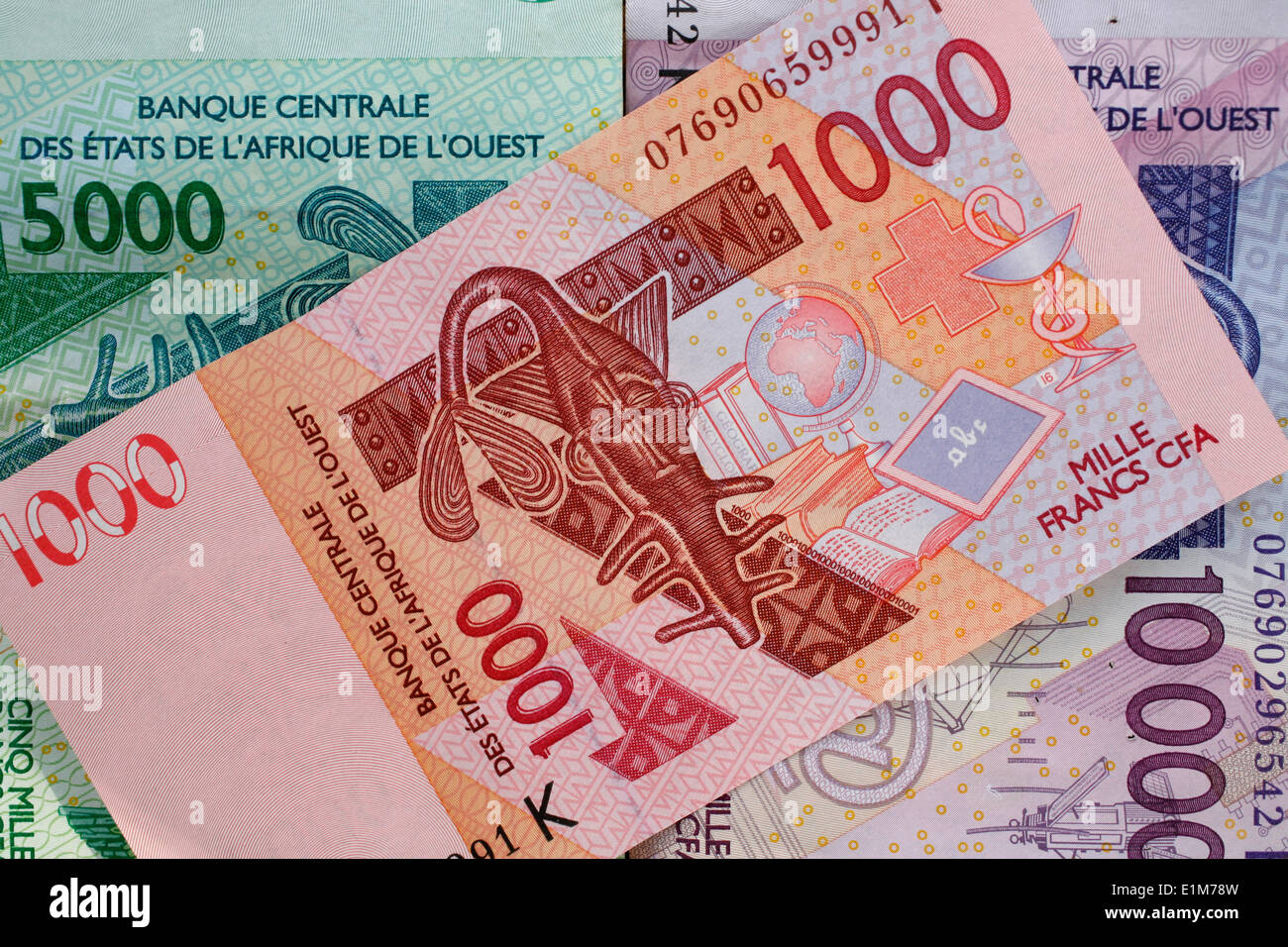

Money is weird. One minute you’re looking at a crisp greenback in a New York deli and the next you’re trying to figure out how many bundles of West African money it takes to buy a sack of rice in Dakar or Abidjan. If you’ve ever Googled 1 dollar us en francs cfa, you probably just wanted a quick number. Maybe 600? Maybe 615? But honestly, that number is a moving target that tells a much bigger story about colonial history, French bank vaults, and the volatile whims of global oil prices.

The exchange rate isn't just a digit on a screen.

It’s a lifeline.

For a merchant in Benin importing electronics or a family in Togo receiving a Western Union transfer from a cousin in Maryland, the fluctuations between the USD and the CFA franc determine whether they can afford to eat meat this week or if they’re sticking to basic grains.

The fixed peg frustration

You have to understand that the CFA franc (both the XOF used in West Africa and the XAF used in Central Africa) doesn't float freely like the British Pound or the Japanese Yen. It is hard-pegged to the Euro. Back in the day, it was tied to the French Franc, but when Europe went collective with its currency, the CFA followed suit.

This means when you look for 1 dollar us en francs cfa, you aren't really looking at the relationship between Washington and Dakar. You are looking at a three-way dance between the US Federal Reserve, the European Central Bank in Frankfurt, and the regional banks in Dakar and Yaoundé.

$1 \text{ USD}$ to CFA is essentially just $(1 \text{ USD} / 1 \text{ EUR}) \times 655.957$.

