Money is weird. You cross an invisible line in the ocean, and suddenly that green paper in your wallet isn't just a buck anymore—it's a whole different animal. If you're standing in the middle of Half Way Tree in Kingston right now, 1 US dollar in Jamaica is hovering somewhere around $158 Jamaican dollars (JMD).

That sounds like a lot, right? Like you’re basically a high roller. Honestly, it’s not that simple. People see the "150-to-1" ratio and think they’re going to live like royalty on a shoestring budget. But if you try to buy a sandwich with a single US dollar, you’re going to be very, very hungry.

The exchange rate is a moving target. According to the Bank of Jamaica (BOJ), the rate as of mid-January 2026 sits at roughly $158.40 for selling and $156.93 for buying. It’s been a bumpy ride lately. Between the recovery from Hurricane Melissa and the global shifts in tourism, the "J-dollar" has been fighting for its life.

The Reality of What 1 US Dollar Actually Buys

Let's get real for a second. What does $158 JMD actually get you on the street?

If you walk into a local "cook shop" or a convenience store, you're not getting a meal. Not even close. You've basically got enough for a small bottle of Wata (the local brand) or maybe a single Jamaican patty if you find a really cheap spot—though even those are pushing $250-$300 JMD these days.

Here is the breakdown of the "One Dollar" purchasing power in 2026:

- A small bag of plantain chips: Usually around $100-$150 JMD. You’re safe here.

- A single bus fare: A one-way ticket on local transport is roughly $150 JMD. You can get from point A to point B, but you're not getting back.

- A banana: Not a bunch. Just one. From a street vendor.

- Public restroom access: In some busy hubs, a "contribution" for the facilities will run you exactly about this much.

It's kinda wild when you think about it. Back in the 1970s, the Jamaican dollar was actually stronger than the US dollar. Hard to imagine now. Since then, inflation has taken its toll. The IMF and local analysts like those at Jamaica Play have noted that while inflation is stabilizing around 3.5% to 5% this year, the "cost of living" hasn't exactly plummeted.

Why the Rate Keeps Shifting

You’ve probably wondered why the rate doesn't just stay put. The Bank of Jamaica uses a "managed float" system. Basically, they let the market decide what the currency is worth, but they jump in with their own reserves if things get too crazy.

Last year was a mess. Hurricane Melissa did a number on the island’s infrastructure, and when the agriculture sector takes a hit, food prices skyrocket. When food prices go up, the value of your money goes down. It's a domino effect.

The BOJ Governor, Richard Byles, has been pretty vocal about maintaining a 4% to 6% inflation target. They’ve been holding interest rates steady at around 5.75% to keep the J-dollar from sliding into the abyss. If you’re a tourist, a weaker JMD is great—it means your US dollars go further. But if you’re living in Spanish Town and trying to buy imported flour? It’s a nightmare.

The "Tourist Trap" Exchange Rate

Here is a pro tip: never, ever exchange your money at the airport.

If the official rate for 1 US dollar in Jamaica is $158, the airport kiosks will probably try to give you $140. They call it a convenience fee; I call it a robbery. Even some hotels will offer a "fixed" rate that is significantly lower than the daily market rate.

- Use a Cambio: These are authorized exchange bureaus found in most towns. They usually have the most competitive rates.

- ATM Withdrawals: Most Jamaican ATMs will give you JMD at the bank’s daily rate, though you’ll pay a transaction fee.

- Pay in JMD: If a shop quotes you a price in USD, they are almost certainly using an exchange rate that favors them, not you.

The Dual Currency Myth

Jamaica isn't officially a dual-currency country, but in places like Montego Bay or Negril, you’d never know it. Most vendors will happily take your "greenbacks."

But here’s the catch. If you pay for a $500 JMD item with a $5 USD bill, you’re basically overpaying by nearly $300 JMD. Most street vendors treat the US dollar as a 1-to-100 or 1-to-120 currency because the math is easier for them. They aren't trying to scam you (usually); they’re just hedging against the hassle of going to the bank to exchange it.

Honestly, if you're traveling, keep a mix. Use USD for big things like tours or hotel tips, but keep a wad of JMD for the roadside jerk chicken. It'll save you a fortune over a week-long trip.

Looking Ahead: The Future of the JMD in 2026

The forecast for the rest of 2026 looks... okay. Not amazing, just okay. The Bank of Jamaica is expecting the economy to rebound by about 1% to 3% this fiscal year.

