Money is weird. One day you’re buying a loaf of bread for a few coins, and the next, those same coins feel like they’ve shrunk in your pocket. If you’re looking at 1 rand to usd, you’re looking at a fraction of a fraction. It’s a tiny, decimal-heavy number that usually starts with a zero and a point. But honestly, that little number is basically a heartbeat monitor for the entire South African economy. It’s influenced by everything from gold mines in Johannesburg to interest rate hikes in Washington D.C.

The South African Rand (ZAR) is famously volatile. Traders love it because it moves fast. Tourists love it because their Dollars go a long way. But for locals? It’s a rollercoaster. When you check the conversion rate for 1 rand to usd, you aren't just seeing a price. You're seeing the result of global geopolitics, commodity prices, and investor fear clashing in real-time.

The Brutal Reality of the Exchange Rate

Right now, the Rand is what economists call a "pro-cyclical" currency. That's a fancy way of saying it does great when the world is happy and terrible when everyone is panicked. When the global economy is booming, investors take risks. They put money into "emerging markets" like South Africa. This pumps up the Rand. But the second there’s a whisper of a recession or a war, everyone pulls their money back into the safe, boring US Dollar.

The Dollar is the king. It’s the world’s reserve currency. So, when you compare 1 rand to usd, the Rand is almost always the underdog.

Historically, the Rand was much stronger. Back in the 70s and early 80s, the Rand was actually worth more than the Dollar. Hard to imagine, right? Decades of political shifts, internal energy crises (like the infamous "load shedding" blackouts managed by Eskom), and changing mining outputs have pushed the value down. Today, you’re usually looking at a rate where one Rand gets you about five or six cents.

Why 1 Rand to USD Changes While You Sleep

Why does it move so much? It’s not just one thing. It’s a messy soup of factors.

✨ Don't miss: Cox Tech Support Business Needs: What Actually Happens When the Internet Quits

First, there’s the "Carry Trade." This is a strategy where big investors borrow money in a currency with low interest rates (like the Yen or sometimes the USD) and invest it in a currency with high interest rates, like the Rand. Because the South African Reserve Bank usually keeps rates high to fight inflation, the ZAR becomes a target for these investors. If the US Federal Reserve decides to raise their own rates, the "gap" closes. Investors suddenly don't find the Rand as attractive. They sell. The Rand drops.

Then you’ve got commodities. South Africa is a treasure chest. Gold, platinum, coal, manganese—the country has it all. When the global price of platinum goes up, the Rand usually follows. This is because foreign companies have to buy Rands to pay for those minerals. More demand for Rands equals a stronger currency.

- Commodity Prices: Gold and Platinum are the big ones here.

- Political Stability: Any news out of Pretoria regarding policy changes or elections sends the ZAR into a tailspin or a rally.

- US Inflation: If the US has high inflation, the Dollar might weaken, making the 1 rand to usd rate look "better" even if South Africa didn't actually do anything differently.

- Energy Issues: It’s no secret that power outages hurt the economy. When factories can't run, they can't export. No exports? No demand for the currency.

The Psychological Gap

There is a massive difference between the "nominal" value and the "purchasing power" value. If you look at the 1 rand to usd rate and see $0.05, you might think a Rand is worthless. But inside South Africa, that Rand still has utility.

Economists use something called the Big Mac Index to explain this. It compares the price of a McDonald's burger across different countries. Often, the Rand is "undervalued" according to this index. This means that while $1 might only get you 18 or 19 Rand on the market, that 19 Rand can often buy more goods and services in Cape Town than $1 can buy in New York.

It’s a weird paradox. The currency looks weak on a trading screen, but the actual "stuff" you can get for it locally tells a different story. This is why South Africa remains a top-tier destination for digital nomads and retirees from the US. Their Dollars feel like superpowers.

🔗 Read more: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

How to Track the Rate Without Going Crazy

If you're a business owner or someone sending money home, checking the 1 rand to usd rate every hour is a recipe for a headache. The ZAR is liquid. It’s one of the most traded emerging market currencies in the world. This means it reacts to news instantly.

A strike at a mine in the North West province? The Rand drops. A positive report from a credit rating agency like Moody's or S&P? The Rand jumps.

Most people use Google Finance or XE for quick checks. But remember, those are "mid-market" rates. They are the average between what people are buying and selling for. When you actually go to a bank or a kiosk at the airport, you’ll get a worse rate. They take a cut. Sometimes a big one.

