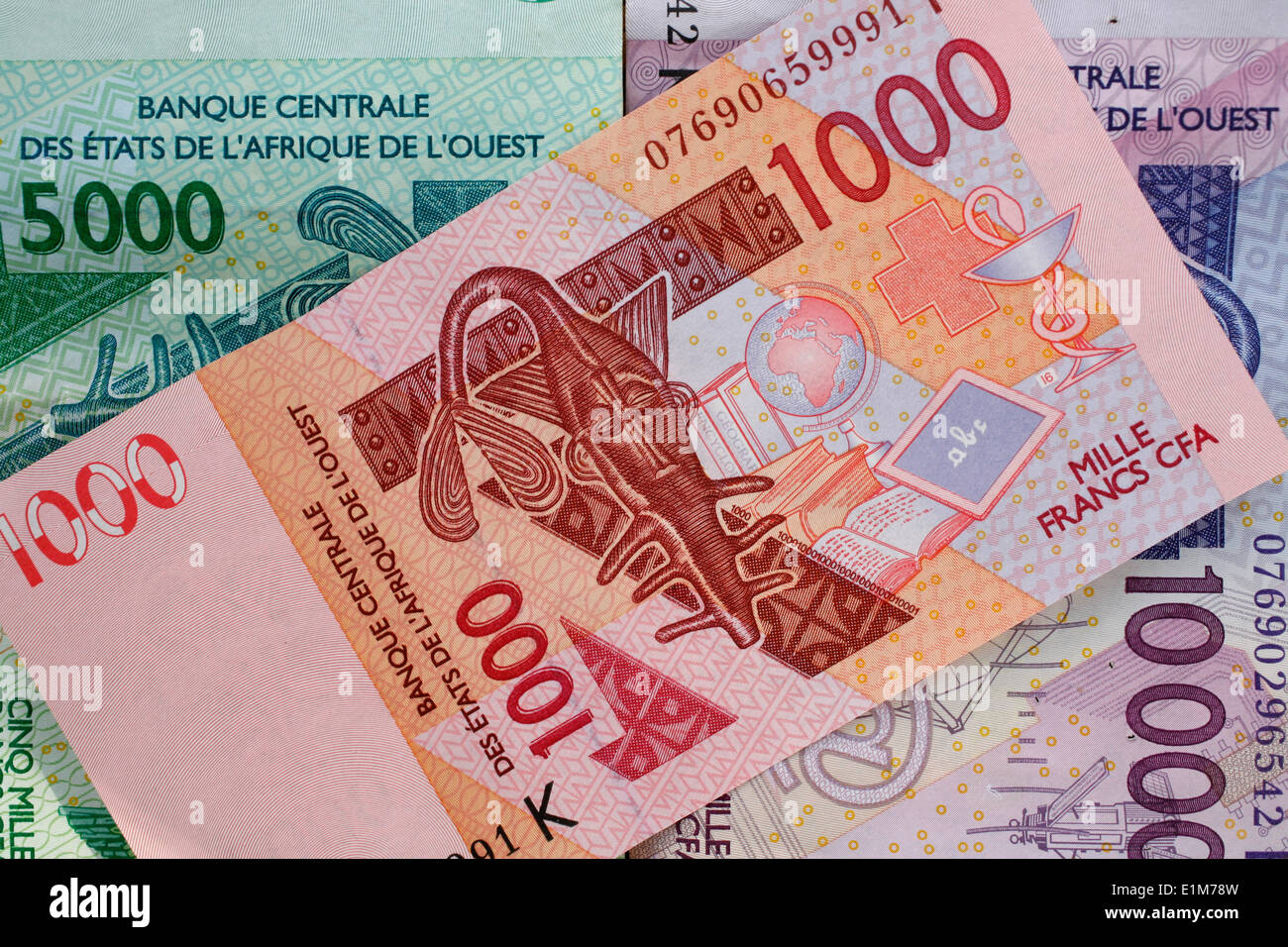

Money is a weird thing. Honestly, if you're looking up 1 dollar en francs CFA today, you're probably either trying to send money back home to Dakar or Abidjan, or you're a business owner trying to figure out why your import costs just spiked. It's never just a number. It’s a pulse check on the global economy.

Right now, the exchange rate isn't just sitting still. It’s vibrating.

The West African and Central African CFA francs (XOF and XAF) are pegged to the Euro. That's the baseline. Because of this, when the U.S. Dollar flexes its muscles against the Euro, everyone in the CFA zone feels the squeeze or the relief. It's a "fixed" currency that feels anything but fixed when you're looking at a greenback.