That number—655.957—is the "eternal" rate. It doesn't change. Ever. Because the French Treasury guarantees the convertibility, the CFA stays glued to the Euro. So, if the Euro gets punched in the mouth by a bad economic report out of Germany, the CFA loses value against the US Dollar too. It’s like being tethered to a giant; if the giant trips, you hit the ground.

Why the rate feels so different on the street

Ever noticed how Google says the rate is 602, but the guy at the "bureau de change" in Bamako only wants to give you 580? That's the "spread." Banks and informal money changers take a cut. Usually, it's about 2% to 5% depending on how much they think they can get away with.

Also, there is a weird psychological barrier. For decades, people mentally calculated 1 dollar us en francs cfa as roughly 500 francs. It was easy math. Two dollars? A thousand francs. But those days are mostly gone. Ever since the global inflation spikes and the US dollar's "king" status in the mid-2020s, we’ve seen the rate hover much closer to 600 and sometimes even flirt with 650.

💡 You might also like: Converting Saudi Riyal to USD: Why the Rate Never Actually Changes

It makes everything expensive.

West African countries import a massive amount of fuel and medicine. These things are priced in dollars. When the dollar goes up against the CFA, the price of a taxi ride in Cotonou goes up. It’s a direct link. You feel the Federal Reserve's interest rate hikes in the heat of a West African afternoon.

The ECO and the future of your money

People have been talking about killing off the CFA franc for years. They want to replace it with a new currency called the ECO. The idea is to break the umbilical cord to France. If that happens, the way we calculate 1 dollar us en francs cfa will fundamentally break.

Without the Euro peg, the currency would likely devalue immediately.

Experts like Kako Nubukpo, a famous Togolese economist, have argued that the current system is a "voluntary servitude." He's not wrong from a sovereign perspective. But from a stability perspective? The peg prevents the hyperinflation seen in places like Zimbabwe or even Nigeria. If you have 100,000 CFA in your pocket today, you know it'll probably buy the same amount of bread tomorrow. You can't say that about the Naira right now.

Real-world math for the traveler

If you’re landing at Blaise Diagne International Airport and you need to swap cash, don't just look at the mid-market rate on your phone. You’ll never get that rate.

- Banks: Best for security, worst for speed. They follow the official rate but add fees.

- Hotel Desks: Total robbery. They might offer you 500 when the rate is 600. Avoid.

- Street Changers: Common in places like Lomé. You get a better rate than the hotel, but you risk getting short-changed or handed "billets noirs" (fake notes).

Actually, the best way to get 1 dollar us en francs cfa value is through an ATM (GAB in French). Use a card with no foreign transaction fees. The machine gives you the interbank rate, which is almost always better than a guy with a briefcase on the sidewalk.

The volatility factor

The US dollar is seen as a "safe haven." When the world gets scary—wars, pandemics, trade disputes—investors buy dollars. This pushes the value of the dollar up. Because the CFA is stuck to the Euro, and the Euro is often struggling with energy costs or slow growth, the CFA ends up looking weak by comparison.

In late 2022, we actually saw parity—where 1 Dollar was basically equal to 1 Euro. During that time, the exchange for 1 dollar us en francs cfa shot up to nearly 670. People in West Africa were panicking. Flour prices doubled. Construction projects stalled because imported steel became unaffordable.

It's a reminder that currency isn't just math. It's power.

How to actually manage your money in the CFA zone

Stop thinking in terms of "Is this a good deal?" and start thinking in terms of "What is the trend?" If the US dollar is strengthening globally, change your money sooner rather than later. If you are receiving a transfer from the US, tell your sender to use apps that show the "all-in" cost.

Many apps claim "zero fees" but then give you a garbage exchange rate. Always check the final amount of CFA that hits the mobile money account (like Orange Money or Wave). Wave has actually disrupted the whole market in Senegal and Ivory Coast by slashing these hidden costs, forcing the big banks to stop being so greedy.

Practical Steps for Currency Conversion

- Check the Euro-Dollar Cross Rate: Since the CFA is fixed to the Euro, if the Euro is getting stronger, your dollar will buy fewer CFA francs. If the Euro is tanking, your dollar is a weapon.

- Use Mobile Money: If you are staying for more than a week, get a local SIM. Loading your phone with CFA is safer than carrying cash and the internal transfer fees are negligible.

- Large Denominations Matter: In the informal market, a crisp $100 bill often gets a better exchange rate than ten $10 bills. It’s stupid, but it’s true.

- Avoid the Airport: This is universal. The exchange booths at the airport are there to tax your lack of preparation. Get just enough for a taxi, then find a bank in the city.

The reality of 1 dollar us en francs cfa is that it’s a reflection of a lopsided global economy. One side prints the world’s reserve currency; the other side uses a currency managed by its former colonial power. It’s a complex, sometimes frustrating system that requires more than just a calculator to navigate.

To get the most out of your money, monitor the EUR/USD pair on any financial news site. When that pair drops, your dollar is gaining muscle in Africa. When it rises, you're losing ground. Stay updated on the BCEAO (Central Bank of West African States) announcements if you really want to be an expert, as they occasionally adjust interest rates that affect local liquidity, even if they can't touch the peg itself.

Log into a reliable currency aggregator like XE or Oanda right before you walk into a bank. Use that as your baseline. If the teller offers you something significantly lower, ask why. Sometimes just showing you know the real rate is enough to get them to magically find a "better" one for you.