Money is weird. You look at a crisp greenback and think you know what it’s worth, but as soon as you land at Oslo Airport, that value starts shifting like sand. Most people checking the rate for 1 dollar in norwegian krone just want a quick number. They see something like 10.50 or 11.00 on a Google snippet and move on.

That’s a mistake.

The "mid-market rate" you see on your phone isn't what you actually get. Ever. Unless you're a high-frequency trading algorithm or a central bank governor, that "official" price is basically a polite fiction. If you’re trying to buy a pølse (the ubiquitous Norwegian hot dog) or pay for a fjord cruise, the reality of your purchasing power is a lot more complicated.

Why the Krone is Acting So Erratic Lately

Norway is rich. Like, absurdly rich. Their Sovereign Wealth Fund—officially the Government Pension Fund Global—holds over $1.7 trillion. Yet, the Norwegian Krone (NOK) has been getting kicked around by the US Dollar (USD) for the better part of a decade.

It feels counterintuitive.

Usually, when oil prices go up, the Krone follows. Norway is one of the world's largest exporters of oil and gas, after all. But that old correlation has broken. These days, the USD is the "safe haven." When the world gets nervous about inflation or geopolitical tensions in Eastern Europe, investors dump smaller currencies like the NOK and sprint toward the Dollar.

Basically, the Krone is a "high-beta" currency. It swings wildly.

I remember talking to a friend who moved to Bergen a few years ago. She was budgeting based on 8 NOK to the dollar. By the time she signed her lease, it was closer to 10. That 25% difference isn't just a rounding error; it’s the difference between a comfortable life and a very expensive lesson in macroeconomics.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

The "Spread" is Where They Get You

Let's talk about the math of a single dollar. If the interbank rate is 10.80 NOK, you might walk into a currency exchange booth at the airport and see they’re offering 9.50.

Where did that 1.30 NOK go?

It’s the spread. It's the fee. It's the "convenience" of having physical cash. Honestly, carrying cash in Norway is increasingly pointless anyway. It’s one of the most cashless societies on Earth. You’ll see buskers with QR codes for Vipps (the local payment app) and public toilets that only take credit cards.

If you use a standard debit card from a big US bank to spend your 1 dollar in norwegian krone, you’re likely losing 3% on the foreign transaction fee and another 1-2% on a subpar exchange rate used by the card network.

A Quick Reality Check on Costs

To understand what 1 dollar actually buys you in Norway, we have to look at the Big Mac Index—or just a cup of coffee.

- A standard coffee in Oslo: Roughly 45 to 55 NOK. At current rates, that’s about 5 bucks.

- A pint of beer: 110 to 130 NOK. Yeah, that’s $11 or $12.

- One single US Dollar: It buys you... maybe a small piece of fruit at a discount grocer like Rema 1000.