The Real Math Behind 1 Dollar en Francs CFA Today

Let’s get the raw data out of the way. Usually, $1 is going to hover somewhere between 600 and 615 FCFA. But "usually" is a dangerous word in finance.

If the Federal Reserve in Washington D.C. decides to keep interest rates high, the dollar gets stronger. Investors flock to it like it's the only safe house in a storm. When that happens, your dollar buys more CFA. Great for the diaspora sending money home! Not so great for the local shopkeeper in Yaoundé trying to buy American equipment.

💡 You might also like: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

The fixed parity with the Euro is $1 Euro = 655.957 FCFA$. That never changes. It's literally written into the law. But the Dollar-to-Euro relationship? That’s a rollercoaster. If the Euro weakens because of energy prices in Europe or political drama in France, the CFA drops right along with it. You're basically holding a "French-flavored" currency that reacts to German industrial output and American inflation reports.

Why the Rate Moves While You Sleep

You've probably noticed that Google gives you one rate, but the guy at the Bureau de Change gives you another.

Why?

Middlemen. Banks and transfer services like Western Union, MoneyGram, or Wave don't just give you the "mid-market" rate. They take a slice. Sometimes that slice is a flat fee, and sometimes it's hidden in a worse exchange rate. If the official rate for 1 dollar en francs CFA today is 608, you might only "see" 595 after everyone takes their cut. It’s annoying. It's also how the world works.

📖 Related: Exchange rate of dollar to uganda shillings: What Most People Get Wrong

The volatility we see lately is tied to "The Fed." When Jerome Powell speaks, the CFA zone listens, even if they don't realize it. High U.S. interest rates make the dollar a vacuum, sucking up global capital. This leaves the Euro—and by extension, the CFA—feeling a bit light in the pockets.

The Import-Export Headache

Imagine you're running a small tech firm in Cotonou. You need to buy servers. Those servers are priced in dollars. If the rate for 1 dollar en francs CFA today jumps from 590 to 610, your business just got 3% more expensive overnight. You didn't do anything wrong. You didn't change your business model. The global "vibes" just shifted.

On the flip side, if you're exporting cocoa or cotton, a strong dollar is kinda nice. Your goods are priced in dollars on the international market, but your workers are paid in CFA. When you convert those dollar sales back into CFA, you have more "paper" to spread around. It's a double-edged sword that cuts depending on which side of the trade balance you're standing on.

Is the Peg Actually Good for You?

There is a massive, heated debate about the CFA franc. Some economists, like Kako Nubukpo, argue that the peg to the Euro overvalues the currency and hurts local industrialization. They say it makes imports too cheap and exports too expensive.

👉 See also: Enterprise Products Partners Stock Price: Why High Yield Seekers Are Bracing for 2026

Others argue the opposite. They look at neighboring countries like Nigeria or Ghana. The Naira and the Cedi have been through the ringer lately, with massive inflation and devaluations that wiped out people's savings. The CFA zone? It’s boring. And in macroeconomics, boring is usually good. Inflation stays lower because the currency is tied to the European Central Bank's discipline.

But that discipline has a price: lack of sovereignty. You can't just print more money to stimulate your own economy if your currency is effectively managed in Frankfurt and Paris.

Practical Steps for Handling Your Money

Stop checking the rate every five minutes. It'll drive you crazy. Instead, focus on the "spread."

If you are sending money, look for apps that offer "interbank rates." Don't just settle for the first thing you see in a Google search. The rate for 1 dollar en francs CFA today is a starting point, not the final price you'll pay.

- Compare at least three platforms. Use a mix of traditional (Western Union) and digital-first (Remitly, WorldRemit, or local African fintechs).

- Watch the Euro, not just the Dollar. Since the CFA is tied to the Euro, any news about the European Union's economy will tell you where the CFA is headed next week.

- Buffer your business costs. If you're importing, always calculate your margins using a "worst-case" exchange rate. If the rate is 605, pretend it's 625. If it stays at 605, you've got a bonus. If it spikes, you're not bankrupt.

- Time your transfers. If the U.S. inflation data is coming out on a Thursday, wait until Friday to see how the market reacts before sending a large sum.

The CFA is one of the most stable currencies in Africa, but "stable" doesn't mean "static." It’s a reflection of a complex relationship between African growth, European policy, and American financial dominance. Keep your eyes on the Euro-Dollar pair (EUR/USD) on any finance app; that is the real engine behind the numbers you see on your screen.

Stay informed, but don't panic over a 5-franc swing. It’s just the global machine breathing.