics is weird.

If the GYD became too strong too fast, it would kill off other industries like sugar, rice, and gold mining because their exports would become too expensive for the rest of the world to buy. This is what economists call "Dutch Disease." To prevent this, the government and the central bank manage the supply of US dollars in the local market.

- The 2026 Forecast: The IMF and World Bank are looking at a 23% GDP growth for Guyana this year.

- Inflation: It's a factor. Prices for food and rent in Georgetown are climbing, which means even if the exchange rate stays the same, your US dollar doesn't "feel" as strong as it did three years ago.

Real-World Tips for Exchanging Currency in Guyana

If you're landing at Cheddi Jagan International (GEO) or Eugene F. Correia (OGL), don't change all your money at the airport. You'll get a "convenience" rate. It's rarely the best deal.

Where to go for the best rates

- Commercial Banks: Safest bet, but usually involves lines. Bring your passport. They are strict about ID.

- Licensed Cambios: Places like Confidential Cambio or Sarjoo’s often offer competitive rates and faster service.

- Hotels: Most big hotels like the Marriott or Pegasus will change money for guests, but the rate is usually a few points worse than a bank.

A note on the "Street Market"

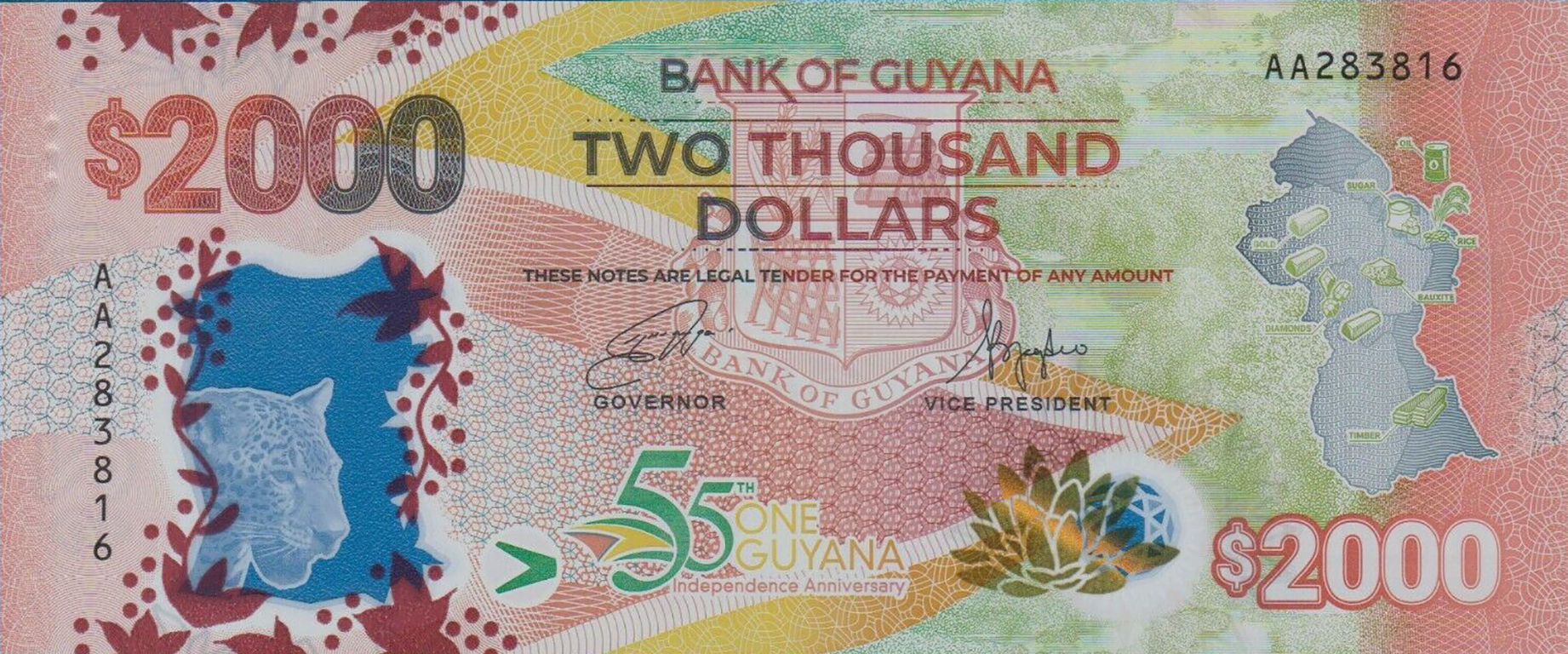

You will see people in downtown Georgetown offering to change money. Don't do it. It’s not just about the rate; it’s about safety. Foreigners have been targeted after visible cash transactions in public areas. Plus, there’s always the risk of counterfeit notes. It's just not worth the extra two dollars you might save.

👉 See also: Are There Tariffs on China: What Most People Get Wrong Right Now

Is the Guyana Dollar going to get stronger?

Most experts, including those looking at IDB (Inter-American Development Bank) data, suggest the GYD will remain relatively stable against the USD throughout 2026. The government wants stability to attract more investment.

However, "stability" is a relative term. In the last week alone, we saw the rate move from $200 to $209 on some international trackers. This is often due to "liquidity" issues—basically, how many US dollars are actually available in the banks at that exact moment. If the big oil companies need to pay local taxes or contractors, they dump USD into the market, and the rate shifts.

Actionable Steps for Your Money

If you need to convert 1 US dollar to Guyana dollar right now, here is exactly what you should do to get the most value:

- Check the "Weighted Average" first: Go to the Bank of Guyana website. This gives you the baseline. If a cambio is offering you much less than this, walk away.

- Use ATMs strategically: Scotiabank and GBTI ATMs often accept international cards (Visa/Mastercard). You'll get a decent rate, but your home bank might charge a foreign transaction fee. Check that first.

- Pay in USD where possible: Many hotels and high-end restaurants in Georgetown actually list prices in USD. Sometimes, their internal exchange rate is better than the bank's buying rate.

- Keep your receipts: If you have Guyanese dollars left over when you leave, you often need the original exchange receipt to change them back into USD at the bank.

Don't over-rely on the $209 figure you see on currency apps. That’s a "mid-market" price for banks trading millions, not for a person buying a beer or paying a taxi driver in Stabroek Market. Plan for a rate closer to $210 or $212 when buying, and don't be surprised if the seller wants $216. That's just the way the market breathes in Guyana right now.