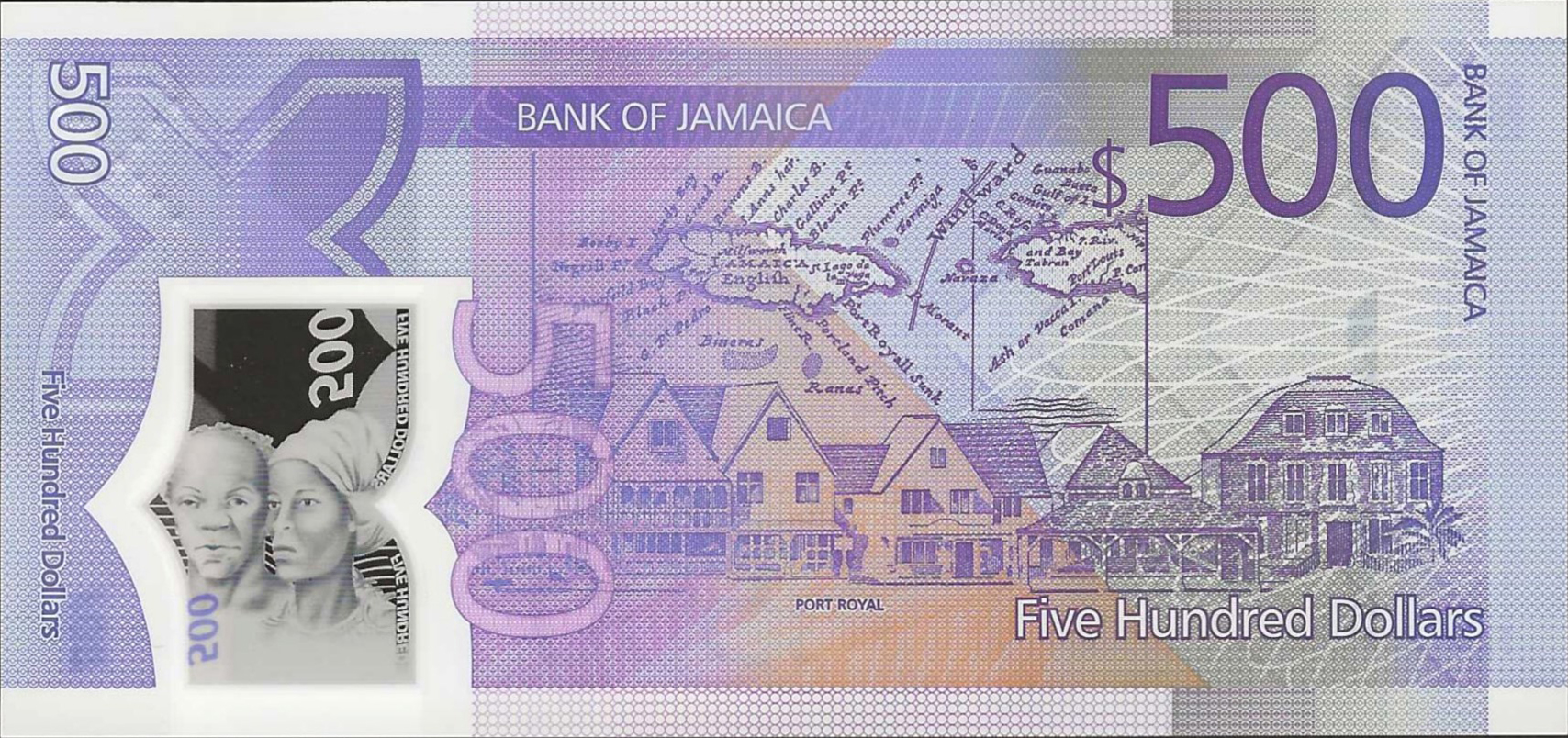

There's a lot of talk about the "JAM-DEX"—Jamaica's central bank digital currency. The government is pushing hard for people to go digital to reduce the cost of printing physical notes. Whether that actually helps the average person buy more with their dollar remains to be seen.

For now, the value of 1 US dollar in Jamaica remains a symbol of the island's economic struggle and its resilience. It’s a tiny amount of money that carries a huge amount of history.

Actionable Insights for Managing Your Money in Jamaica

If you are planning to deal with currency in Jamaica this year, don't fly blind. Knowledge is literally money in this context.

- Download a Converter App: Use something like XE or OANDA that works offline. Check the "Mid-Market" rate every morning so you know if a vendor is lowballing you.

- Carry Small JMD Denominations: The $100, $500, and $1000 notes are your best friends. Trying to break a $5000 JMD note at a small shop is a great way to make enemies.

- Watch the "GCT": General Consumption Tax is 15%. Often, prices are quoted without it. That $1 USD item might suddenly cost $1.15 at the register.

- Notify Your Bank: If you’re using a card, make sure they know you’re in Jamaica. Nothing kills a vibe faster than a frozen debit card at a restaurant in Ocho Rios.

The exchange rate is more than just a number on a screen. It's the pulse of the island's economy. Whether it’s $155 or $165, the trick is knowing how to make every cent count. Keep your eyes on the official BOJ daily releases and you'll be fine.

👉 See also: Alexander Brothers West Nyack: What Most People Get Wrong

Smart Move: Before you head out, check the local newspaper, The Gleaner, or the Bank of Jamaica's official website for the "Weighted Average Selling Rate." That is the gold standard for what your dollar is worth today.