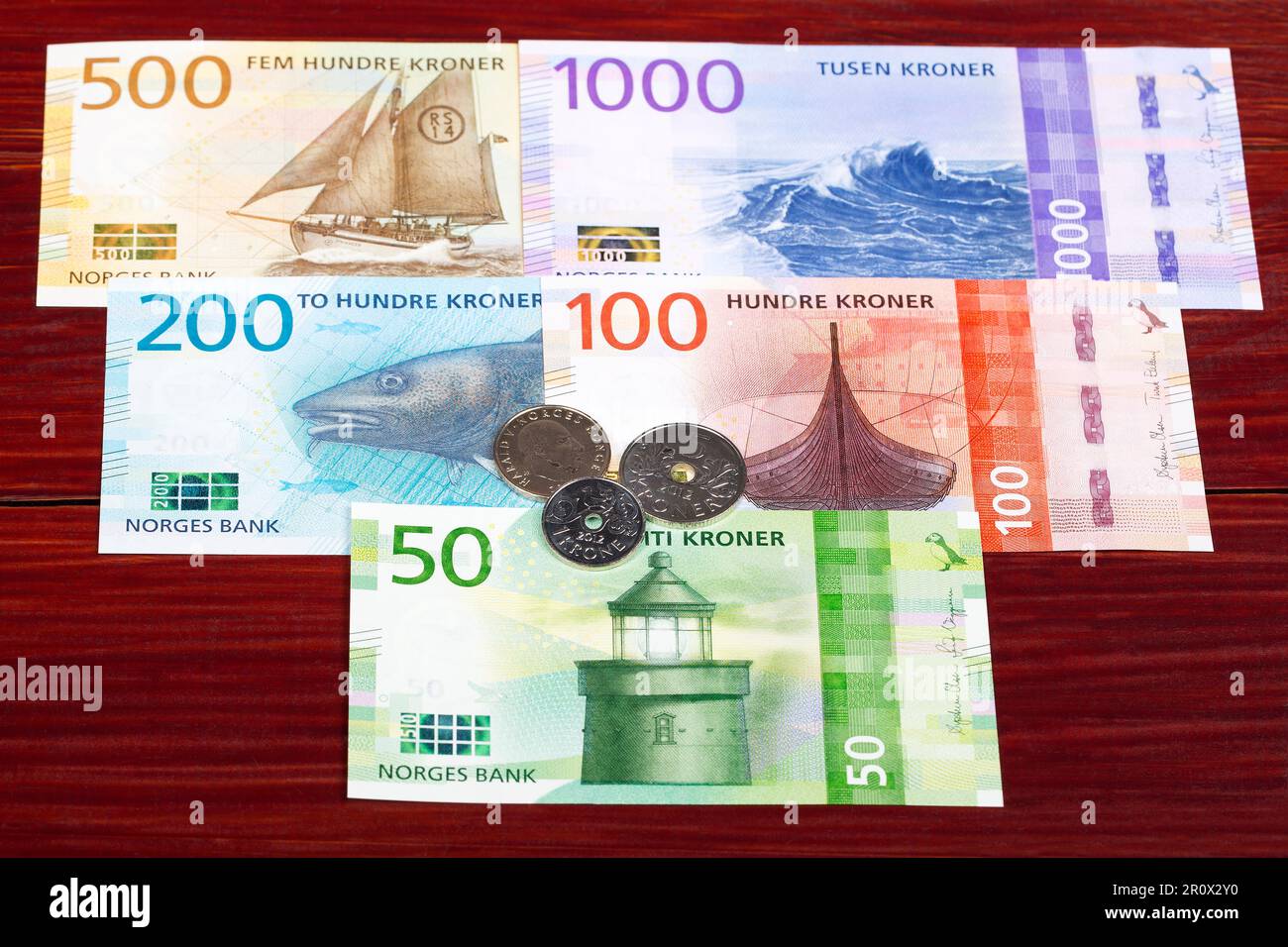

You’ve got to adjust your internal compass. If you're used to the US where a dollar still carries some weight at a vending machine, you're in for a shock. In Norway, the 10-krone coin is the "small change."

Interest Rates and the Norges Bank Factor

The person pulling the strings on your exchange rate is Ida Wolden Bache, the Governor of Norges Bank. While the Federal Reserve in the US has been aggressive with interest rates, Norges Bank has a tougher balancing act.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

If they raise rates too high to support the Krone, they crush Norwegian homeowners. Most Norwegians have floating-rate mortgages. It's a massive debt bubble waiting to pop. If they keep rates too low, the Krone stays weak, imports get expensive, and inflation spirals.

It’s a trap.

Lately, the Fed’s "higher for longer" stance has kept the USD incredibly strong. As long as US Treasury yields remain attractive, big institutional money isn't going to flow into a niche currency like the Krone. Why take the risk on a small, volatile currency when you can get 4% or 5% on "risk-free" US debt?

How to Actually Get the Best Rate

Stop using airport kiosks. Just stop.

If you want to maximize your 1 dollar in norwegian krone, you need to use fintech tools. Services like Revolut or Wise (formerly TransferWise) offer the mid-market rate with minimal, transparent fees. They basically bypass the traditional banking "tax" on travelers.

Another tip: always pay in the local currency.

You’ll be at a restaurant in Aker Brygge, and the card terminal will ask, "Pay in USD or NOK?"

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Always choose NOK.

When you choose USD, the merchant's bank chooses the exchange rate. This is called Dynamic Currency Conversion (DCC), and it is a legal scam. They will give you a terrible rate, often 5% to 10% worse than your own bank would. By choosing NOK, you let your card issuer handle the conversion, which is almost always cheaper.

The Future of the Dollar-Krone Pair

Predicting currency movements is a fool's errand. Seriously. If someone tells you they know where the USD/NOK pair will be in six months, they’re lying.

However, we can look at the pressures.

Norway is trying to transition away from oil dependency. That’s a long, slow process. As the world shifts toward green energy, the "petro-currency" status of the Krone might fade. This could lead to a structural weakening of the NOK over decades.

On the flip side, if the US economy cools down and the Fed starts cutting rates aggressively, the Dollar will lose its luster. That’s when you might see the Krone rally back toward that 8.00 or 9.00 mark.

It’s all about the "yield spread."

Actionable Steps for Your Money

Don't just watch the ticker. Take these steps to protect your purchasing power if you're dealing with Norwegian Krone:

- Get a No-Foreign-Transaction-Fee Card: Before you leave home, ensure your credit card doesn't charge you extra just for being abroad. Capital One and Chase (Sapphire series) are generally solid for this.

- Use an e-SIM for Real-Time Tracking: Download an app like XE or Oanda. Check the rate right before you make a big purchase. If the "1 dollar in norwegian krone" rate has dipped significantly that day, maybe wait to buy that expensive Dale of Norway sweater.

- Buffer Your Budget: If you’re planning a trip, budget at a "worst-case" rate. If the current rate is 10.50, build your spreadsheet at 9.50. If the Krone gets stronger, you have a nice surprise. If it stays weak, you’re already covered.

- Skip the Cash: Don't withdraw large amounts of NOK from ATMs. You'll likely end up with leftover coins you can't exchange back. Use your phone or card for everything—even a 15 NOK pack of gum.

- Monitor Norges Bank Meetings: If you're moving large sums of money for business or real estate, pay attention to the Norges Bank's monetary policy reports. They telegraph their moves months in advance.

The relationship between the Dollar and the Krone is a story of global energy markets, interest rate differentials, and investor fear. It’s never as simple as a single number on a screen. Understanding the "why" behind the fluctuations helps you keep more of your money where it belongs: in your pocket.