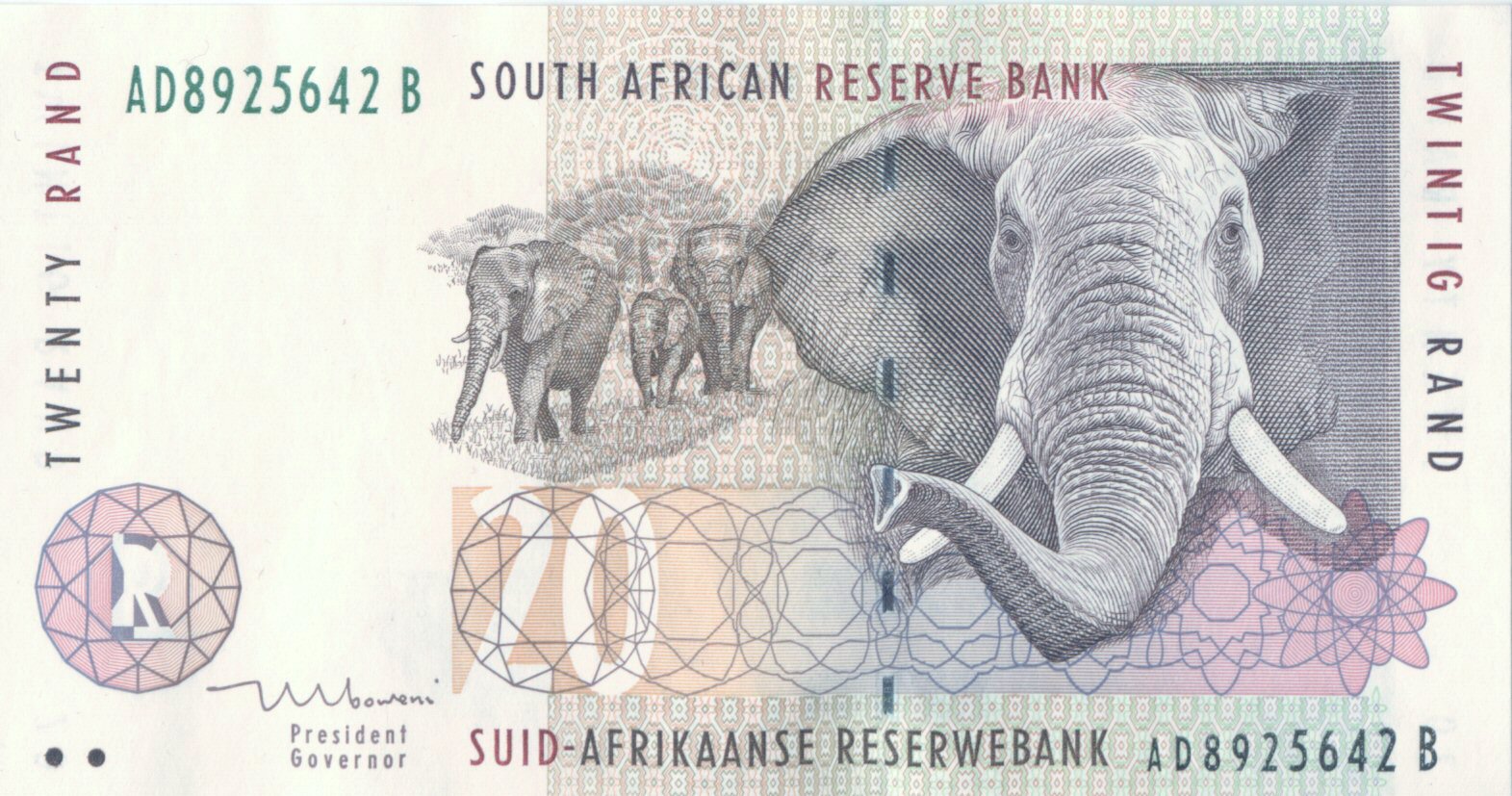

The Role of the South African Reserve Bank (SARB)

Unlike some countries that try to "peg" their currency to the Dollar, South Africa lets the Rand float. The SARB, led by Governor Lesetja Kganyago, generally doesn't intervene to prop up the currency. They care more about inflation. Their job is to keep price increases between 3% and 6%. If the Rand crashes too hard, it makes imports (like oil) more expensive, which drives up inflation. That’s when the Reserve Bank steps in—not by buying Rands, but by raising interest rates to make the currency more attractive to hold.

Real World Examples of the Shift

Think back to 2001. The Rand hit a then-record low of about R13.80 to the Dollar. People panicked. Then, it recovered significantly. Fast forward to the COVID-19 pandemic in 2020, and it blew past R19.00.

💡 You might also like: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Every time it hits a new low, the "1 rand to usd" conversion becomes a talking point at dinner tables across the country. It affects the price of petrol. It affects the price of the new iPhone. It even affects the price of bread, because farmers need imported fuel and fertilizer.

Practical Steps for Managing Currency Risk

If you are dealing with 1 rand to usd conversions regularly, stop gambling on the daily "spot" price.

- Use Forward Contracts: If you're a business and you know you need to pay a US supplier in three months, you can "lock in" a rate today. This protects you if the Rand decides to take a dive.

- Avoid Airport Kiosks: They are notorious for "spreads" (the difference between buying and selling) that can be as high as 10-15%. Use a multi-currency card or a local ATM instead.

- Watch the Fed: Honestly, watching the US Federal Reserve is often more important than watching South African news. The Dollar side of the pair is the "heavy" side. When the US sneezes, the Rand catches a cold.

- Diversify Your Savings: If you're living in South Africa, having some assets in a "hard" currency like USD or Euro is a classic hedge against local volatility.

The Rand is a survivor. It has lived through political transitions, global financial crises, and internal strife. While the 1 rand to usd rate might look small, it’s a reflection of a complex, resource-rich nation trying to find its footing in a global market that favors the giants.

Don't get discouraged by the decimals. Understanding why they move is the first step to making smarter financial decisions, whether you’re planning a trip to the Kruger National Park or moving capital across borders. The rate is never static, and in that movement, there is always opportunity if you know where to look.

Check the current "mid-market" rate on a reliable platform like Reuters or Bloomberg before making any large transfers. Always compare the "effective rate" (the rate after fees) rather than the "headline rate" you see on Google. If you are moving large sums, look into specialized currency brokers rather than traditional retail banks; they often shave off a percentage of the spread which saves you thousands in the long run.